This paper analyses whether digital transformation improves productivity using firm-level data of manufacturing in Vietnam in 2020. This includes examining the importance of absorptive capacity in enhancing productivity gains from digital transformation. Overall, we highlight the strong direct contribution of digital transformation to firm’s productivity. Specifically, it is shown that a firm that uses Internet for e-commerce and/or transactions with other institutes, has its own website, uses operations management software, spends on software, and has an automatic mechanism for operating will boost the performance of firms. Our results also support the meditating role of absorptive capacity in enhancing the positive effects of digitalization on productivity.

Keywords: digital transformation, absorptive capacity, productivity.

Industry 4.0's rapid technological advancements have urged businesses and organizations to adopt new digital-based systems and incorporate knowledge-intensive components to achieve their desired innovation performance in the changing environment of the new digital world (Mubarak & Petraite, 2020; Muller et al., 2018). Because these new digital technologies offer a critical set of instruments that improve firms' agility as a reaction mechanism of adaptation to unexpected market difficulties, their adoption was significantly accelerated by the pressures brought on by the COVID-19 pandemic (Wei et al., 2017).

Digital transformation refers to the adoption of new technologies, changing organizational structures, using social media and e-platforms to interact with users, opening new channels of sales, and/or establishing new ways of doing business to create “entirely new business models that undermine existing ways of delivering services” (Mergel & Haug, 2019; Scuotto et al., 2022; Tekic & Koroteeve, 2019).

Extant research has focuses on a variety of aspects related to digital transformation, but mostly on its impacts on innovation (Muller et al., 2018), direct and indirect gains in terms of production efficiency, overall performance (e.g., return on sales), and product quality (Blichfeldt & Faullant, 2021; Daleogare et al., 2018; Porter & Heppelmann, 2014;). However, a few papers investigate impact of digital transformation on productivity and the role of absorptive capacity within this relationship. This paper focuses on effect of digital transformation in Vietnam as the country is pushing for digital transformation at a national scale. According to the World Bank, the use of digital platforms, e-commerce sites, social networks and specialized applications in Vietnam has increased sharply in response to the COVID-19 epidemic, from 48 % businesses in June 2020 to 73 % in January 2021. During the same period, the rate of enterprises investing in digital solutions — such as installing equipment and software for business operations — quadrupled from 5 % to 21 %. In addition, the Vietnamese Government has stepped up efforts to streamline procedures and provide public services to the people through digital tools. The number of online public services increased from 169 in March 2020 to over 1,900 services in October 2020.

In the light of the above, the aim of this paper is to study the impact of digital transformation on productivity, using evidence from the Vietnam manufacturing sector. Furthermore, the paper explores the role of absorptive capacity as a mediating factor in the creation of productivity. Building on this main research question, the contribution of this paper is two-fold. First, to investigate the impact of digital transformation on productivity of firms, and second, to evaluate the role of absorptive capacity as an antecedent of the digital transformation.

The empirical research is based on a Vietnamese Economic Census to firms and investigates the contribution of digital transformation and absorptive capacity to productivity of a diverse sample of 83,681 Vietnamese manufacturing firm. Overall, our findings support to some extent that the emerging digital technologies contribute to productivity. However, our analysis goes deeper into the mechanism through which digitalization can play a positive role for supporting and enhancing productivity. Specifically, it is shown that a firm that uses Internet for e-commerce and/or transactions with other institutes, has its own website, uses operations management software, spends on software, and has an automatic mechanism for operating will boost the productivity of firms. Our results also support the important meditating role of absorptive capacity in enhancing the positive effects of digitalization as the integration of new digital business functions, accessing to next generation network technologies, and transaction with other institutions can enhance and support learning process and build the absorptive capacity of domestic firms, which in turn increase firm’s productivity.

The remainder of this paper is structured as follows. In the second section, we discuss the theoretical implications that provide the background for the formulation of our research hypotheses. In the third section, we present the empirical research, including the methodology, the formulation of the variables, and the estimation technique. In the fourth section, we present the empirical results and discussion. A final section provides some limitations of the research and future research steps.

Theory development

Digital transformation

There are different perspectives in the literature when studying the digital transformation at the firm level but to some extent, there is a consensus that digital transformation is about adopting new technologies, changing organizational structures, using social media and e-platforms to interact with users, opening new channels of sales, and/or establishing new ways of doing business (Scuotto et al., 2022; Tekic & Koroteeve, 2019). It is widely acknowledged that emerging digital technologies accelerate innovation through organizational transformation (Boeker et al., 2021; Vertegen et al., 2019). Internet expansion, e-commerce development, and use of emerging technologies such as IoT, artificial intelligences, and blockchain increase opportunities for firms to enter global markets and reach customers all over the world.

Extant research has focuses on a variety of aspects related to digital transformation, but mostly on its impacts on innovation (Muller et al., 2018), direct and indirect gains in terms of production efficiency, overall performance (e.g., return on sales), and product quality (Blichfeldt and Faullant, 2021; Daleogare et al., 2018; Porter and Heppelmann, 2014).

Theoretically, digital transformation can be a good source for the development of firm’s performance. Digital technologies’ adoption can rapidly change the knowledge generation process of firms as it relates to the successful integration and exploitation of advanced ICTs in the firm’s functions (Brynjoffson & McAfee, 2014). It is possible to find empirical evidence for this argument from existing studies. More specifically, Kastelli et al. (2022) finds a positive direct contribution of digital capacity to innovation performance on Greek firms. In the case of Vietnam, the positive relationships between digital transformation, human capital and firm performance are explored (Ghi et al., 2022). Therefore, we formulate our first research hypothesis:

Hypothesis 1: Digital transformation has positive impact on the productivity of firms.

However, digital transformation is not only about adopting digital technologies, as the effective use of technologies is a crucial factor in the digitalization process (Zammuto et al., 2007). These technologies have strong complementarities because their adoption requires the incorporation of complex systems with interconnected tangible and intangible parts, as well as technical and managerial skills, organizational capital, innovation, and financing capacity. (OECD, 2019). Employees must develop a set of metaskills to adapt and/or expand their existing skill set in response to the evolution and ever-expanding introduction of new digital technologies during this digitalization process. (Ciarlic et al., 2021). Building on this implication, this study puts forward the argument that firm’s performance depends not only on digital capability directly, but also on the firm’s existing knowledge base and its own capabilities to acquire, assimilate and effectively use digital technologies for the creation of new value. In this line, we suggest that digital transformation also occurs in the presence of absorptive capacity.

The meditating role of absorptive capacity

The term “absorptive capacity” has been initially defined as “to identify value of external knowledge before assimilating and applying them into commercial ends” (Cohen & Levinthal, 1989, 1990). Then, the authors supplement that absorptive capacity is not only about external knowledge recognition and exploitation but also the ability to predict future knowledge (Cohen & Levinthal,1994). After Cohen and Levinthal, many authors expand or reify the firm’s absorptive capacity (Zahra and George, 2002; Lane et al., 2006) but to some extent, there is a consensus that absorptive capacity is firm’s competitive advantage. Zahra and George (2002) state that absorptive capacity is a dynamic capability that directly affects the competitiveness of a firm. Tu et al. (2006) supports the perspective and suggest a broader definition, stating that absorptive capacity should be an organizational mechanism that helps to identify and assimilate both internal and external knowledge and apply it to improve the productivity of a firm. Martinkenaite and Breunig (2015) argue that individual and organizational absorptive capacity are different; therefore, a firm’s absorptive capacity requires the interaction between micro level (individual) and macro level (firm). From another perspective, some papers value the importance of inter-firm factors when studying the absorptive capacity of firms. Lane et al. (2006) concludes that there are 07 themes of absorptive capacity: external knowledge, organizational structure, organizational scope, organizational learning, and innovation. Therefore, firm’s absorptive capacity could depend on external factors such as type of external knowledge but majorly depend on firm specific factors.

From a knowledge-based view, absorptive capacity is crucial for developing and increasing a firm’s learning capacity (Volberda et al., 2010). Some scholars have confirmed that absorptive capacity enhances manufacturing abilities, and thus, firm performance (Tu et al, 2006; Patel Terijesen & Li 2012; Zhang et al., 2015). The use of artificial intelligence and the ability to make decisions based on big data analysis and exploitation strengthen the interconnection of organizations and their ability to seize and exploit opportunities through the innovation process. Meanwhile, social interactions, as well as the way information and knowledge management, integration, and exploitation are carried out, can significantly contribute to the development of organizational absorptive capacity (Tu et al, 2006; Patel Terijesen & Li 2012; Zhang et al., 2015).

From a technology-based view, absorptive capacity contributes to technological effort and capability (Srivastava et al., 2015) and technological change increases labour productivity (Samuelson & Nordhaus 2009). Sanchez-Sellero et al. (2015) find that innovation activities in firms (both relating to product and process innovations) help to improve employee’s knowledge absorption and productivity which, in turn, have a positive impact on firm performance. As emerging digital technologies rapidly transform into competitive assets in the innovation activity, and the rate of technological advancement accelerates, firms must develop their capacity to recognize opportunities derived from the exploitation of these technologies, assimilate, and incorporate them into their strategic management, and create new propositions that build new competitive advantages (Mubarak & Petraite, 2020; Rego et al., 2021; Scuotto et al., 2017; Siachou et al., 2021). Because of the exponential change in digital technologies, firms must have a knowledge base to either follow advances and integrate them into their production and management practices, or to leapfrog towards new ways of delivering value, bridging the gap between what is known and what had to be established. Learning and assimilation of external knowledge become critical in the process of digital transformation and its successful application in all aspects of the firm in this context (Mubarak and Petraite, 2020; Rego et al., 2021; Scuotto et al., 2017; Siachou et al., 2021). Although scholars have indicated that the mediating role of absorptive capacity between digital transformation and firm productivity, empirical research on this is rare. Accordingly, we propose:

Hypothesis 2: Absorptive capacity mediates the relationship between digital transformation and firm productivity.

Method and data

Estimation model

For estimating purpose, the log-linear production function (Aitken & Harrison, 1999; Konings, 2001) of the firms is applied (Equation (1)). The main purpose of the regression is to estimate the effect of digital transformation on the performance of firms.

y

i

=α+ β

1

AC

i-1

+ β

2

DIG

i

+ β

3

X

ij

+

where i is firm i; Y is productivity of firm and in logarithm transformation; DIG is digitial transformation; ABC is absorptive capacity of firm. X is the set of other control variables including capital intensity, human capital, firm size, capital share, concentration index and institution.

Then, the interaction terms are created to examine the mediating role of absorptive capacity (AC) in the link from digital transformation to firm performance.

y

i

=α+ β

1

AC

i-1

+ β

2

DIG

i

+ β

3

DIG

i

*AC

i

+ β

4

X

ij

+

Construction of productivity and absorptive capacity and description of control variables are specified below.

Productivity — Dependent variable:

As a residual of a production function (also known as Solow’s residual), total factor productivity (TFP) includes everything that is not measured by physical factors. Its difference over time will measure changes in non-technical efficiency, such as creativity, managerial aptitude, and all the knowledge that comes from global improvements and regional knowledge. As a result of the variation in technological efficiency with which these factors are employed, this residual can be interpreted as the rate of product growth that exceeds the rate of capital growth or as growth that is not explained by production factors. (Lesage & Rober, 2009).

To perform the calculation of TFP, the value of which is the result of the estimate of Cobb-Douglas production function, we used the following proxies: gross sales revenue is used as a proxy for product; total fixed assets is used as a proxy for capital; and as a proxy for labour, legal labour obligation is used since this variable represents a fixed percentage of paid wages.

Usually, starting from a Cobb-Douglas framework (Behera, 2017) the TFP estimation is performed by using the semiparametric procedure of Levinsohn and Petrin (2003) (LP), since the problem of simultaneity associated with the choice of inputs makes parameters estimation by ordinary least squares (OLS) inconsistent. By using an intermediate input demand function, this procedure solves the problem of endogeneity. Nevertheless, recent literature shows that while addressing the correlation between input levels and productivity shocks for the TFP computation, the consolidated methods of Olley and Pakes (1996), Levinsohn and Petrin (2003) may yields estimates that suffer from functional dependence problems. Accordingly, using a technique more general than that proposed by Wooldrige (2009), Ackerber (ACF) propose an estimator that invest input demand functions that are conditional on the choice of the labour input. Given data availability, we followed Moralles and Moreno (2020) to choose the ACF correction in the OP method to calculate the TFP.

Absorptive capacity

To measure the firm’s level of absorptive capacity (AC) we follow the widely employed used by studies, such as Girma (2005) and Moralles and Moreno (2020), which use the technological frontier distance (technology gap) as a proxy, as shown as follows in equation (3).

where TFP is total factor productivity of firm i and max (TFP) is maximum value of total factor productivity of firm in the same industry.

Digital transformation

DIG i is firm’s digital transformation, and is obtained from the responses to the Economic Census questionaire as follows.

– E-Commerce = Does enterprise use Internet for E-commerce? (a binary variable that takes unity if the answer is “Yes”, zero otherwise)

– Transaction = Does enterprise use Internet for transaction with other institures, organizations such as bank, stock market? (a binary variable that takes unity if the answer is “Yes”, zero otherwise)

– Website = Does enterprise have its own website? (a binary variable that takes unity if the answer is “Yes”, zero otherwise)

– Introduction (Product introduction and/or market research) = Does enterprise use Internet for product introduction and/or market research? (a binary variable that takes unity if the answer is “Yes”, zero otherwise)

– Software = Does enterprise use operations management software? (a binary variable that takes unity if the answer is “Yes”, zero otherwise)

– Spending = Does enterprise spend on software? (a binary variable that takes unity if the answer is “Yes”, zero otherwise)

– Automatic = Does this establishment have an automatic mechanism for operating? (a binary variable that takes unity if the answer is “Yes”, zero otherwise).

We capture the effect of digital transformation through the adoption of two different technologies, namely: management based I4.0 technology and product based I4.0 technology.

It is expected that the adoption and use of management-based technologies including the use of big data analytics (proxied by introduction ), access to next generation network technologies (proxied by software and spending) , integration of new digital business functions (proxied by ecommerce ), and use of website (proxied by website ) will contribute to firms’ productivity. It is also expected that the adoption and use of product-based technologies will contribute to firm’s productivity. These technologies are tangible and directly relate to the production process per se, including new production planning systems, advanced solutions for product quality control, supply chain technologies that relate to advanced systems for communication with partners/suppliers/customers, and predictive maintenance and workspace safety systems. In this research, the adoption and use of product-based technologies is proxied by automatic .

Control variables . We also consider a set of controls since firm characteristics may affect firm performance. First, capital intensity, human capital, firm size, and financial leverage were applied as firm-level controls. Human capital is proxied by wage level assuming that higher skilled labour can receive higher wage, therefore, if a firm pays higher wage per cap, it can have better human capital. It is constructed by the ratio between wage level of individual and the highest wage level in the same industry.

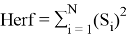

It is also interesting to establish control regarding the market concentration environment to which a particular firm is exposed. As such information is not accounted for by the public Vietnamese statistic agencies or trade associations, a proxy was applied to construct a modified version of the Herfindahl Hirschman index ( Herf ) presented in (4) and where S i is the market share and N is the number of firms operating in a specific sector.

Finally, institution is a provincial variable which is collected from PCI index in Vietnam. This index allows us to compare the institutions environment among provinces in Vietnam.

Data

To test the proposed hypotheses, we utilised data from Vietnam Economic Census. The database includes basic information of firms including operating industries, output, total labour, fixed capital, and wage of workers. The Vietnam Economic Census in 2020 also includes information about use of compute and Internet. After excluding missing values, our sample includes 83,681 observations for the analysis.

The sample used in the present study allowed us to evaluate their business practices and the mediating model linking absorptive capacity to firm performance via digital transformation within a national context. Specifically, Panel A of Table 1 shows the distribution of the sample across 24 manufacturing sectors. The top three sectors are (1) Fabricated Metal, (2) Food, and (3) Apparel representing 35.6 % of the sample. Panel B of Table 1 displays the research & development and the use of Internet taken by the sample firms. Panel C of Table 1 presents the characteristics of our sample including productivity, capital intensity, human capital, firm size, financial leverage, absorptive capacity and the two control variables namely: industry concentration and institution.

According to General Statistics Office of Vietnam, the manufacturing sectors have the largest GDP proportion in Vietnam in 2021 which comprises 25.2 % of total GDP share. This industry also accounted for 95.1 per cent of total exports in the same period, with two key sectors being electronics and textiles. Hence, these authors have selected the manufacturing sector in Vietnam to test the above-mentioned hypotheses. Many large enterprises have boldly invested in building smart factories with a production control system, automatic line connection and seamless data transmission, such as Thaco Mazda, VinFast complexes in Dinh Vu-Cat Hai Economic Zone (Haiphong), Vinamilk dairy factory (Binh Duong), and Rang Dong plastic factory (Long An) among others.

Table 1

Descriptive statistics of the sample firms

|

Panel A: Distribution of the sample firms across industries |

||||||||

|

Industry |

Firm frequency |

Firm percentage |

Industry |

Firm frequency |

Firm percentage |

|||

|

Food |

7,069 |

8.45 % |

Rubber & Plastic |

5,470 |

6.54 % |

|||

|

Beverages |

1,627 |

1.94 % |

Other non-metallic minerals |

5,017 |

6.00 % |

|||

|

Tobacco |

23 |

0.03 % |

Basic Metals |

1,404 |

1.68 % |

|||

|

Textile |

3,633 |

4.34 % |

Fabricated Metal |

16,380 |

19.57 % |

|||

|

Apparel |

6,311 |

7.54 % |

26 Computers |

1,922 |

2.30 % |

|||

|

Leather & Footwear |

2,104 |

2.51 % |

Electrical Equipment |

1,529 |

1.83 % |

|||

|

Wood |

5,431 |

6.49 % |

Machinery |

1,929 |

2.31 % |

|||

|

Paper & Printing |

2,740 |

3.27 % |

Motor and Trailers |

513 |

0.61 % |

|||

|

Printing & Media |

5,613 |

6.71 % |

Other Transport Equipment |

610 |

0.73 % |

|||

|

Coke & refined petroleum |

104 |

0.12 % |

Furniture |

4,341 |

5.19 % |

|||

|

Chemicals |

3,809 |

4.55 % |

Other Manufacturing |

2,178 |

2.60 % |

|||

|

Pharmaceutical |

433 |

0.52 % |

Repair & Installation of Machinery and Equipment |

3,495 |

4.18 % |

|||

|

Panel B: Research & Development and Use of Internet |

||||||||

|

R&D and use of Internet |

Number |

Total share |

R&D and use of Internet |

Number |

Total share |

|||

|

R&D |

3,764 |

4.50 % |

Ecomerce |

44,479 |

53.15 % |

|||

|

Introduction |

19,888 |

23.77 % |

Software |

23,018 |

27.51 % |

|||

|

Transaction |

44,138 |

52.74 % |

Automatic |

7,989 |

9.55 % |

|||

|

Website |

7,387 |

8.83 % |

Spending |

14,935 |

17.85 % |

|||

|

Panel C: Characteristics of the sample firms |

||||||||

|

Variable |

Obs |

Mean |

Std. Dev. |

Min |

Max |

|||

|

Productivity |

83,685 |

3.332 |

1.521 |

-7.915 |

19.118 |

|||

|

Capital intensity |

83,685 |

1575.542 |

32200.491 |

.001 |

8805031 |

|||

|

Human capital |

83,685 |

5551.245 |

1589367.5 |

.016 |

4.598e+08 |

|||

|

Firm size |

83,685 |

2.4 |

1.569 |

.693 |

10.96 |

|||

|

Financial leverage |

83,685 |

.445 |

.323 |

0 |

1 |

|||

|

Industry concentration |

83,685 |

.019 |

.032 |

.002 |

.348 |

|||

|

Institution |

83,685 |

65.208 |

3.04 |

59.61 |

75.09 |

|||

|

Absorptive Capacity |

83,685 |

44.958 |

33.156 |

0 |

100 |

|||

Empirical Findings

Effects of digital transformation on productivity

The hypothesis 1 and hypothesis 2 are examined by exploring the regression results of the models in Equation (1) and (2) respectively. Firstly, the model is run without interaction terms between digital transformation and absorptive capacity to examine the main effect of digital transformation on the firms’ performance (the Model 1). Then, the mediating role of absorptive capacity is tested by adding the interaction terms (the Model 2).

The regression results from the first column of Table 2 shows that apart from capital intensity and human capital, firm size, research and development, financial leverage have positive effects on the performance of firms. More specifically, 1 % increase in financial leverage may lead to 0.851 % increase in the added value created by the firms. Not surprisingly, the implement of research and development ( R&D ) is an important factor when having R&D activities will boost 0.064 % of the performance of firms. Meanwhile, the negative impact of industry concentration is approved when 1 % rise in industry concentration causes 0.266 % reduction from firms. Similarly, the coefficient of absorptive capacity ( AC) is negative and statistically significant, and it implies that absorptive capacity negatively affects the performance of firms.

Essentially, the Model 1 detects the positive influences of digital transformation on firm’s performance except introduction . The positive and significant of transaction, website, ecommerce, software, automatic, and spending indicate that a firm that uses Internet for E-commerce and/or transactions with other institutes, has its own website, uses operations management software, spends on software, and has an automatic mechanism for operating will boost the performance of firms.

The second column of Table 2 displays the regression results after adding the interaction terms between digital transformation and absorptive capacity ( AC ). The mediating role of absorptive capacity in the effect of digital transformation on firm’s performance can observed in some aspects of digital transformation when the coefficients of website*AC, ecommerce*AC, software*AC are all positive and statistically significant. Apparently, the integration of new digital business functions, accessing to next generation network technologies, and transaction with other institutions can enhance and support learning process and build the absoprtive capacity of domesic firms.

Unfortunately, it seems that absorptive capacity cannot boost the influence of automatic mechanism for operating when the coefficient of automatic*AC is not statistically significant. The estimation results are explainable because only 6 % of businesses in Vietnam used cloud computing for business tasks and under 2 % of businesses used big data or artificial intelligence for marketing (World Bank, 2021). At the same time, only about 6 % of manufacturing enterprises used additive manufacturing (AM) or other advanced techniques, and less than 2 % used robots. The low level of digital innovation in the private sector is explained by limited business needs, inadequate government support and underdeveloped «digital» businesses.

Table 2

Digital transformation, absorptive capacity, and productivity

|

Dependent variable: lnTFP t |

Direct effect (1) |

Indirect effect (2) |

Domestic firm (3) |

Foreign firm (4) |

|

Capital intensity |

-0.000 (0.000) |

-0.000 (0.000) |

-0.000 (0.000) |

0.000 (0.000) |

|

Human capital |

0.000*** (0.000) |

0.000*** (0.000) |

0.000*** (0.000) |

0.000*** (0.000) |

|

Firm size |

0.237*** (0.003) |

0.277*** (0.003) |

0.277*** (0.004) |

-0.003 (0.007) |

|

Financial leverage |

0.851*** (0.015) |

0.856*** (0.015) |

0.968*** (0.016) |

-0.332*** (0.04) |

|

R&D |

0.064*** (0.019) |

0.265*** (0.019) |

0.230*** (0.022) |

0.315*** (0.028) |

|

Industry Concentration |

-0.266* (0.146) |

-0.320** (0.148) |

-0.480*** (0.166) |

0.809*** (0.25) |

|

Institution |

0.017*** (0.001) |

0.017*** (0.001) |

0.0130*** (0.002) |

0.004 (0.003) |

|

Absorptive Capacity |

-0.010*** (0.000) |

-0.012*** (0.000) |

-0.010*** (0.000) |

-0.022*** (0.001) |

|

Introduction/Introduction*AC |

-0.009 (0.011) |

0.000* (0.000) |

0.000 (0.000) |

-0.001 (0.001) |

|

Transaction/Transaction*AC |

0.080*** (0.001) |

0.000** (0.000135) |

0.000*** (0.000) |

0.001 (0.001) |

|

Website/Website*AC |

0.288*** (0.014) |

0.002*** (0.000240) |

0.002*** (0.000) |

0.002** (0.001) |

|

Ecommerce/ Ecommerce *AC |

0.079*** (0.010) |

0.001*** (0.000132) |

0.001*** (0.000) |

0.001 (0.001) |

|

Software/Software*AC |

0.163*** (0.012) |

0.001*** (0.000) |

0.001*** (0.000) |

0.001 (0.001) |

|

Automatic/Automatic*AC |

0.237*** (0.014) |

-0.000 (0.000) |

0.000 (0.000) |

0.001** (0.001) |

|

Spending/Spending*AC |

0.037*** (0.012) |

-0.000*** (0.000188) |

-0.001*** (0.0002) |

0.001 (0.000) |

|

Constant |

1.639*** (0.096) |

1.649*** (0.097) |

1.738*** (0.103) |

4.912*** (0.229) |

|

Observations |

83,681 |

83,681 |

75,059 |

8,622 |

Note: The numbers in parentheses in columns are robust standard errors. Significance at the 1 percent, 5 percent and 10 percent level is indicated by *** , ** and * .

Effects of digital transformation on productivity by firms

Up to now, the hypothesis 1 and hypothesis 2 are tested, and it is possible to argue that digital transformation has positive effects on the productivity of firms and absorptive capacity plays a mediating role in this relationship. As the impact of digital transformation depends on absorptive capacity, we will capture the effect of digital transformation for domestic and foreign firms separately from all firms.

The regression results from the third column of Table 2 shows that only domestic firms report the mediating effect of absorptive capacity in the link between the use of Internet for e-commence and productivity when transaction*AC is positive and statistically significant . At the same time, significance of software*AC shows that absorptive capacity can be a catalyst to improve the effect of using operations management software on the performance of domestic firms. Apparently, the integration of new digital business functions, accessing to next generation network technologies, and transaction with other institutions can enhance and support learning process and build the absoprtive capacity of domesic firms.

Regarding foreign firms, no evidence of mediating role of absorptive capacity in the link between digital tranformation and productivity can be found in foreign firms based on the regression results shown in the fourth column of Table 2. However, the use of automatic mechnism for operating affects positively for foreign firm’s producitvity, subject to absorptive capcity.

Effects of digital transformation on productivity by technology intensity

To further evaluate the mediating effect of absorptive capacity in the relationship between digital transformation and productivity by technology intensity, the results are organized into groups based on technological intensity: (1) high technology (HT), (2) medium high technology (MHT), (3) medium low technology (MLT), and (4) low technology (LT) (see Table A1 in Appendix).

Regarding the management-based technology adoption, the empirical findings show that almost all groups (except LT sectors) improve productivity through owning website. Apparently, the operation of website helps firm to enhance social interactions with their suppliers, customers, and other shareholders, which in turns increasing ability to absorb external knowledge and technology. Meanwhile, only HT firms report significant and positive effects on productivity from the use of Internet for product introduction purpose. This indicates that firms with the requite levels of absorptive capacity tend to benefit from the use of Internet for production introduction and market search.

We also found that the integration of new digital business functions (for example, e-commerce) plays a positive role in the productivity of HT, MLT and LT firms. Similarly, accessing to next generation network technologies (e.g, software) fosters productivity of MLT and LT firms. However, spending on software hampers the productivity of MHT and LT firms. It is frequently stated that LT firms have low absorptive capacity due to low skills among workers and less sophisticated managerial practices when compared to MNCs or large firms. A low skilled workers and less sophisticated managerial practices may explain why firms in LT are unable to adopt technology and increase productivity.

Regarding the product based technology adoption, the empirical findings show that the use of automatic mechanism has a dampening effect on productivity of firms within HT and LT sectors. As noted in the literature, workforce skills, capabilities, and competencies are diverse, complex, and dynamic, suggesting that the HT and LT sectors may lack complementary skills among workers to tackle the productivity challenges that their sector demand. According to the digital maturity survey conducted by ABeam Consulting in five Southeast Asian countries, the digital transformation vision and strategy are currently at an ideal level, but the lack of clear direction and practical experience can lead to unsuccessful conversions.

Conclusion

This study builds on previous literature (Blichfeldt and Faullant, 2021; Daleogare et al., 2018; Kagermann, 2015; Porter and Heppelmann, 2014; Yunis et al., 2018) that puts emphasis on the role of digital transformation in accelerating firm’s productivity they generate new value through digitally driven business models, radically new products, transformation of the firm's knowledge base, creation of new solutions to existing needs, and restructuring of business functions. Productivity is a complex process relying among other things on prior knowledge and intensity of efforts or commitment in problem solving and on interaction with external sources of knowledge. As presented in our theoretical discussion, variety of aspects related to digital transformation are studied, but mostly on its impacts on innovation (Muller et al., 2018), direct and indirect gains in terms of production efficiency, overall performance (e.g., return on sales), and product quality (Blichfeldt and Faullant, 2021; Daleogare et al., 2018; Kagermann, 2015; Porter and Heppelmann, 2014; Yunis et al., 2018). However, a few papers investigate impact of digital transformation on productivity and the role of absorptive capacity within this relationship. We expand this discussion and study the contribution of digital transformation on firm performance, proposing the mediating role of absorptive capacity in the context of digital transformation.

The empirical analysis concerns the specific case of the Vietnam manufacturing industry. Our results highlight the strong direct contribution of digital transformation to firm performance. Specifically, tt is shown that a firm that uses Internet for e-commerce and/or transactions with other institutes, has its own website, uses operations management software, spends on software, and has an automatic mechanism for operating will boost the performance of firms. Our findings also support the critical role of absorptive capacity in enhancing the positive effects of digitalization, as the integration of new digital business functions, access to next generation network technologies, and transactions with other institutions can enhance and support the learning process and build the absorptive capacity of domestic firms, increasing firm productivity.

When capturing the effect of digital transformation for domestic and foreign firms separately from all firms, our findings show that only domestic firms report the mediating effect of absorptive capacity in the link between the use of Internet for e-commerce and operations management software and productivity. Meanwhile, the use of automatic mechnism for operating affects positively for foreign firm’s producitvity, subject to absorptive capcity.

Regarding technology intensity, the empirical findings show that almost all groups (except LT sectors) improve productivity through owning website and the integration of new digital business functions (for example, e-commerce) plays a positive role in the productivity of HT, MLT and LT firms. Meanwhile, only HT firms report significant and positive effects on productivity from the use of Internet for product introduction purpose and only MLT and LT firms benefits from accessing to next generation network technologies (e.g, software).

Our findings have significant implications for business managers and policy makers. When accelerating digital transformation, Vietnamese businesses should think about the need for improvement in other aspects of their business ecosystems that are related to productivity. Simultaneously, policy design and implementation should consider the diversity of firms' capabilities and foster the upgrading process not only in terms of digital transformation adoption, but also in terms of their ability to integrate and assimilate new knowledge and transform it into firm performance.

Appendix

Table A1

Classification of high technology and low technology

|

High Technology |

Medium-High Technology |

Medium-Low Technology |

Low-Technology |

|

Code/Subsector |

Code/Subsector |

Code/Subsector |

Code/Subsector |

|

21. Pharmaceutical |

27. Electrical Equipment |

19. Coke & refined petroleum |

10. Food |

|

6. Computers & Peripheral Equipment |

28. Machinery |

20. Chemicals |

11. Beverages |

|

29. Motor and Trailers |

22. Rubber & Plastic |

12. Tobacco |

|

|

30. Other Transport Equipment |

23. Other non-metallic minerals |

13. Textile |

|

|

24. Basic Metals |

14. Apparel |

||

|

25. Fabricated Metal |

15. Leather & Footwear |

||

|

33. Repair & Installation of Machinery and Equipment |

16. Wood |

||

|

17. Paper & Printing |

|||

|

18. Printing & Media |

|||

|

31. Furniture |

|||

|

32. Other Manufacturing |

[Source: OECD, 2011, ISIC REV.3 Technology Intensity Definition]

Table A2

Reports the estimated coefficients of digital transformation

|

Dependent variable: lnTFP |

HT (1) |

MHT (2) |

MLT (3) |

LT (4) |

|

Capital Intensity |

0.000*** (0.000) |

-0.000 (0.000) |

-0.000*** (0.000) |

0.000** (0.000) |

|

Human Capital |

0.000*** (0.000) |

0.000*** (0.000) |

0.001*** (0.000) |

0.000*** (0.000) |

|

Firm Size |

0.287*** (0.016) |

0.354*** (0.011) |

0.343*** (0.006) |

0.239*** (0.004) |

|

Financial Leverage |

0.397*** (0.095) |

0.713*** (0.049) |

0.837*** (0.024) |

0.887*** (0.021) |

|

R&D |

0.238*** (0.059) |

0.240*** (0.042) |

0.143*** (0.033) |

0.223*** (0.030) |

|

Industry Concentration |

-2.391** (1.062) |

-0.266 (0.284) |

0.294 (0.404) |

-1.139*** (0.206) |

|

Institution |

0.044*** (0.010) |

0.021*** (0.005) |

0.010*** (0.002) |

0.015*** (0.002) |

|

AC |

-0.012*** (0.001) |

-0.012*** (0.001) |

-0.012*** (0.000) |

-0.010*** (0.000) |

|

Introduction*AC |

0.002** (0.001) |

0.000 (0.001) |

-0.000 (0.000) |

0.000 (0.000) |

|

Transaction*AC |

0.000 (0.001) |

0.000 (0.000) |

0.000** (0.000) |

0.000 (0.000) |

|

Website*AC |

0.002* (0.001) |

0.002*** (0.001) |

0.001*** (0.000) |

0.000 (0.000) |

|

Ecommerce*AC |

0.002*** (0.001) |

0.001 (0.000) |

0.000*** (0.000) |

0.005** (0.000) |

|

Software*AC |

-0.000 (0.001) |

0.001 (0.001) |

0.001*** (0.000) |

0.001*** (0.000) |

|

Automatic*AC |

-0.002** (0.001) |

-0.001 (0.001) |

0.000 (0.000) |

-0.001** (0.000) |

|

Spending*AC |

-0.000 (0.001) |

-0.001* (0.001) |

-0.000 (0.000) |

-0.001*** (0.000) |

|

Constant |

0.383 (0.678) |

1.545*** (0.311) |

2.079*** (0.15) |

1.686*** (0.137) |

|

Observations |

2,354 |

8,389 |

31,870 |

41,068 |

[Note: The numbers in parentheses in columns are robust standard errors. Significance at the 1 percent, 5 percent and 10 percent level is indicated by *** , ** and * ]

References:

- Ackerberg, D., Benkard, C. L., Berry, S., & Pakes, A.. (2006). Econometric tools for analyzing market outcomes. Handbook of econometrics, 6, 4171–4276.

- Aitken, B. J., & Harrison, A. E. (1999). Do domestic firms benefit from direct foreign investment? Evidence from Venezuela. American economic review, 89(3), 605–618.

- Behera, S. R. (2017). Regional foreign direct investment and technology spillover: evidence across different clusters in India. Economics of innovation and new technology, 26(7), 596–620.

- Blichfeldt, H., & Faullant, R. (2021). Performance effects of digital technology adoption and product & service innovation–A process-industry perspective. Technovation, 102.

- Boeker, W., Howard, M. D., Basu, S., & Sahaym, A. (2021). Interpersonal relationships, digital technologies, and innovation in entrepreneurial ventures. Journal of Business Research, 125, 495–507.

- Brynjolfsson, E., & McAfee, A. (2014). The second machine age: Work, progress, and prosperity in a time of brilliant technologies. WW Norton & Company.

- Ciarli, T., Kenney, M., Massini, S., & Piscitello, L.. (n.d.). Digital technologies, innovation, and skills: Emerging trajectories and challenges. Research Policy, 50(7).

- Cohen, W. M., & Levinthal, D. A. (1989). Innovation and learning: the two faces of R & D. The economic journal, 99(397), 569–596.

- Cohen, W. M., & Levinthal, D. A.. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative science quarterly, 128–152.

- Cohen, W. M., & Levinthal, D. A.. (1994). Fortune favors the prepared firm. Management science, 40(2), 227–251.

- Dalenogare, L. S., Benitez, G. B., Ayala, N. F., & Frank, A. G. (2018). The expected contribution of Industry 4.0 technologies for industrial performance. International Journal of production economics, 204, 383–394.

- Ghi, T. N., Thu, N. Q., Huan, N. Q., & Trung, N. T. (2022). Human capital, digital transformation, and firm performance of startups in Vietnam. Management, 26(1), 26(1), 1–18.

- Girma, S. (2005). Absorptive capacity and productivity spillovers from FDI: a threshold regression analysis. Oxford bulletin of Economics and Statistics, 67(3), 281–306.

- Kastelli, I., Dimas, P., Stamopoulos, D., & Tsakanikas, A. (2022). Kastelli, I., Dimas, P., Stamopoulos, D., & Tsakanikas, A. (2022). Linking Digital Capacity to Innovation Performance: the Mediating Role of Absorptive Capacity. Journal of the Knowledge Economy, -35.

- Keller, W. & Yeaple, S. R. (2009). Multinational enterprises, international trade, and productivity growth: firm-level evidence from the United States. The review of economics and statistics, 91(4), 821–831.

- Konings, J. (2001). The effects of foreign direct investment on domestic firms: Evidence from firm‐level panel data in emerging economies. Economics of transition, 9(3), 619–633.

- Lane, P. J., Koka, B. R., & Pathak, S. (2006). The reification of absorptive capacity: A critical review and rejuvenation of the construct. Academy of management review, 31(4), 833–863.

- LeSage, J., & Pace, R. K.. (2009). Introduction to spatial econometrics. Chapman and Hall/CRC.

- Levinsohn, J. & Petrin, A. (2003). Estimating production functions using inputs to control for unobservables. The review of economic studies, 70(2), 317–341.

- Martinkenaite-Pujanauskiene, I., & Breunig, K. J. (2015). The emergence of absorptive capacity through micro-macro level interactions. Journal of Business Research, 69(2), 700–708.

- Mergel, I., Edelmann, N., & Haug, N.. (2019). Defining digital transformation: Results from expert interviews. Government information quarterly, 36(4).

- Moralles, H. & Rosina Moreno, R. (2020). FDI productivity spillovers and absorptive capacity in Brazilian firms: A threshold regression analysis. International Review of Economics & Finance, 70, 257–272.

- Mubarak, M. F., & Petraite, M.. (2020). Industry 4.0 technologies, digital trust and technological orientation: What matters in open innovation? Technological Forecasting and Social Change, 161.

- Müller, J. M., Buliga, O., & Voigt, K. I. (2018). Fortune favors the prepared: How SMEs approach business model innovations in Industry 4.0. Technological Forecasting and Social Change, 132, 2–17.

- OECD. (2019). DIgitalization and productivity: A story of complementarities.

- Olley, S. & Pakes, A.. (1996). The dynamics of productivity in the telecommunications equipment industry. Econometrica, 64(6), 1263–1294.

- Patel, P. C., Terjesen, S., & Li, D. (2012). Enhancing effects of manufacturing flexibility through operational absorptive capacity and operational ambidexterity. Journal of Operations Management, 30(3), 201–220.

- Porter, M. E., & Heppelmann, J. E. (2014). How smart, connected products are transforming competition. Harvard business review, 92(11), 64–88.

- Rêgo, B. S., Jayantilal, S., Ferreira, J. J., & Carayannis, E. G. (2021). Rêgo, B. S., Jayantilal, S., Ferreira, J. J., & Carayannis, E. G. (2021). Digital transformation and strategic management: A systematic review of the literature. Journal of the Knowledge Economy, 1–28.

- Samuelson, P., & Nordhaus, W. (2009). Economics (19th ed.). McGraw Hill.

- Sánchez-Sellero, P., Sánchez-Sellero, M. C., Sánchez-Sellero, F. J., & Cruz-González, M. M. (2015).. Effects of innovation on technical progress in Spanish manufacturing firms. Science, Technology and Society, 20(1), 44–5.

- Scuotto, V., Del Giudice, M., & Carayannis, E. G. (2017). The effect of social networking sites and absorptive capacity on SMES’innovation performance. The Journal of Technology Transfer, 42(2), 409–424.

- Scuotto, V., Magni, D., Palladino, R., & Nicotra, M. (2022). Triggering disruptive technology absorptive capacity by CIOs. Explorative research on a micro-foundation lens. Technological Forecasting and Social Change, 174.

- Siachou, E., Vrontis, D., & Trichina, E. (2021). Can traditional organizations be digitally transformed by themselves? The moderating role of absorptive capacity and strategic interdependence. Journal of Business Research, 124, 408–421.

- Srivastava, M. K., Gnyawali, D. R., & Hatfield, D. E. (2015). Behavioral implications of absorptive capacity: The role of technological effort and technological capability in leveraging alliance network technological resources. Technological Forecasting and Social Change, 92, 346–358.

- Tekic, Z., & Koroteev, D. (2019). From disruptively digital to proudly analog: A holistic typology of digital transformation strategies. Business Horizons, 62(6), 683–693.

- Tu, Q., Vonderembse, M. A., Ragu-Nathan, T. S., & Sharkey, T. W. (206). Absorptive capacity: Enhancing the assimilation of time-based manufacturing practices. Journal of operations management, 24(5), 692–710.

- Verstegen, L., Houkes, W., & Reymen, I.. (2019). Configuring collective digital-technology usage in dynamic and complex design practices. Research Policy, 48(8).

- Volberda, H. W., Foss, N. J., & Lyles, M. A. (2010). Perspective—Absorbing the concept of absorptive capacity: How to realize its potential in the organization field. Organization science, 21(4), 931–951.

- Wei, Z., Song, X., & Wang, D.. (2017). Manufacturing flexibility, business model design, and firm performance. International Journal of Production Economics, 193, 87–97.

- Wooldridge, J. M. (2009). On estimating firm-level production functions using proxy variables to control for unobservables. Economics letters, 104(3), 112–114.

- Zahra, S. A., & George, G. (2002). Absorptive capacity: A review, reconceptualization, and extension. Academy of management review, 27(2), 185–203.

- Zammuto, R. F., Griffith, T. L., Majchrzak, A., Dougherty, D. J., & Faraj, S.. (2007). Information technology and the changing fabric of organization. Organization science, 18(5), 749–762.

- Zhang, M., Zhao, X., Lyles, M. A., & Guo, H.. (2015). Absorptive capacity and mass customization capability. International Journal of Operations & Production Management, 35(9), 1275–1294.