This article discusses some modern methods of the financial management ofcosts.

It explains the importance of costallocation as an important management activity which gives information, used by internal and external users for the calculation of the costsofindividual cost objects (unit per cost).

The article looks into the activity, stages and methods of cost allocation, such as:

- the method of allocation of fixed and variable costs;

- the method of allocation of the costs of supplementaryunits in the presence of mutual services;

- the single-ratemethod and the dual-ratemethodof allocation.

Keywords:direct costs, indirect costs, items of calculation, cost allocation, basis forcost allocation, allocation rate, single-rate methods, dual-rate methods.

Introduction

The management of the costs of the company in market conditions establishes requirements and skills of a new kind.

The management of costs is expressed in the ability to save resources and to maximize their use.

This article has both a theoretical and practical application and is an attempt at a creative rethinking of the modern notion of «cost management». The aim is to describe the diagram and the stages of allocation of the costs of the company, as well as to offer modern methods of cost management.

1. Objectives of the cost allocation of the company

Cost allocation is an important management activity, as a result of which information is obtained about the costs of the individual items of calculation[1].

The resources spent on the manufacturing of products and providing of services are divided into direct and indirect costs.

The direct costs of a particular item of calculation are the costs that are connected with this item and can be directly attributed to it in an effective way.

The indirect costs of a particular item of calculation are the costs that are connected with this item of calculation but cannot be directly attributed to it in an economically acceptable and effective way. Because they cannot be directly attributed, they are allocated to the items of calculation. An item of calculation may be the products A, B and C, which are produced in the company. Direct costs are the costs of producing only product A, which can be directly attributed to it. The direct costs include only costs directly addressed to the creation of a particular product. Indirect costs in this case refer to all products and are allocated to the three items of calculation (product A, product B, product C). These costs are usually a large part of the total costs of the items of calculation, such as products, customers, and branches of companies. Indirect costs are allocated (as a stage of the calculation of the costs by items of calculation) through a basisfor allocationand allocationrate.Therefore the allocation of costs is applicable to theindirect costs of the company. Direct costs are not subject to allocation [4]. An exception to this are the cases of the manufacturing of related and by-products.

Indirect costs are calculated as a percentage of other percentage specified costs, which is an adequate argument to reject the direct nature of these costs. According to Bulgarian accounting practices indirect costs are allocated by products proportionionally on some basis — direct material costs, direct labor costs, machine or man hours worked. If the ndirect costs for the manufacturing of the three products A, B and C are 1000 hours, the direct costs by products are:

|

Products |

A |

B |

C |

|

Machine hours |

200 h |

150 h |

50 h |

|

Man hours |

150 h |

100 h |

250 h |

For which product is it more profitable to use machine hours, man hours respectively, as a basis for the allocation of indirect costs [3].

Solution:

Based on machine hours the allocation rate is 2,5.

![]()

Indirect costs will be as follows:

Product A: 200 * 2,5 = 500 h

Product B: 150 * 2,5 = 375 h

Product C: 50 * 2,5 = 125 h

Based on man hours the allocation rate is 2.

![]()

Indirect costs are, respectively:

Product A: 150 * 2 = 300 h

Product B: 100 * 2 = 200 h

Product C: 250 * 2 = 500 h

If indirect costs are allocated, based on machine hours, in the best position will be product B (with the lowest deductible portion of indirect costs in total costs), while based on man hours product B is in a better position. The deductible portion of the indirect costs in the cost of a product is influenced by the chosen basis, which, in modern pricing methodology, is still avoided.

Indirect costs are allocated for four main purposes:

- To obtain information, necessary for making cost-effective management solutions, which can be strategic and operational. For example, whether to launch a flight to a new destination, whether to produce a particular component, necessary in production,or to purchase it, to determine the price of a new special product or service in order to assess how much of the manufacturing capacity is used.

- To motivate managers and employees. For example, to encourage the design of products that are easy to manufacture or cheap to maintain, to motivate sales staff to hard sell products of higher return.

- Toreimburse expensesor calculate commissions. For example, to calculate the commission of a consultancy, the cost of service of which is based on a percentage of the costs, saved through the advice it has given.

- To provide information,necessary for the preparation of financial statements. To calculate the cost of production for accounting and tax purposes and to measure company profits.

To achieve these objectives, not all costs are always allocated to the items of calculation. Here operates the rule «different costs for different purposes». In preparing the annual reports of the company, the cost of production includes only manufacturing costs. To determine the price of production in the long term, the cost can include the costs of all business functions.

Managers can limit the use of a particular service by the company, as well as allocate the costs of the department, providing the service, based on the services used. If the main production units in a company need different transportation services from another, supplementary unit, and the costs of this supplementary unit have to be limited, then the allocation of transportation costs to the production units will be as follows:

The transport unit has 1,000,000 BGN costs for one year. The company has two production units, called in the exposition operating branches, and for each one transportation costs are calculated, depending on the amount of services used (mileage covered) that are 100,000 kilometers. — 10 BGN costs per kilometer.

The manager of the company must charge each production unit the cost of 10 BGN per kilometer of transportation service, and each production unit will seek to reduce this amount. If transportation costs were not allocated to production units, that would lead to their excessive use and a lot of costs. When the use of a particular service (internal audit) has to be encouraged, the costs of the»internal audit» department may not be allocated to the branches of the company or may be allocated on the basis of a fixed amount.

Of course, cost allocation incurs expenses which should be compared to the benefits of this endeavor. With the advance of technology the benefits outweigh the costs in more and more of the cases in which managers make such decisions.

2. Stages in the allocation of the costs of the company

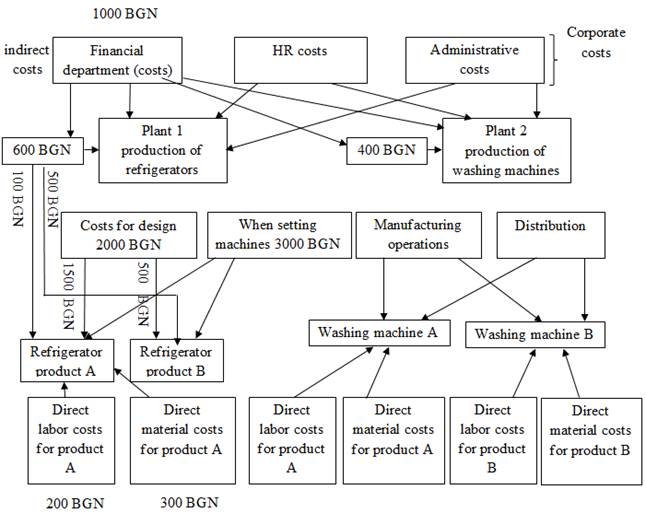

The diagram illustrates the stages of the allocation of all costs by products and services[2]. Of course, depending on the purpose of calculation, the allocation of some costs and some stages of the diagram may be omitted. The diagram shows a company with two operating branches: Plant 1, manufacturing refrigerators and Plant 2, manufacturing washing machines. Each of the two branches has two direct costs categories (direct labor and direct materials) and several indirect costs categories (design, machine setting, manufacturing operations, distribution, administration, premises and equipment).

The company has three types of corporate costs:

1) Financialcosts — expenses on interest payments on loans, used to finance machinery.

2) Human resources costs — recruitment and training of staff.

3) Corporate administrative costs — salaries of managers, rent for premises.

2.1. Allocation of corporate (indirect) costs to operating branches

For the allocation of corporate costs to operating branches, companies have to solve several problems.

- Which categories of corporate costs will be allocated to operating branches? In the different cases, companies allocate all or part of or none of the corporate costs. The decision depends on the purpose of the calculation. If the aim is to fix the price of the products of the company in the long term, it is most likely that all costs will be allocated. If the aim is assessment of the results achieved and control of the manager of the operational branch, the costs over which he has control will be allocated, such as services, requested from the HR Department or financing the purchase of a new machine.

- Having decided which corporate costs will be involved in the calculation, the company now must decide how to rank them in groups and in how many groups to put them for allocation. One extreme is to put all corporate costs in one group and use one basis for allocation. The other one is that each cost be treated independently with a separate basis for allocation. Here the main criterion is to group costs so that groups are homogeneous. This means that all costs in the group should have the same or similar cause and effect relationship with the basis for allocation, which helps for the more precise allocation of costs to the items of calculation.

- The third issue relates to the determination of the basis of allocation of all groups of costs. Those basis should be chosen that have the best cause and effect relationship with the costs, i.e. they should be cost-determining factors.

After addressing these issues, the allocation is of a technical nature — the amount of costs in each group is divided by the basis of allocation and an allocation rate is received. This was shown by an example in the earlier statement.

2.2. Allocation of the corporate (indirect) costs of operating branchesto activities and / or products

The operating branches in this case are Plant 1 and Plant 2.

The corporate costs of 1000 BGN of the financial department are thus allocated — 600 BGN for Plant 1 and 400 BGN for Plant 2. This is a general allocation from the corporate to the operational units. The costs for design of 2000 BGN are allocated on an item-by-item basis to product A — 1500 BGN and to product B — 500 BGN.

The costs of 600 BGN of Plant 1 should be allocated to both products on some basis — 100 BGN for product A and for product B — 500 BGN.

The result is the cost of product A (1500 + 100) from indirect costs and materials (200 + 300 = 500).

1600 (indirect) + 500 (direct) = 2100 costs for product A

If the manager for Plant 1 requires the recruitment of new staff from the «Human Resources» Department, this will be costs for the «Human Resources» Department, but these costs will be allocated to Plant 1. He can also himself recruit the necessary staff, with which Plant 1 reports the costs incurred.

3. Peculiarities and methods of the allocation of fixed and variable costs

So far answers were given to the questions about which costs should be allocated, which homogeneous groups and which basis for allocation should be chosen. Another important problem, dealt with in the American publications on cost management is whether the fixed and variable costs in a certain homogeneous group of costs should be allocated separately or together, i.e. with one single or two rates of allocation.

3.1. Single-rate and dual-rate methods of allocation

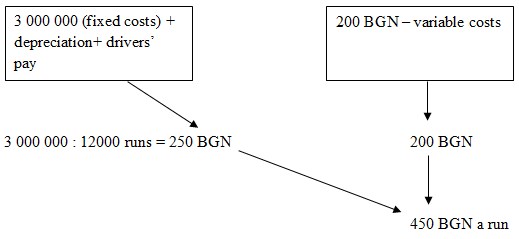

Let us take as an example a supplementary unit which provides services for two operational units. This can for example be a department that provides transportation services in one manufacturing company for two separate workshops. For the provision of these services, this department has fixed costs for the depreciation of cars and the pay of drivers and variable costs for fuel, which depend on the amount of transportation services provided. Let us assume that the fixed costs are 3,000,000 BGN and the variable costs are 200 BGN per run. Also, let us assume that the capacity of the transport unit is 18,750 runs for a period and for Workshop A and Workshop B 8000 and 4000 runs respectively have been budgeted for the period.

So the budgeted total costs will be 3000000 + 200 * (8000 + 4000) = 5,400,000. With the single-rate method, a single one is calculated, based on total costs, in this particular case 5,400,000 BGN / 12,000 runs = 450 BGN/ a run. So each provided run will cost Workshop A or Workshop B 450 BGN.

The single-rate method converts fixed costs into fixed costs per unit run so they are perceived by the managers of workshops as variables. This of course may mislead managers to make wrong management decisions that cost the company additional expenses.

If there is an offer by an outside provider of transportation services for the company at a price between 450 and 200 BGN, for 300 BGN managers may accept it, thinking that they are saving costs. In fact, they will save costs charged to their units, but those fixed costs of 3,000,000 BGN will still be costs for the company, so the total sum of costs will be 300 BGN. / external services + 3,000,000 BGN (allocated in 250), i.e. 550 will be paid instead of 450.This is misleading because those 3,000,000 still remain and we have to compare 300 BGN with 200 BGN. Only variable costs are compared.

For this purpose American publications [5] suggest the dual-rate method. With it are calculated separate rates for the allocation of variable and fixed costs. In this case 200 BGN/a run variable and 250 BGN/ a run fixed. Here the essential thing is that fixed costs are allocated based on budgeted rates, not actual ones. For example, with actual 9000 runs for Workshop A and 3000 for Workshop B, the allocation of fixed costs is 8000 * 250 = 2,000,000 BGN for Workshop A and 4000 * 250 = 1,000,000 B for Workshop B, although the number of budgeted runs is different from the actual ones. The variable costs in this case will be 9000 * 200 = 1,800,000 BGN for Plant A and 3000 * 200 = 600,000 BGN for Workshop B. Thus the managers of Workshop A and Workshop B have a clear notion of which costs are fixed and which are variable and will not be misled and take wrong management decisions.

References:

1. Gatev, K. General Theory of Statistics, Karl Marx Higher Institute, Sofia, 1986.

2. Yonkova, Boichinka, Management Accounting, Romina, S, 2006.

3. Кlasova, S., Prices in Marketing, Sofia, “Economy” University Press „Стопанство“, 2011.

4. Lambovska, Маya, The Management of Company Costs, Thrace-М, S., 2006.

5. Horngren, C. T., Foster, G., Datar, S. M. Cost Accounting — A managerial Emphasis, 11th ed., Prentice Hall, 2002.