The article analyzes the current state of small and medium-sized businesses in the Republic of Kazakhstan. The author reveals the economic essence of business through the prism of public administration and defines its role in the economy of Kazakhstan. As a result of the study, the features were studied and systemic problems in the functioning of small and medium-sized businesses of the Republic of Kazakhstan were identified. When analyzing the current state and development of the republic's SMEs, the method of collecting information and partially the method of abstraction was used for effective search, grouping, processing and generalization of the necessary material. The study of the dynamics of economic indicators by means of a comparative method made it possible to establish causal relationships and identify systemic problems of state regulation and the development of small and medium-sized businesses. By applying appropriate economic methods, promising directions for the further development of small and medium-sized enterprises of the Republic of Kazakhstan have been developed, which include improving the strategy and tactics of interaction between representatives of SMEs and the authorities; improving legislation (tax, financial and innovation) in the field of SME support; improving mechanisms that ensure access of SMEs to financial resources; creation of centers financed from the state budget for the training of specialized personnel and intensification of the development of modern forms of business integration.

Keywords: small and medium-sized entrepreneurship, state, business climate, population, organizational and legal form, subjects, economy.

As of March 1, 2023, the number of registered legal entities amounted to 510,797 units, including 410,744 active legal entities. The number of registered subjects of individual entrepreneurship amounted to 1652564, including 1550617 active subjects. The number of registered small and medium–sized businesses amounted to 2097519 units, including 1904656 operating ones.

Table 1

Registered and active entities by dimension and activity attribute (2023)

|

Legal entities |

Subjects of individual entrepreneurship |

Branches and branches of foreign legal entities |

Small and medium-sized businesses | |||||

|

registered |

current |

registered |

current |

registered |

current |

registered |

current | |

|

All |

510 797 |

410 744 |

1 652 564 |

1 550 617 |

32 200 |

22 130 |

2 097519 |

1 904656 |

|

Small |

501 657 |

401 746 |

- |

- |

31 056 |

21 000 |

1 839108 |

1 653680 |

|

Medium |

6 647 |

6 538 |

- |

- |

630 |

620 |

2 992 |

2 910 |

|

large |

2 493 |

2 460 |

- |

- |

514 |

510 |

- |

- |

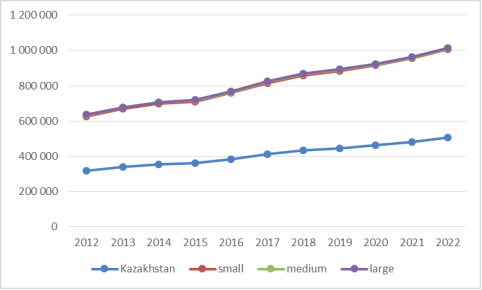

Every year there is an increase in the number of registered legal entities by an average of 5 %, so over the past ten years (2012–2022) their number has increased from 317926 to 507238 (by 189312 units or 59.5 %). At the same time, it should be noted that the main growth is due to small legal entities, their number is steadily increasing by an average of 4.9 % every year. Unlike small, the dynamics of medium and large legal entities is not stable. Over the past decade, against the background of the annual growth in the number of medium and large legal entities, in 2016, 2017 and 2019 their number was not significant, but decreased (by 1.3 %, 1.4 % and 3.1 %, respectively).

Table 2

Number of registered legal entities

|

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 | |

|

Kazakhstan |

317 926 |

338 981 |

353 833 |

360 287 |

383 850 |

412 677 |

433 774 |

446 687 |

461 983 |

481 732 |

507 238 |

|

small |

309 499 |

330 435 |

344 994 |

351 229 |

374 912 |

403 862 |

424 796 |

437 988 |

453 343 |

472 777 |

497 995 |

|

medium |

6 095 |

6 113 |

6 364 |

6 572 |

6 502 |

6 432 |

6 490 |

6 297 |

6 235 |

6 494 |

6 685 |

|

large |

2 332 |

2 433 |

2 475 |

2 486 |

2 436 |

2 383 |

2 488 |

2 402 |

2 405 |

2 461 |

2 558 |

Fig. 1. Dynamics of registered legal entities

In February, compared with January 2023, there was a slight increase in the number of registered legal entities (by 0.5 %), compared with the corresponding period of the previous year, their number increased by 6.0 %. At the same time, there is an increase in the number of operating legal entities — by 0.8 % and 14.1 %, respectively. Since the beginning of the year, by types of economic activity, the largest number of registered legal entities has been maintained in the «Wholesale and retail

— trade; repair of cars and motorcycles», the share of which amounted to 27.9 % as of March 1, 2023.

— In second place –«Construction» (13.4 %), in third — «Provision of other types of services» (9.9 %). Together, the share of these three types of activities is 51.2 % of all registered legal entities.

As of March 1, 2023, the largest number of registered legal entities accounts for the cities of Almaty (142271 or 27.9 %) and Astana (95697 or 18.7 %), and the Karaganda region (28530 or 5.6 %). The smallest number of registered legal entities is in the regions of Ulytau (2936 and 0.6 %), Abai (8113 and 1.6 %) and Zhetisu (8002 and 1.6 %).

Despite all the measures taken by the Government, the analysis of the development of SMEs in Kazakhstan shows that at the moment there are a number of problems in the Republic of Kazakhstan that hinder the effective functioning and development of small and medium-sized businesses, which include:

— Imperfection of the legislative framework;

— limited access of SMEs to financial resources and objects of investment and financial and credit infrastructure;

— The presence of a large number of administrative barriers;

— relatively low competitiveness of small and medium-sized business products [10].

The solution of these problems requires a more pragmatic approach from the Government and a detailed study of the measures currently being implemented in part:

- Improving the strategy and tactics of interaction between SMEs and the authorities. We consider it necessary to develop an effective national doctrine for the development of entrepreneurship, in which small and medium-sized businesses should become the fundamental core.

- Improving legislation (tax, financial and innovation) in the field of assistance to small and medium-sized businesses. It is necessary to regulate the following issues in a regulatory manner:

1) breakdown of powers and ownership rights, also to the products of scientific developments, i.e. to clarify which structures will be contenders for the upcoming results (cash receipts in the form of orders for services, applied developments, samples of new products, etc.);

2) participation of budgetary funds in the form of gratuitous financing not only of fundamental research, but also of preparatory workings, initial financing of independent subjects of innovative activity (through a system of business incubators or technoparks);

3) to allow the participation of local executive bodies in the assistance of SMEs by providing preferential conditions for the current use of communal property and payment of utilities;

4) provision of guarantees for the purposes of commercial and non-commercial (covering state) lending.

- Improving the mechanisms that provide small and medium-sized businesses with access to financial resources. In this regard, we consider it necessary: the formation of information, consulting and the rest of the SME infrastructure; search for new non-traditional sources of financing, using, first of all, leasing operations; increase in the share of R&D financing by the state.

- Creation of Centers funded from the state budget for training personnel focused on: rationalization of the management process within small and medium-sized enterprises; correct accounting and tax accounting; optimal allocation of own and borrowed funds by the firm; intra-company planning and management [11].

- Intensification of the development of modern forms of business integration: associations and small business support funds, technology parks, international and regional marketing information centers, franchising and business incubators.

In the conditions of slowing business activity of the business sector against the background of the coronavirus pandemic, a lot of work was carried out on behalf of the President of the Republic of Kazakhstan to support small and medium-sized businesses. Since the state of emergency and the introduction of quarantine measures had a negative effect on the business of Kazakhstan. About 300 thousand business entities postponed their activities, about 1.6 million people were sent on leave without pay, 4.5 million social benefits were paid in the amount of 42500 tenge, about 1 million business entities suffered losses from the pandemic, about 14–15 thousand business entities with loans from second-tier banks applied for a postponement.

References:

- Susan S., Chris R., (2017) Business Continuity and Disaster Recovery for Small-and Medium-Sized Businesses. International Journal of Production Economics, 5(3), pp. 451–478. https://www.sciencedirect.com.

- Jayanth J., Mita D., Jaideep M., (2017) Supply chain management capability of small and medium sized businesses: Amultiple case study approach. International Journal of Production Economics. (142), pp. 472–485. https://www.sciencedirect.com.

- Тулепов А. (2020) Малый и средний бизнес как основа среднего класса в Казахстане: монография / А. Тулепов. Алматы: Экономика, 194 с.

- АО «Фонд развития предпринимательства «Даму». Отчет о состоянии развития малого и среднего бизнеса в Казахстане [АО «Фонд развития предпринимательства «Даму». Отчет о состоянии развития малого и среднего бизнеса в Казахстане. https://www.damu.kz.

- Абжанова D.Sh. (2020) Практические аспекты совершенствования поддержки малого и среднего бизнеса [Электронный ресурс]. Вестник КарГУ. Серия экономическая, № 3. — с. 83–89.

- Аждарханова Б. Б. (2019) Малый бизнес Казахстана: тенденции и проблемы развития [Электронный ресурс]. Вестник КАЗУЕФМТ, № 1. — с. 13–18.

- Гаджиев Ф. А. (2020) Анализ инфраструктурной поддержки малого и среднего бизнеса в Казахстане [Электронный ресурс]. Экономика: стратегия и практика, № 2.

- Aristeidis G., Dimitris F. K., (2019) Entrepreneurship, small and medium size business markets and economic integration. Journal of Policy Modeling, 3(27), pp. 363–374 // https://www.sciencedirect.com.

- Steven Y. H., Liu E. N., Andrea R. S., Tamer C., (2018) MNE-NGO partnerships for sustainability and social responsibility in the global fast-fashion industry: A loose-coupling perspective. International Journal of businesses. 5(29), pp. 214–222. https://www.sciencedirect.com.

- Наурызбекова А. Е. (2020) Государство и проблемы малого и среднего предпринимательства в Казахстане [Электронный ресурс]. Вестник КазНУ. Серия Экономическая, № 2. — с. 121–127.