With the development of modern banking system in Russia and in the conditions of stabilization of the financial market, there is an active introduction of bank cards in payment transactions of the country. Operations with bank cards are among the most profitable banking activities. The Issue and service of cards are coordinated by different payment systems. Banking is one of the oldest classes of mankind. Today there are many services provided by banks to their customers. One of the fastest growing types of services is issuing plastic cards. This explains the relevance of the topic of plastic cards, as well as an increased interest to the subject of plastic cards and cashless payment.

Keywords: bank card, plastic card, Visa, Master Card, Union Pay, banking, defense.

Modern banking system provides the ability to make payments promptly with plastic cards. Currently, plastic cards are widely used not only in the banking sector, but also wherever needed to perform transactions to pay for a wide variety of goods and services, including the purchase of products in supermarkets, shops, services in hotels, restaurants, mobile communications and the Internet; where there is need to confirm the identity of the person, obtain the necessary information about the concrete person and commercial facilities, etc.

Today, plastic cards carry a lot more functions than their «ancestors», which were made of cardboard. According to some sources, the first credit cards were used by Mobil Oil (General Petroleum Corporation of California) to pay for petroleum products sold to retail customers [1]. According to other sources, the first cards were introduced at the enterprises of restaurants and shopping segment, and then at gas stations [2]. Clearly, these cards’ life is small, over time the material of their manufacture has been replaced by a metal. So, in 1928, the company Farrington Manufacturing began issuing its VIP-clients metallic embossed cards with individual data on them.

In all these relationships there were two sides — the seller and the buyer, we did not see the third side — a financial intermediary. The closest prototype of the modern plastic cards is a system Charge-it, developed in 1946 by J. S. Biggs. According to this system, customers in stores left personal notes which were taken into account in the banks by debiting the necessary amounts from the accounts of the respectable clients.

Further historical development of cards is usually associated with the system of Diners Club, founded in 1950. Solid restaurants offered their patrons a loan made by the issuance of original loan books. It is clear that each institution had its own book. The idea of business was to replace a large number of documents of various restaurants by one card Diners Club. For a long time, Diners Club was a kind of monopoly, but in 1958 two other companies — Carte Blanche and American Express (AmEx) began to offer similar products.

Since the 60s bank credit cards received the active development. The largest banks offering such products were Bank of America and Chase Manhattan Bank.

In fact, the beginning of the 70s of the XX century the market of plastic cards of America was controlled by two major associations — Interbank Card Association and National Bank Americard Incorporated, which eventually switched to using existing and now brands — MasterCard and VISA, respectively.

The first card of foreign payment system served in the Soviet Union was a card Diners Club. Commercial production of plastic cards began in the 90s after the collapse of the Soviet Union [2].

In the early 90s the first domestic payment systems were created in Russia. Among the existing now there is STB, Ltd. Processing Company «Union Card» Golden Crown. It is worth noting that one of the largest domestic payment systems, created by Sberbank in 1993, Sbercards was voluntarily liquidated in August 20, 2012.

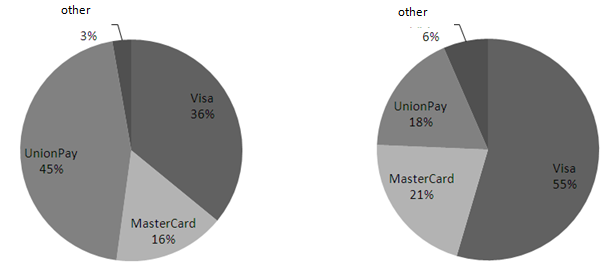

Considering the global trends, it is necessary to note the broad expansion of the Chinese payment system Union Pay. It was created relatively recently (in 2002) with the generous support of the People's Bank of China, currently it has partnership agreements with more than 8 million companies in 135 countries. World statistics of leading payment systems is shown in Figure1.

The share of international payment systems from the total number of bank cards in circulation is on the left, and the volume of transactions is depicted on the right.

In Russia, Union Pay payment system does not have a significant distribution yet, although it has been on the domestic market since 2007. Technical characteristic of these cards is their inability to be used on standard banking terminals, which greatly restricts the penetration through the world, including Russia.

Thus, the evolution of bank cards for the past 100 years was largely predetermined by technological progress, one can notice the move to less resourceful technologies in the production of cards (plastic), and in their service by electronic document.

Modern manufacturing techniques and protection of plastic cards allow to store and transmit information in them safely, protect them from unauthorized access and use.

There are many ways to protect plastic cards. These methods constitute the technical and information sides of the cards’ defense. The technical side is protection against mechanical impacts of the cards, and information side is protection of the cards from counterfeiting.

Mechanical protection is designed to save the cards from wear and tear, mechanical and thermal damage and damage caused by faulty operation of ATMs, thus prolonging the use of these cards. The most common methods of mechanical protection of plastic cards are cards with UV varnish coating and laminating protective polyester film.

The process of painting card is to cover the card by special UV lacquer and dry it in a special dryer under UV light. Usually lacquer is glossy or matte and lifespan of these cards is low.

Unlike varnish laminating is a reliable barrier against any contamination or mechanical damage and provides longer life. While manufacturing of laminated cards plastic card with two sides is covered by protective film and baked it with plastic. Lamination allows you to add into the card various types of personal data, microchips and even GPS-sensors. Lamination should be done only after the completion of all work related to the introduction of personal data.

Besides laminating and varnishing there are additional elements of mechanical protection of cards which perform the same functions.

In the process of manufacturing of plastic cards personalization is carried out simultaneously, which minimizes the possibility of using the card by third parties in case of loss or theft. Personal protection means tying cards to a specific person to whom it belongs. That is why individual data about its owner is written on the card.

At the moment there are quite many varieties of personal protection. They are:

- embossing;

- numbering;

- PIN-code;

- Scratch-band;

- band for personal signature;

- barcode;

- hologram;

- microchip;

- QR-code;

- magnetic stripe, etc.

Each of these security features has its advantages and disadvantages. They also differ in the degree of protection: some have stronger protection, others weaker (or disposable). We are going to consider each of these elements in more detail personal protection.

One of the elements of personal protection is embossing. Its essence lies in the fact that different alphanumeric information is displayed on the front side of the card by means of mechanical squeezing by means of special devices — embossers. These convex data may be painted in gold, silver or other colors, and this process is called typing. Another method of applying the information is numbering, which is covered by sublimation printing. For example, the name of the owner, the card number, etc.

PIN code is an analog of a password, but the only difference is that for the PIN-code only numbers are used, and for a password both numbers and letters can be used. PIN code, as usual, is composed of four-digital combination of numbers and used during the transaction for authorization or confirmation of an electronic signature request. In its turn, it should be noted that Scratch-band is used for the disposable protection of PIN-code, it is easily erased by the edge of a coin.

Barcode is not new for us. Today it can be met on each packaging in the shops. It contains information enciphered in the form of black-and-white stripes, and also includes figures in various combinations. As a rule, such international standards of bar coding as EAN 8, EAN 13, Code 39 are used.

QR-Code is a two-dimensional bar code. A hologram is a three-dimensional image, which is made on the basis of self-destroying and cannot be reused. This method of protection is more efficient, since it cannot be transferred to a fake and not restored after the destruction when trying to remove the label from the card.

All methods of protection mentioned above are to some extent, on the one hand, replicate and, on the other hand, differ from each other. For example, enciphered information by the means of one device cannot be read by another device.

Thus, it becomes clear that modern technology and the protection of plastic cards are very diverse and are able not only to ensure the security of the card, but also to increase its service life.

References:

1. Илясов Д. О. Пластиковые карты как перспективный платежный инструмент в РФ // Интеллектуальный потенциал XXI века: ступени познания. — 2012. — № 10–2. — С. 105–110.

2. Эзрох Ю. С. Банковские пластиковые карты: экономическая эволюция и конкуренция // Вестник Сибирского университета потребительской кооперации. — 2013. — № 3 (6). — С. 53–56.

3. Вареникова Е. С., Абышева А. В. Банковские пластиковые карты как платежный инструмент этапа электронных денег // Современные тенденции в экономике и управлении: новый взгляд. — 2012. — № 15. — С. 200–204.