The efficiency of any business depends on the ability of management to adapt quickly to changing conditions. The need for management decisions in adjusting the implementation of investment projects often occurs in response to the arrival of new strategic information from the market or the strategic actions of competitors. However, the use of traditional approaches based on discounted cash flows, does not allow exercising managerial flexibility in the analysis of efficiency of the investment project. The solution to this problem can reside in the application of the method of real options valuation or real options analysis (ROV or ROA).

The topicality of this article is stipulated due to the fact that options, and especially real options, play a crucial role in the mobilization of available funds for the needs of the company in the market economy and evaluation of investing attractiveness of possible alternatives when seeking for the optimal strategic move.

Looking back, thirty years ago time, salaries and bonuses, or, generally, cash, represented the biggest component of executive compensation. Stock options amounted for negligible parts. Now everything has completely changed. With tremendous speed, stock option grants prevail not only the pay, but also the wealth of top executives.

The posed problem of this article is to study the nature of real and financial options’ role within the framework of challenging business environment, considering the implementation of the real options approach in energy sector.

To analyze the identified problem it is necessary to solve the following aims:

- To identify the categories of options with their peculiarities;

- To compare real and financial options;

- To examine the advantages of real options’ application;

- To consider options as risk management tools;

- To study the examples of real options theory in energy industry;

- To analyze the main barriers to adoption of real options.

There is no doubt that realization of unexercised option grants has improved the wealth of many individual executives, investors, entrepreneurs, and software engineers.

Options are defined as contracts, through which a seller grants a buyer the right, but not the obligation, to buy or sell a specified number of shares at a predetermined price within a set time period. Options are derivatives. Their value is derived from the value of an underlying investment. In the majority of cases, the underlying investment, which serves the basis for an option, is the equity shares in a public company.

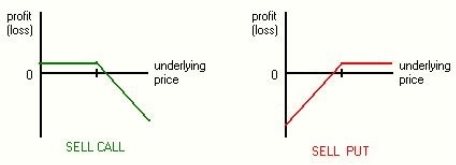

Two types of options exist: call and put options. The first one allows a holder buying a specific amount of a certain asset at a predetermined price within a specific period of time. Calls can be compared with having a long position on a stock. Logically, buyers of calls hope that the stock will increase dramatically before the option matures. A put gives the holder a right to sell an underlying asset at a predetermined price within a specific period of time. In contrast to calls, puts are almost equivalent to having a short position on a stock. Buyers of puts are waiting for the price of the stock to drop before the maturity of the option. The graphical interpretation is shown in Figure 1 below.

Figure 1. Call and put option: Profit (loss) versus price

It is crucial to mention, why options are such an attractive trading vehicle for many traders.

First and foremost, leverage is a part of options. A trader of options can control a really huge amount of stock for a small quantity of capital. Thanks to leverage, traders can make a sizable amount of money using insignificant changes of price. Investors and traders include options in their portfolios because of leverage’s benefits. The ability to make bigger bets using small amount of money is appealing to traders, while investor seeks for the opportunity to hedge long-term stock positions at a low cost.

What is more, traders are able to make leveraged bets on a stock’s direction. However, traders also can benefit from a stable stock that is without any movements. In such a case, trades use different strategies, which vary depending on their complexity.

Besides, options’ leverage is an option that serves a perfect instrument for stock portfolio’s hedging. A trader has an opportunity to completely protect long-term investment from market risk by buying options against this type of investment for a minor quantity of money.

Actually, stock traders have lower commissions than options traders. But options’ commissions have fallen dramatically during the last years. Such a decline was caused by the volume growth of options trading. A rapid increase in online options brokers has become the reason for a competition among options broker. It also can be a reason for option trading costs to be low.

The last, but not the least, options allow traders to fully control their risk exposure. For instance, there is only a risk of losing the premium amount for buyers of put options, while a trader who sells a stock short can, as a matter of fact, will suffer if the position unexpectedly becomes red.

Moving to the next subtopic of the article, in practice options can be divided into real and financial ones.

A financial option is a derivative instrument which value depends on the volatility of the underlying financial securities from which it is derived. Financial option is a right, but not an obligation, to buy or sell an underlying financial asset at a predetermined price over a specific period of time. For instance, equity securities are underlying financial assets for stock options while cash denominated in various currencies is the underlying asset for currency options.

On the contrary, “A real option is defined as an option, the underlying asset of which is a real asset, invested under uncertainty, and taking into account potential opportunities of the project and management flexibility.” [4]Real options are decision choices about real assets that a manager may exercise in the future. Managerial decisions related to the resource allocation (e.g R&D projects, real estate, or investments in the group of nonfinancialtangible or intangible assets) as well as the capital budget serve as the basis for real options. Due to the fact that the assets underlying real options are illiquid, they are not traded on financial exchanges. Various valid investment projects could enclose a combination of uncertainces and thus include compound real options or options on an option (with the possibility of interaction of their values).

The following part of the article would specify the similiarities and differences between financial and real options.

The parallel between both options' valuations is shown in the Table 1. At a first glance, the components look pretty similar if the criteria refer to the Black and Scholes (1973) option valuation parameters. However, the factors that are taken for the basis are different in their nature.

Table 1

Comparison of real and financial options

|

The parameter that affects the value of the option |

Financial option |

Real option |

|

Asset |

Share |

Project (NPV) |

|

The value of the underlying asset |

Current stock price |

Present value of expected cash flows |

|

Volatility (standard deviation) |

The volatility of the stock price |

Volatility of the underlying asset (project value, probability distribution) |

|

The exercise price |

The exercise (strike) price of the option |

Investment cost |

|

The time remaining to the date of option’s maturity |

The time of option's maturity |

Time remaining until the decision must be made |

|

The level of interest rates |

Yield of government bond (risk-free rate of interest) |

Yield of government bond (risk-free discount rate) |

|

Dividends |

Dividends paid out by the underlying asset |

Mandatory project’s payments (taxes, duties and other payments over the project’s lifecycle) |

Source: D. G. Perepelitsa/ Methods of analysis and assessment of efficiency of investment projects through real options, Moscow, 2009

This fact brings us to the cocnclusion that both types of options hold unique peculiarities that should be carefully examined. The majority of distinctions could be explained by the fact that financial options have been traded for several decades, whereas real options are supposed to be relatively young instruments.

In contrast to real options that possess long maturities (expiring in several years), financial options have short maturities, generally expiring in several months.

As a rule, the underlying asset in financial options is the stock price, while real options enjoy greater variety, ranging from market demand to commodity prices.

A significant difference lies in the measurement of option’s volatility. The holders of financial options do not have an opportunity to influence stock prices for gaining benefits. The situation is opposite when applied to the holders of real options. The thing is that management makes assumptions that are critical for creating strategic options so that the decisions made can enhance the value of the project. In fact, the main idea is that the ability to observe the external environment to adapt suitable behaviour internally has a huge impact on the value of real options.

In addition, the value of financial options is measured in tens or hundreds of dollars per option while real options represent higher value measured in thousands, millions, and possibly even billions of dollars per strategic option.

The previous section has already revealed the advantages of real options, but there are still a few left. One of the real options’ benefits is the flexibility that they possess in a number of crucial ways.

Before a real option’s exercise, it is necessary to pay a special exercise price. Obviously, it is much better to pay as small amount as possible. With an increase of the ratio of cash flows to the cost of investment, the value of the options also goes up.

In fact, a real option is associated with a free loan. A person carries the investment cost only when he/she decides to exercise the option. Thus, the value of a real option grows with interest rate and the length of time before the actual investment. Logically, the holder of such option receives profit if everything goes right and loses nothing with increasing uncertainty. It can be said, that the larger the uncertainty, the greater the probability of more beneficial outcome.

It should be noticed that real options could be seen as strategic decisions. A better choice could be made since real options comprise several functional processes (like changes in major factors that define the value of investment and cash flows).

The reference of both financial and real options to risk management is well established.

With the help of financial options investors construct portfolios with actual and desired returns and manage the financial risks they encounter. Real options, in their turn, are specific tools seeking for potential good opportunities and reduction of unfavourable outcomes.

However, precise and accurate identification and measurement of sources of risk, procedures with relevant variables, and correlations as well as bets values are required to realize the potential of options.

To illustrate it clearly, specific models are used. For instance, the single asset mean-variance model (the process of weighing risk (variance) against expected return) and the single asset real options analysys (ROA applies option valuation techniques to capital budgeting decisions) state that volatility is centric. Simply, with higher volatility the value of financial asset falls.

Furthermore, the several assets CAPM model (the capital asset pricing model describes the relationship between risk and expected return, used in the pricing of risky securities) and the several assets real options analysis declare that the correlation between assets has equal importance with volatility, thus, a low beta, or a low coefficient of correlation between asset values, increases the chance of both real and financial assets being used as insurance.

It is critical to mention that real options are extremely valuable instrument in renewable energy sources investment projects evaluation. It should be noted that renewable energy sources lack competitiveness in line with other generation technologies. That could be partially explained by the fact that investment costs compose a significant constraint against their wide usage. In addition, since the resulted beneficial returns of renewable energy technologies are not fully transparent and clear, these are wrongly supposed to be less effective than traditional technologies. Hence, the appropriate back ups and outline has to be prepared in advance to attract investors to this area and turn renewable energy sources investment into the desired sector.

To start with, one of the first attempts to apply real options theory to the usage of wind energy sector, goes back to 2002, by Venetsanos and сo-authors [11]. The authors defined a scope to estimate power projects of renewableenergy. Firstly, they took into account the uncertainties and directly related features of resources, which were connected with energy production. Secondly, they defined the real options included in a wind energy project. Thirdly, they estimated the project, focusing on the real options theory. For that authors relied on the Black– Scholes Model that is used for estimating the value of a stock option. It is possible to calculate both call and put options’ values. Finally, Venetsanos and co-authors compared the outcomes of their model with technique of traditional Discounted Cash Flow. They found that on the one hand, the option value was positive, but on the other hand, the net present value was less than zero. Only in Norway in 2007 Kjarland [12] implemented theory of real options to evaluate the value of opportunities of hydropower investment, and came up with the correlation between electricity price level and optimal timing of investment decisions in hydropower sector.

In 2009, Munoz [13] developed a model for calculating wind energy investments. Stochastic model used for this purpose determined the parameters that influenced NPV and real options model to estimate the probabilities of investment, to realize if it would be better to take time of just abandon the project.

In 2006 real options technique was used to evaluate changing tariff for various wind generation assets, and to highlight optimal switching policies and values in electricity market of Spain. Two years later, Kum-baroglu˘ et al. [14] applied a planning model that integrated learning curve information on renewable power generation technologies into a programming formulation including theory of real options. In fact, that model was successfully used in Turkey.

As none of the system is perfect in its implementation, there are some barriers to the use of real options as well.

The first barrier is that real options models suppose a lot of repeated bets, while project managers make single-use decisions. Modeled options that are priced precisely that show the profitability to buy these options and use them, do not guarantee that these actions would make the present value grow. An option can actually increase project value or can be independent when uncertainty resolution and managerial decisions do not affect it. If the uncertainty leads to the fact that the option should not be exercised, costs for the maintenance of this option are paid without capturing any benefits. Logically, such options do not increase project value but decrease it. Sometimes these options are recommended because their price is determined based on the average payoff of a number of repeated bets. According to the assumption, the same circumstances would happen not once, that is why a holder of option will grab the average of all losses and gains.

Some project managers can choose using probabilistic (exposure-based) perspective of risk. To begin with, project managers may predict conditions in which they could be asked to clarify the reasons for the expense they did (e.g. to purchase an option) with no contribution to the project value since there was no real need in option. Besides, it is critical to understand, that the choice of probabilistic perspective can depend on the fact that, if the option is exercised not precisely, it is possible to survive and loses will not be enormous. In this case, if short-term aims are prior, the project manager will act conservatively and execute only options with low risk.

The second barrier can be the fact that project managers may be unwilling to take a risk while valuing real options. In this situation, project managers are ready to refuse some benefits in order to decrease the level of possible risk. A great number of managers’ actions can add up to project value if uncertainty plays a minor role in the result of value adding. Risk-averse managers would better choose to extend the duration of the project, rather than adopt innovative technology, the impact of which is still uncertain. Adding a cost in the valuation of real options can increase the level of managers’ tolerance to risk. Consequently, it would make real options less attractive compared to more certain alternatives. Today, pricing models of real options do not include such costs because of perspectives of managers. These costs related to risk aversion of managers lead to the growth of real options’ cost, decrease in their attractiveness to managers, and logically, real options are used less than their price envisages.

The next barrier could emerge from the idea that real options or managers’ projects are less valuable than traditional pricing assumes. In fact, there are plenty of managerial actions that lead to a growth of the project value. However, the greater the numbers of additional alternatives that are available, the smaller the values of real options are. Thus, every additional strategy that can improve results without the consideration of option decreases the number of gain the option can add. What is more, most models of options assume that option’s holder does not influence the price of the original asset. The holder, according to the option pricing models for financial assets, does not depend on the asset except through the market.

The possible benefit of option falls due to the desire of project managers to influence project uncertainties in order to increase values of projects. Therefore, it can cause overvaluation of real options while using the traditional models.

The fourth barrier is that the resources for project managers are limited. According to the real options theory: when an option adds value, the potential holder should maintain, buy and use it. However, in practice, managers require real options add as much value as possible before the options are purchased. Limitations on some types of resources narrow the real options use, including labor, raw materials, equipment, time for options’ use, funds for buying flexibility, etc.

Moving further, project managers do not always look for opportunities to maximize project value. It can be simply explained using agency problem. According to this, managers evaluate project differently from the owners of these projects.

The last but not the least, bounded rationality is a widespread limited resource that project managers usually face. There is a probability that some managers might find options less attractive if they are really complex. In other words, project managers prefer simpler alternatives.

To overcome the barriers mentioned above, project managers can develop and provide tools expanding capabilities of project managers to use, and what is equally important, to understand options. The results of implementation of new methods and tools could be: price balancing, valuation, and managerial practice.

Summarizing all of the above, a proper combination of financial and real options raise chances to eliminate risks and expand opportunities to create value for the firm and outpace competitors or increase personal wealth of individuals.

The real options approach strenghthens business capabilities and stimulates decisions leading to best possible results.

The focus on energy sector emphasizes the scope of real options theory applicability. Since high initial costs and high financial risk are the main peculiarities of the renewable energy sources investment projects, real options approach is exactly the way to estimate the value of the project most precisely.

Obviously, there is always space for improvement for real options to be transformed into a standard part of toolbox of every project manager. Hopefully, the real options theory is gaining its power as the completed projects that implemented the approach reveal good results.

References:

- NASDAQ/ Options defined/ URL: http://www.nasdaq.com/investing/options-guide/definition-of-options.aspx#ixzz45dL41Wrn

- Brian J. Hall/What you need to know about stock options, 2000, Harvard Business Review/ URL: https://hbr.org/2000/03/what-you-need-to-know-about-stock-options

- D. Penn/ Top 5 reasons you should trade options and 2 why you shouldn’t, 2008/ URL:http://tradingmarkets.com/recent/top_5_reasons_why_you_should_trade_options__and_2_why_you_shouldnt_-676633.html

4. D. G. Perepelitsa/ Methods of analysis and assessment of efficiency of investment projects through real options, Moscow, 2009

5. Marcel Boyer, Peter Christoffersen, Pierre Lasserre, Andrey Pavlov/ Value creation, risk management, and real options/ 2003

- Constance Lütolf-Carroll, Antti Pirnes and Withers LLP/ From Innovation to Cash Flows: Value Creation by Structuring High Technology Alliances, 2009/ URL: http://onlinelibrary.wiley.com/store/10.1002/9781118273166.app5/asset/app5.pdf;jsessionid=53AEC968CE58EAF73D8A9358902E067D.f04t02?v=1&t=imxjxi08&s=d29b96f7ea7539b020e5007a642e91fe1c0bc2e2

- Chris Walters and Tim Giles of London Economics / Using real options in strategic decision making, 2000/ URL: http://mba.tuck.dartmouth.edu/paradigm/spring2000/articles/walters-decision_making.html

- Tero Haahtela / Differences between financial options and real options, 2012/URL: http://orlabanalytics.ca/lnms/archive/v4/lnmsv4p169.pdf

- Lokesh Madan/ What’s the difference between — REAL OPTIONS & FINANCIAL OPTIONS Trading, 2012 / URL: http://algotradingindia.blogspot.ru/2012/09/whats-difference-between-real-options.html

- H. B. Nembhard, M. Aktan/ Real options in engineering, design, operations, and management, 2010

- Venetsanos K, Angelopoulou P, Tsoutsos T. Renewable energy sources project appraisal under uncertainty, the case of wind energy exploitation within a changing energy market environment. Energy Policy 2002;30:293–307.

- Kjarland F. A real option analysis of investments in hydropower — the case of Norway. Energy Policy 2007;35:5901–8.

- Munoz˜ JI, Contreras J, Caamano˜ J, Correia PF. Risk assessment of wind power generation project investments based on real options. In: IEEE Bucharest power tech. conference. 2009.

- Kumbaroglu˘ G, Madlener R, Demirel M. A real options evaluation model for the diffusion prospects of new renewable power generation technologies. Energy Economics 2008; 30:1882–908.