Updating the economics and implementing deep structural changes in national banking system demands progressive development today. Having gained independency our Republic has carried out consecutive reforms in national bank system liberalization.

However, it is necessary to point out, banks are not competent to use their opportunities to gain their customers’ confidence. Therefore, taking into consideration the above mentioned, it is asked to introduce new types of bank services: a) to increase the attraction of people’s and economic entities’ spare cash capitals to the long-term deposits of commercial banks; b) to increase the long-term credit shares of the country on the strong basis on the account of inner sources.

Effective usage of marketing factors based on scientific research is of great importance especially in both: a) attracting the people’s and economic entities’ spare cash capitals to the long-term deposits of commercial banks; and b) in improving the bank activity.

Nowadays it is getting very actual to increase the people’s and economic entities’– customers’ confidence in attracting spare cash and credit capitals, using them wisely and to restrict out-of-bank money circulation.

Successive activity of bank system in market economy and their development depends on the attracting spare cash and credit capitals, and their rational usage. Because, attracting spare cash and credit capitals and using them in important branches of national economy of the country as a credit is considered to be a continuous responsible financial provider of national industry.

The President of the Republic of Uzbekistan pays much attention to the intensification of the bank resources, to provide an active participation of commercial banks in the processes of investment and structural changes of the national economy, amplification of active and passive bank operations. In May 2016 the President adopted a resolution which runs as follows: “Increasing the financial consistency of commercial banks and taking steps and measures for improving their resource base”. It is directed to increase the financial invariability and liquidity of commercial banks according to the international standards; reinforcing their resource base; to take measures for widening the bank service spectrum and its quality. This means that attracting spare cash and credit capitals has become a strategic target to the commercial banks.

As a result of increasing the resource base of commercial banks the volume of all the deposits of has been increasing year by year. During the last five years the rate of bank deposit increase has covered over 30%. Attracting spare cash and credit capitals as the main source of the commercial banks gave the result of: a) people’s real income has been growing; b) people’s confidence to the banking system has been growing; c) the countries economy has been growing fast; people’s welfare has been growing.

Situation in financial markets and sound competition demands the commercial banks to increase the efficiency of bank services and their types. The banks improving their activity in markets implement new tempting savings activity in order to attract people’s spare cash and credit capitals to their deposits. Moreover, it comes in handy to our state leader’s resolution “Waging a competition among republican commercial banks on attracting people’s spare cash and credit capitals”. Accordingly to that annual competition on attracting people’s spare cash and credit capitals at the end of each year.

The competition has opened a highway: to speed up attracting people’s spare cash and credit capitals activity of commercial banks, improving the quality and types of bank services; introducing the new types of deposits and expanding them taking into consideration the demands and wants of natural persons.

Nowadays the commercial banks suggest their customers over 250 types of savings: – a) in time-limitless and unlimited quantity local and foreign currencies, b) handed in customer’s first demand and returned after the agreed term with the customer, c) aimed conditioned savings and others.

It is necessary to point out, that customers can save their money in cash or through money order or currency conversion from their personal deposit accounts in foreign banks.

According to analysis the savings types cover people in all ages. It is reflected in the quantity and deposit amounts of money savers. According to the results of the last International currency deposit research every 1000 deposit-accounts opened by elderly natural-persons make up 1102 units and it was pointed out that this indicator is the highest among the countries of Commonwealth of newly – Independent States.

Financial stability and development of banking system, principally the deposit volume of people and house holding parties’ 2015 semiannual account indicators correspond to a “high degree” appraisal of data. It is in conformity with the President of Uzbekistan Islam Karimov’s program measures on deepening and broadening the economic reforms in 2011 – 2015 periods. Particularly, the dynamics of crediting companies deposit volume made up 30’2 % over the GDP rate of increase; the dynamics of people’s savings in banks made up 30’4 % over the rate of increase of the population real income. The same situation was observed in Kara-Kalpack republic, in all regions of Uzbekistan and in Tashkent. The business-like situation and social-economic development rate indicators should be accounted quarterly.

It is perfectly clear that, bank – customer mutual relations problem reflects the bank’s competitiveness. Financial competence of the country’s population is less than the desired, but the customers consider that they are served perfectly.

It must be pointed out that it is of great importance to study the bank-customers wants, but it hadn’t been the object of specially researched enough. The marketing efficiency of the bank does not depend on its size, but it depends on its goals, plans and its rating. The following chart # 1 shows the influence of the bank services properties to the bank marketing properties.

Chart # 1

Classification of bank marketing properties

|

Groups of service marks |

Bank marketing properties |

|

Distinguishing marks: 1. Providing the economy with payment capital 2.Controlling the amount of money in circulation 3.Supporting the money institution activity |

Taking into consideration of people’s socio-psychological relations; using this property in making up the acting influence of commercial bank products |

|

Bank service marks characteristic to other types of services 1. Using the credit money |

Necessity of alternating the bank customer data |

|

2. Individual description |

Analyzing the bank customer data systematically |

|

3. Closedness to the third party |

Difficulty of the marketing data obtaining and their storage |

|

4. Strict state control |

Analyzing the orientations, actions and resolutions of government structures concerning the banking system, country, territories, market economy |

|

5. Dependence to the customers |

a) necessity of the customer data alternation; b) analyzing the orientations, resolutions of different structures concerning the bank system; c) creating a reliable communication with customers; d) making a complex analysis of the customers data. |

|

6. Customer service alternation |

a) differentiated approach towards the bank service; b) universalization of the bank activity; c) customer data alternation; d) using this property in creating the bank products. |

|

7. Dependence of stable bank activity in gaining the bank customers’ confidence |

a) alternating the customer data; b) creating a reliable communication with customers; c) making a complex analysis of the customers data. |

|

8. Profit is the result of continuous, non-stop activity |

Using this property in the formation stages of the bank marketing strategy |

|

9. Dependence of the bank risks to the customer risks |

a) alternating the customer data; b) using this property in the formation stages of the bank marketing strategy |

|

10. Servicing duration comparatively high |

Cooperating with customers permanently |

|

11. Information volume |

Using update technologies in collecting the bank marketing information |

The chart was formed on the base of the author’s empiric research.

Marketing concept is based on informing all the persons of the economy with all departments’ activity. The activity of the bank clients is considered to be more complex than that of the production. Because, servicing the client takes place simultaneously. Thus and so, bank clients are the actual and potential buyers of bank products.

Nowadays, it is important to get answers for the following questions while getting in communication with the customer for the first time – Whether he will become a permanent customer of the bank? Will the first customer-service become useful to the bank? Is it necessary to keep him as a bank customer? [1].

Attracting the new clients to the bank among successful enterprises and organizations shows the degree of the bank client-policy. Practice shows that, to keep the “old” client manages more cheaply than to find and to attract perspective, new clients. If the circle of clients does not extend constantly, If the bank does not improve its skills of maintenance of clients and their attraction the bank will lose its image and, hence, loses its profit.

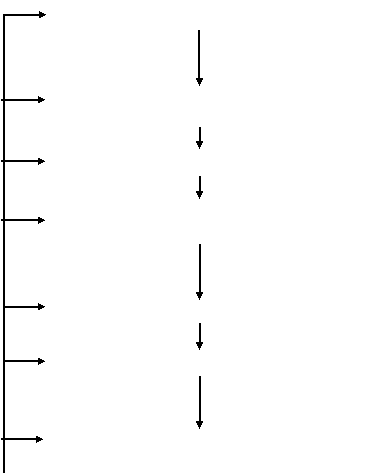

Generally, the following four functions are very important in client business: a) client attracting; b) keeping the client; c) developing them and the last – d) refusing the non-useful client (fig. 1)

Fig. 1. Functions of client business

The chart was formed on the base of the author’s empiric research

The above mentioned information shows that client maintaining is in the first place which is not in vain. A famous expert Peter Drooker points out that the significance of attracting new clients is the process connected with enforcing all the bank departments responsible for the deal, in general, reviving the activity of the bank [2]. Because, banks are interested not only in the amount of attracted capital, but also it is interested in the profit obtained by the bank services to the new client and the profit received from the bank-product sale.

Attracting a new client is considered to be an expensive measure. Some instances connected with the problem show that the other forms of client business (e.g. client maintaining) client attracting is twice or three times more expensive [3]. Client attracting technology comprises some important stages such as: a) personnel training; b) seeking the corresponding organizations; c) negotiating with them; d) getting into the way with others e) obtaining positive decisions from potential clients and others.

Since client attracting stage is very important special attention must be paid to that. Client attracting process can be described as in the following block-scheme in fig.2.

Such variant makes easy to imagine the process as technological deeds. To our mind, successful -end of attracting clients can be achieved through showing the process as consequent stages. It makes easy to carry on research work. Besides that such scheme helps the manager responsible for attracting new clients to map the bank guidance (instructions). Working out the guidance needs necessary tests for each stages, methods of business assessment of the client, providing the manager with information and others must be deliberately expressed.

Estimating the manager’s skills must be based on the person’s knowledge (about his bank, about his bank-product’s advantages), his communication skills (telephoning and dominance in communications, presenting the goods, expressing his position and so on) as well as being familiar with the client’s trade should be compared with the requirements of the bank. Such variant of assessment can successfully be achieved by computer tests.

Client attracting comprises the following: a) information providing preparation; b) organizing preparation; c) manager’s psychological readiness on looking for and attracting the new client.

The first two stages are about manager’s readiness, as well as about the departments dealing with looking for new clients and attracting them to the bank.

Speaking about the personnel (i.e. about the managers consisting of highly-qualified skillful bank-personnel group), manager’s readiness degree is defined by their skills. For preparing the highly-skilled managers we recommend the following: the specialist should be selected from those who are eager to work at the department and must be prepared. Inviting from other place is non-advisable. Hereby, to our mind, one should pay attention to some morale points of the client attracting manager such as: his honesty, reliability and sincerity.

I

I

Client attracting

stage assessment -----------------------------------------------------------------

II

III

IV

Preparedness assessment

stage for future --------------------------------------------------------------

meeting

V

V I

Client attracting results ---------------------------------------------------------------

assessment

VII

Fig. 2. Attracting new clients and assessment of the results stage

Drawn up by the Author

Speaking about the personnel (i.e. about the managers consisting of highly-qualified skillful bank-personnel group), manager’s readiness degree is defined by their skills. For preparing the highly-skilled managers we recommend the following: the specialist should be selected from those who are eager to work at the department and must be prepared. Inviting from other place is non-advisable. Hereby, to our mind, one should pay attention to some morale points of the client attracting manager such as: his honesty, reliability and sincerity.

During attracting new clients to the bank a special definite organizational action program must be worked out. This plan includes the following: a) client assessment; b) communication strategy; other actions; client attracting manager’s technical opportunities - vehicle, communication, advertisement material, identity cards, booklets and others. Corresponding service departments of the bank (house holding department, advertising department and others) should prepare and provide the client attracting manager with them.

It is very important to prepare the manager psychologically in the course of attracting the new clients to the bank. It is based on the self-activity modeling exercises. The expert’s behavior is very important during this process, he shouldn’t be impertinent and neither self-arrayed nor self-conscious and indecisive. Manager’s deferential relation towards the client is a success.

Researching in analyzing the client’s market has its own properties, such as following:

Unfeeling the bank’s product;

Client’s satisfying while he is being served;

Non-offering the types of bank services, but how it makes possible to serve him;

Service success is to find an potential client and qualitative satisfying the client’s demands.

There are two ways of finding the potential clients: a) direct (bank-manager’s direct communication with the potential client) and b) indirect (through mass-media, by the help of PR-reaction and through other ways of communication) [4].

The ways of direct attraction of new clients are as following:

Attracting the new clients through successfully before-serviced clients;

Through the mass-media information about successful activities of companies;

Through specially-organized conferences, symposiums and exhibitions;

Through the offices dealing with the newly-organized companies and farms’ registration;

Through the socially-organized by the city and zone meetings information;

Through the relatives of the bank personnel;

Through the manager’s personal relations;

Through the attraction of the bankrupted bank-clients;

Through the additional(non-financial) services of the bank;

Through the well-specialized to the market consumers customers;

Through the direct-mail system;

Through the leading managers.

Looking for this form of clients is as follows:

1. Identifying the potential clients. You can get information about them from managers or from other personnel.

2. Finding and identifying the effective enterprises which need services for improving and expanding their business through mass-media and internet.

3. Making the list and registration of house-holding subjects taking part in symposiums, exhibitions and conferences.

4. Getting information about newly getting formed business subjects.

5. Getting information about successful politicians, their intentions about entering the business.

6. Finding and identifying the relatives of bank personnel, about whom the bank is interested.

7. Organizing inquiries with friends, relatives and colleagues through managers.

8. Being informed about problem banks and companies.

9. Informing the bank clients about the out-of-duty function activities (consulting, training, trade-cooperation and others).

10. Collecting data-base about the potential clients the bank interested in.

11. Defining the territories close to the bank.

12. Sending letters about cooperation with identified potential clients.

13. Holding meetings between the bank and the clients for establishing mutual cooperative relations.

14. Fulfilling the firm decision.

Much has been described about complex research of markets and the marketing research directions and ways in scientific literature [5]. But it should be pointed out they explain the changing ways of production enterprises and consumer markets. We are going to pay a special attention in our bank services to marketing research properties.

First of all it is necessary to define who deals with bank’s potential clients’ market research. It should be pointed out that the marketing research should be paid to the activity of the newly-attracted clients. This is a time-consuming process. The best way is to arrange a competent information analysis center at the bank. It provides the corresponding departments with necessary information about the clients. The center should be supplied with competent experts. They must be skilled and able to get any information in needed volume whenever and wherever they are asked. The information needing departments of the bank must formalize their demand deliberately and in correct order. They must point the volume, period, content, reliability rate and the source of their order.

The second way of solving the problem of potential clients’ market analysis is to have their own information-analysis department communicating with potential clients. Practice shows that this is a comparatively-effective way. Brain storming on a narrow specialization gives high results. It should be pointed out that, although, it is considered to be a comparatively expensive way, to achieve high efficiency proves the expenses.

The third way of client-attraction marketing analysis is considered the direct activity of the marketing manager.

Potential clients’ marketing analysis must have the following information:

a) Clients must have successful activity and perspective;

b) Opportunity and desire to become our bank’s client.

The information background makes possible to have long-term planned cooperation with potential clients, to find new perspective opportunities, to get information about new companies, to attract new potential clients through communication with them. It is necessary to attract effectively-operating enterprises in order to develop the clients’ base. It is not desirable to have problem organizations.

We are going to tell two practical ways of client diagnosis which can give information about bank’s potential client – company’s financial, organizational and commercial competence.

1. Stationar analysis.

2. Client’s fast business diagnosis.

Stationar analysis is carried out on the bases of client’s financial indicators by a group of experts using marketing cabinet research [6]. It is true, financial assessment does not make difficulties (when balance indicators are available). But the assessment of the client’s production, management and commercial competence makes some difficulties. But the depreciation rates of production equipments, business-plan, production quality control-system, managers’ skill rating, the analysis of labor utility and defining other indicators represent some difficulties. Defining the degree of satisfying the clients’ service demands rating is considered to be a complex process as well [7].

While fulfilling the stationar analysis of the client’s status the operations should be carried out by turns. The process should be based on the materials reported through the mass media, enterprise’s reports, and processed balance materials of the production. After that necessary information about the company to which the bank is interested is looked from other sources. They are as follows: controlling organs, such as tax committee, civil courts, patent offices, customs committee, and transport organizations, servicing banks, exchanges, insurance companies and information from other companies. We do not suggest illegal information for the potential clients. We mean that the formally-reported material of the client under discussion is of great importance.

Since deposits increase the banks’ crediting competence of the branches of the economy, bases the increasing of the bank services degrees banks use actively the instruments of attracting the spare cash money of physical and juridical persons.

National currency securities issued by banks – bonds with the principal value, definitely marked interest rates and deadlines, saving certificates with sums and contracted interest rates are getting more popular. The present credit securities offer to their owners some advantages – they can be: sold to anybody prior to the term-date, gifted, presented as a chart-share of a house-holding subjects or as a mortgage.

One of the advantages of depositing in the commercial banks by the population in our Republic, different from other developed countries is that the profits from deposits are not taxed and their sources are not declared.

Similarly, the most liquid, profitable spare cash money savings, physical people’s bank accounts as well as their financial operations are considered as a bank secret. The confidence of such information by the commercial banks is guaranteed by law “Bank secrets” and “State protection guarantee of citizens’ bank savings”.

In accordance to the law the deposit accounts of physical persons regardless of their volume are guaranteed by the state as well as their complete return by the citizen’s first demand.

The growth of people’s incomes in our country requires the optimization of bank deposit policy in conformity with market situation. On grounds of expedience the commercial banks are increasing the volume of credit bond securities using their resource base, as well as the following: a) extending the cashless payment system; b) increasing the quantity of cashless payment terminals; c) working out long-term deposit programs using modern update information communication technologies which provides introducing bank plastic cards into wide circulation.

Литература:

- Васин Ю.В., Лаврентьев Л.Г. Эффективные программы лояльности. Как привлечь и удержать клиентов / 3-е изд. – М.: Альпина Бизнес Букс, 2006. – С.63.

- Владиславлев Д.Н. Как организовать клиентскую службу банка. – М.: Ось-89, 2004. – С.34.

- Кендра Ли. Создание клиентской базы: пошаговое руководство по превращению контактов в деньги / Пер. с англ. – М.: Вершина, 2006. С.14.

- Ахунова Г.Н. и др. Стратегия бизнеса: учеб. пособие – ТГЭУ, 2007. – С.43.

- АакерД., Кумар В. И др. Маркетинговые исследования: 7-е изд./ Под ред. Божук С.; Пер. с англ.– СПб.: Питер, 2004. –с.848.

- Алимов Р., Жалолов Ж., Хотамов И. Акромов Т., Маркетингни бошқариш. – Т.; “Адолат”, 2000. – б. 424.

- Беляевский И.К. Маркетинговое исследование: информация, анализ, прогноз: уч. пособ. – М.: Финансы и статистика, 2004. С.205.

- Котлер Ф. Маркетинг-менеджмент: Экспресс-курс/ пер. с англ. под ред. Ю.Н.Каптуревского – Спб.: Питер, 2005. С.800.

- Мухитдинов Д.М. и др. Маркетинг: рыночная концепция управления. – Т.:1997 –с.123;

- Стоун М., Бонд Э., Блейк Э. Прямой и интерактивный маркетинг. /Пер. с англ. –Днепропетровск: Баланс Бизнес Букс, 2005 –с.552.

- Малхотра Н.К. Маркетинговые исследования. Практическое руководство / 4-е изд.; Пер. с англ.– М.: ООО «Вильямс», 2007 –с.67.

- Фоксал Г. Психология потребителя в маркетинге / Пер. с англ. Под ред. И.В. Андреевой. – СПб.; Питер, 2001 – с.29.