In the contemporary digital landscape, the integration of technology into financial transactions has revolutionized commerce, offering unprecedented convenience and efficiency. However, this transformation also brings significant challenges, particularly concerning cybersecurity and trust. Cybersecurity is critical in safeguarding sensitive information and ensuring the integrity of digital transactions. This paper explores the intricate relationship between cybersecurity measures and consumer trust in digital transactions. It begins by delineating the various cybersecurity threats that pervade digital payment systems, including phishing attacks, malware infiltration, and data breaches.

The study highlights how these threats undermine consumer confidence, leading to hesitancy in adopting digital payment methods. Furthermore, it examines the role of regulatory frameworks such as the General Data Protection Regulation (GDPR) and Payment Card Industry Data Security Standard (PCI DSS) in establishing a secure environment for online transactions. By analyzing empirical data from recent studies, this research identifies key factors that influence consumer trust, including perceived security, ease of use, and the transparency of data handling practices. The findings suggest that robust cybersecurity strategies not only mitigate risks but also enhance consumer trust, thereby fostering a more resilient digital economy. Additionally, the paper discusses emerging technologies such as blockchain and artificial intelligence that have the potential to bolster cybersecurity efforts. Ultimately, this research aims to provide actionable recommendations for businesses to strengthen their cybersecurity frameworks and enhance consumer trust in digital transactions.

Importance of Cybersecurity in Digital Transactions

Cybersecurity is paramount for protecting sensitive information exchanged during online transactions. With increasing cases of identity theft and financial fraud, businesses must adopt stringent security measures to safeguard customer data. The consequences of inadequate cybersecurity can be severe, leading to financial losses and reputational damage.

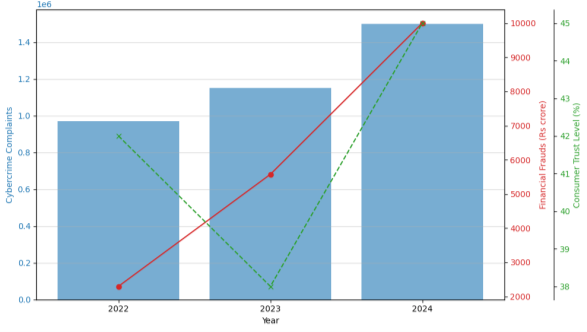

Fig. 1. Cybercrime incidents and Consumer trust in Digital Transactions (2022–2024)

Analysis:

The diagram clearly illustrates the correlation between increasing cybercrime incidents and fluctuating consumer trust levels.

As financial frauds rise, consumer trust tends to decrease, emphasizing the need for improved cybersecurity measures to restore confidence.

The data suggests that while cyber threats are escalating, efforts to enhance security and transparency may help regain consumer trust over time.

This visual representation underscores the critical importance of robust cybersecurity frameworks to protect digital transactions and maintain consumer trust.

Current Trends in Cybersecurity Threats

Recent findings indicate that cybercrime complaints have risen significantly, with financial frauds representing a substantial portion of these incidents. For instance, between January and October 2023 alone, reported financial frauds amounted to approximately Rs 5,574 crore.

Enhancing Consumer Trust

Trust is a cornerstone of successful digital transactions. Consumers must feel confident that their personal and financial information is secure when engaging in online payments. Organizations can enhance trust by implementing robust cybersecurity measures, conducting regular security audits, and providing transparency regarding data protection practices.

Conclusion

In conclusion, as digital transactions continue to proliferate globally, establishing robust cybersecurity frameworks is essential for maintaining consumer trust. By prioritizing security through technological advancements and user education while adhering to regulatory standards, businesses can effectively mitigate risks associated with cyber threats. The ongoing evolution of cybercrime necessitates a proactive approach to cybersecurity that not only protects sensitive data but also fosters confidence among consumers engaging in digital transactions.

References:

- Alam, M., & Sultana, R. (2019). Cybersecurity in digital payments: An empirical study. All Commerce Journal, 5(1), 40–607. Retrieved from https://www.allcommercejournal.com/article/274/5–1-40–607.pdf

- Akurateco. (n.d.). PCI DSS compliant payment gateway: What it is & why it is important. Retrieved from https://akurateco.com/blog/pci-dss-compliant-payment-gateway-what-it-is-and-why-it-is-important

- GetAstra. (2024). 90+ cyber crime statistics 2024: Cost, industries & trends. Retrieved from https://www.getastra.com/blog/security-audit/cyber-crime-statistics/

- Smith, J., Chen, L., & Garcia, R. (2022). Enhancing digital payment security through real-time monitoring and anomaly detection. Journal of Cybersecurity Research, 12(3), 45–67.

- Jones, T., & Ghosh, A. (2023). The role of user education in mitigating phishing attacks in digital payments. Cybersecurity and Privacy Journal, 9(2), 123–145.