The institutionalization of economic relations of social insurance of population is determined by changing of social conditions and needs, presenting a dynamic and continuous process, directed on the formation of culture of social insurance, regulatory frameworks, material-technical, financial, professional staff of mechanisms of activity in the system of social insurance, that contributes to raise the level of social protection of population. Table 1 shows the directions of institutional perfection of the economic relations of social insurance according to the authors levels of institutional development.

Table 1

The Institutionalization of economic relations of social insurance

|

The levels the institutionalization |

Subjects of economic relations of social insurance |

Problem |

The direction of the institutional improvement |

|

1 |

Worker |

The mentality of «dependence», the low level of insurance culture. Lack of information about the insurance services, insufficient level of insurance payments. Bureaucratization of the collection of documents, restriction of freedom of choice, etc. |

The formation of a culture of social insurance: social advertising, advocacy, creating and maintaining the image of a self-sufficient person etc. |

|

2 |

Employer |

Opportunistic behavior («gray» wages, fraud, etc.), a weak organization of labour protection, etc. |

The formation of a culture of social insurance, the increase of the level of wages. |

|

3 |

State |

The imperfection of the institutional environment of the social insurance, the low level of quality of the service of social insurance and administration of revenues and expenditures, the lack of clear linkage between the contributions in to the social insurance system and provided guarantees on the level of the individual participant of the economic relations of social insurance. The old «obsolete» institutions, the redundancy of the bureaucracy, the lack of institutional mechanisms, slowing the process of obtaining the services of social insurance, etc. |

The development of the mechanism of competition in the social insurance, institutional framework, mechanisms of the investment activity, economic responsibility, the financial mechanism of the responsibility, the mechanism of how to encourage insurers, as well as the infrastructure of social insurance, improvement of preventive and rehabilitative measures. Improvement of the institutional and regulatory framework of social insurance, formal rules. The introduction of the institution of social partnership and others. |

In the context of identified directions of institutional provision let us to consider the concrete institutional conditions and measures on the institutionalization of economic relations of social insurance. According to the opinion of the most scholars, the creation of the institutional conditions for the effective functioning of the social insurance system should be carried out on the basis of observance of the constitutional rights of citizens of the Russian Federation; a clear definition of the goals, objectives and sources of funding for the various types of social insurance; compliance with insurance principles; the adequacy of the level of social protection the size of insurance payments; the creation of conditions for the achievement of financial sustainability of social insurance system, etc.

For these it is necessary to take the following actions:

- conducting normative-institutional analysis of social insurance;

- a more detailed study of the structure of disbursements and expenditures carried out within the social insurance system, and the preparation of proposals for the establishment of borders for insurance and non-contributory benefits and costs, determining sources of financing for each of their type; improvement of methodology of actuarial calculations;

- the implementation of measures of align meut the conditions and sizes of social insurance in accordance with the socio-economic situation of the country;

- the determination of the needs of the social insurance system in financial resources;

- the introduction of the efficient and the elimination of the inefficient legislative norms of the out-of-budget of the state social funds and about the system of management of social insurance and its resources, on ensuring the parity of the participation of representatives of subjects of social insurance;

- creation of conditions for attracting private insurance companies to the systems of social insurance.

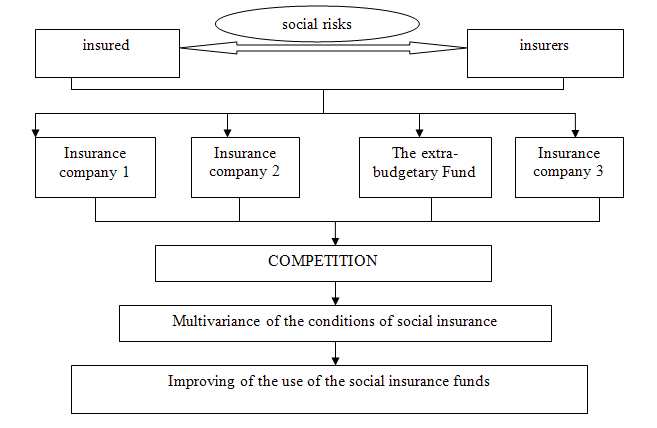

For the implementation of the last event we offer the following organizations-investment mechanism of transfer of social insurance to the market relations (Fig. 1).

According to our own opinion and taking into account the fact that the social extra-budgetary funds are monopolists the field of social insurance, thus creating a competition in the sphere of co-social insurance, you can significantly improve the quality of social insurance services and satisfaction of the population with the quality of these services. The content of the mechanism is to provide a choice for the insurers and those insured. The proposed mechanism shows that the insured persons and the employers have the right to choose; where they can insure social risks. Along with the social-mi-of-budget funds the objects of choice may be different insurance companies. Moreover, the various social risks can be secured in different insurance companies.

Fig.

1. The organizational mechanism of social insurance in the market

conditions

Fig.

1. The organizational mechanism of social insurance in the market

conditions

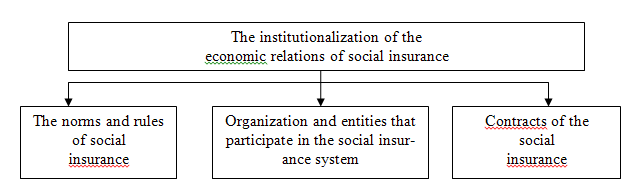

N.A. Alexandrova notes that the institutionalization of economic relations can take place at three levels: norms and rules, institutions, contracts (Fig. 2)

Fig. 2. The institutionalization of economic relations of social insurance

Researchers are actively studying the question of rising the age of retirement (flexible retirement age). The retirement age in Russia is considered to be one of the lowest in the world (55 years for women and 60 years for men; for comparison, in Japan - 70 years).

There should be a legislative level of the retirement age, as well as the possibility of one-time receipt of pension assets in the hands of those retired (at the request of the participants of the pension insurance). And it is also necessary legislatively to establish that pension funds – are not a state property, but a specific form of property insured by persons themselves [6]. It is requires to make attention to the development of the civil liability of insurance of the professional violations of medical workers.

There is an argent question of increasing the level of wages, by means of its leg-up. «The economy of a cheap worker leads to a total degradation not only of the worker, but himself, but by the very economy it has no future» [3].

We agree with N. Shestakova, that notes that among the main causes of the crisis of the pension system is the process of population ageing and the real retirement age. The percentage of persons over 65 years of age and older in comparison with the working population in the EU countries in 2000 amounted to 26.7 percent, according to the forecasts in 2012 should be increased to 29.8%, in 2030. - up to 43.8%, and in 2050 – up to 53.4% [7].

In this connection the problem of the employment of the persons of the older age groups is relevant and can serve as one of the measures of improvement of social insurance in the country. However, as the author rightly observes the majority of employers in respect of the senior age groups have a number of unreasonable prejudices they are: the older workers are less productive than younger, and less interested in improving their skills. Meanwhile, the positive qualities of the labour force of the older age groups can be mentioned, such as the labour and professional experience, sense of responsibility, the desire for stability and high motivation in order. To achieve the goal of increasing the employment of the older age groups it is necessary to apply the following conditions:

- Change the attitudes of the employers and the society to these categories of workers.

- The Removal of the restrictions connecting with the increasing of pensions and the continuation of employment after reaching retirement age and the maximum age for work.

- Reducing the benefits for the pensioners, which should make a contribution to the growth of employment and should race-the growth of private alternative public pension systems.

- Support to the employers who hire older workers (in Belgium, the great Britain, Germany, Italy, the Netherlands such a programmes have already take place ).

The discussions on the introduction of the system of social insurance the Institute of social-social partnership are underway. A.A. Cossacks rightly makes a note, that in our country the employers act as a kind of «pocket» for the state and do not participate in the supervision of the activities of state extra-budgetary funds along with the employees. The result is a paradox: the only one is interested in social insurance - the very worker - does not pay personally insurance contributions. Everyone must personally participate in ensuring their future. Only in this case the person becomes a real subject of social policy of the state. So, for example, in Italy, where the replacement rate is one of the highest in the world - 90% - the financing of the pension system is made at the expense of social contributions by employees and employers in the amount of 32.7% of the salary Fund, so 8.89% pays the worker and 23.81 % - employer [2].

In order to introduce this institution in our country, you can, for example, to reduce to a few per cent of the tax of the incomes of physical persons, in order that could pay the insurance premium, along with the employer. You can use this measure temporarily, in order to «train» people to participate in social insurance.

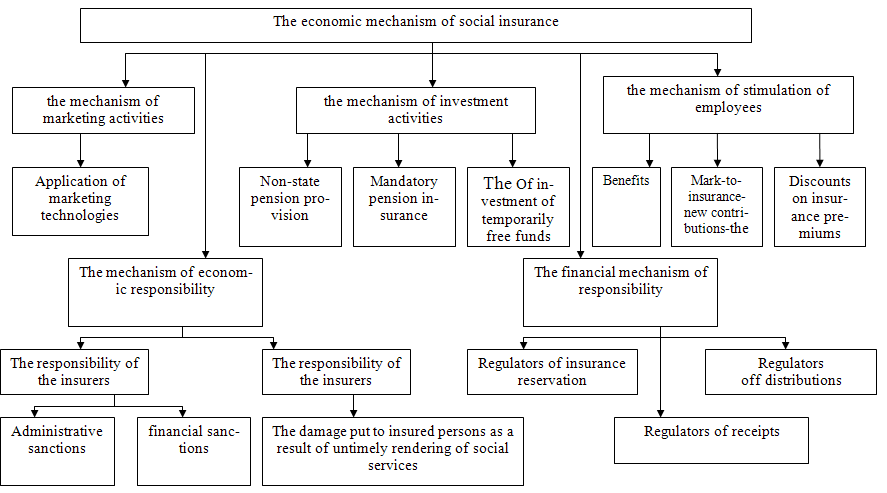

We offer to clarify the structure of the economic mechanism of social insurance, adding to the already existing mechanisms the mechanism of marketing activities (Fig. 4). It should be said that the transformation of the Russian social insurance system, into the three-level system by the recommended International labour organization, demands a definite sequence. It is necessary to recreate the social insurance system as a basic institute of social protection, improving the system of social security at the same time, and secondarily, in addition to develop actively the institute he of personal insurance against social risks. For the effective functioning of the social insurance there are must be strict distinction between the social security system and the social insurance. An important aspect of the successful improvement social insurance system is to create conditions for the emergence and the realization of personal interests of the insured citizens. This task is solved by strengthening the replacement in social insurance that is based on the financial balance of the insurers. This decision requires, either to reduce the insurance premiums concerning relatively high wages by means of the restriction of the insured level, or to the high wages the paid insurance payments along side with the reducing the already low payments of the rest already low level insured. A number of techniques can also weaken the issue at least in respect of the part of the insurance payments. And the main of them is the establishment, both contributions, as well as insurance-denominated security of the insurable wage level. So, for example, by limiting the insured wage instead of limiting the size of the book and return to the insurance contributions instead of the single social tax, regular payments under the insurance cases (temporary disability, pregnancy and childbirth, care of the child up to the age of 1.5 years, and the regular payments of benefits in connection with employment injury and professional illness), carried out by the social insurance Fund as a share of earnings, can be linked with the share of the payment from the same earning.

In system of obligatory medical insurance in today's realities it is impossible to carry out such coordination, at its reforming it is necessary to analyse carefully expenses, what types of medical care it is necessary to insure, first of all, and in what size.

Fig. 4. The structure of the economic mechanism of social insurance

In our opinion, expenses on the expensive types of treatment prescribed to big mass of patients, it is necessary to insure at least partially.

The most effective types of medical care (preventive actions, ambulance and primary medicosanitary help), and also socially dangerous (the out-patient and polyclinic and stationary help rendered in specialized clinics, hospitals at tuberculosis, acquired immunodeficiency syndrome, mental disorders etc.) it is necessary to leave in the form of free, financed from local budgets. Entirely for the insured one should determine expenses on medical care rendered by experts of out-patient, polyclinic and stationary institutions.

Among effective mechanisms of an institutionalization of the economic relations of social insurance researchers allocate the following major directions:

- the formation of effective mechanisms on ensuring adequacy of the sizes of pensions and the accumulated sums of insurance fees;

- the strengthening of insurance principles and expansion for this purpose the bases of contributions, the numbers of the insured workers, the procedure of introductions of «a flexible retirement»;

- the legislative differentiation of the financial resources of not insurance and insurance pensions on obligatory social insurance, with attraction of the resources of the federal budget for financing of base pensions;

- the formation of insurance mechanisms of professional pensions and additional pension insurance of working pensioners;

- the gradual introduction of the institute of social partnership – insurance payments by those working from the earnings limited to the bottom limit (3 living minima of workers) and the top limit (5 living wages).

It is expedient to determine by the main institute of pension insurance the institute of the conditional and accumulative insurance which value is now being reduced and will even more decrease within the next 5-10 years. And on the contrary, institutes of base and funded pensions should be auxiliary single – at the expense of the federal budget (its function, as well as at social pension), accumulative – on a voluntary basis in the system of non-state pension funds. Today this mechanism is already being realized. Thus the major task is redistribution the responsibility of the main subjects of social insurance: employers, the state and workers on pensions financing for this purpose it is necessary to provide a number of legislative measures.

- To define a range of salary to involve workers in direct participation in financing of additional pension systems, and also to expand possibilities of additional pension insurance (professional, corporate, personal).

- To solve a question of target financing of professional and northern pensions.

- To solve a question of pension insurance and provide those working at the small enterprises and self-busy workers.

- To solve a question of pension insurance and to provide a care of lonely pensioners, disabled people and other categories of the population having a need for a regular and systematic help about the house.

Thus, there is an urgent need for transition from the existing simplified pension system to the differentiated system of pension in all types, allowing to insure various groups of workers and citizens from specific types of professional, northern and other social risks.

Also, in comparison with the operating system it is offered to enter the following new types of social insurance:

- insurance of professional and regional pensions that will allow to provide financially existing types of early pensions (for a work in harmful working conditions and "northern" early pensions);

- unemployment insurance which will solve problems of professional retraining and employment of the unemployed;

- insurance of taking care of lonly pensioners, disabled people and other categories of the population needing regular and systematic home visiting service.

On the directions of institutional development can be the increasement of the insurance culture of the population of Russia. One of the sources of institutional changes by Douglas Nort is a change in tastes and preferences of people.

In this regard it is important to carry out training of specialists and active explanatory work among the population for the formation of culture of social insurance.

D. Nort notes that informal restrictions «arise from information transferred by means of social mechanisms, and are a part of that heritage which we designate culture» [5].

Efficiency of the above given directions and levels of institutional ensuring development of social insurance is expedient for estimating by two criteria:

- by positive dynamics of level and quality of life of the population (social effect);

- by on degree of the accounting of influence of consequences of social policy on dynamics of economic growth (development) (economic effect).

Indispensable condition of a correctness of calculation of indicators of efficiency is comparability of by result and expenses. However complexity of an assessment of efficiency in social insurance consists that expenses and results are, as a rule, expressed in different indicators. It induces many researchers to reduce efficiency to effect (to specify result, costs of its achievement and to avoid calculation of their ratio). Possible levels and indicators of an assessment of effect and an institutionalization of social insurance are given in table 2.

Table 2

Possible levels and indicators of an assessment

of the effect from the institualization

of social insurance

|

Levels of an assessment of the effect from an institutionalization of the social insurance |

Effect assessment from an institutionalization of social insurance | |

|

Economic effect |

Social and psychological effect | |

|

population |

High-grade and worthy insurance payments |

Lack of the excessive bureaucratization, feeling of social security and psychological comfort, satisfaction services of social insurance, strengthening of protection of the rights and interests of workers |

|

Employer |

Decrease in insurance loading at the expense of introduction of the institute of social partnership (distribution of insurance fees between the employer and the worker). |

Exit from shadow sector, leaving from "gray" salaries, etc. |

|

State |

The increase in revenues of budgets of insurers for the account of the expiration of insurance fees. Return of expenses from an institutionalization of social insurance |

Quantity reduction of defaulters of insurance fees and reduction of cases of fraud in social insurance. Stability of development of the human capital |

As costs for an institutionalization of social insurance are expressed in monetary indicators, and results often have no cost measuring instrument, that is why for the calculation of efficiency of an institutionalization of social insurance it is expedient to carry out the analysis of efficiency of social insurance from the target and position [4].

Ei = (C/P) × (R/C) × (R/S),

where Ei – is the effectiveness of the measures for the institutionalization of social insurance;

C - the purpose of the event (the planned result);

P - the needs of the participants of the event (the desired results for the subjects of the social insurance);

R - actual results of institutionalization;

With - expenses for carrying out of activities;

D/P - the desired form of efficiency;

R/C - the target form efficiency;

R/C - economic form of efficiency.

I.N. Krakow specifies that if the purpose of action corresponds the needs of all his participants, and the result completely realizes the purpose, in this cassette traditional expression of economic efficiency turns out. The most productive appears that system of actions which most satisfies the requirements at the minimum expenses.

Thus, as a result of the carried-out research it is possible to draw a conclusion of importance of the process of an institutionalization of social insurance for the economic development of the state.

The institutionalization of the economic relations in the sphere of social insurance is expedient for carrying out on the levels of institutional development outlined the author. Formation of the institutional conditions for the effective functioning of the system of social insurance should be carried out on the basis of observance of constitutional laws of citizens of the Russian Federation; accurate definition of the purposes, tasks and financing sources on different types of social insurance; observance of the insurance principles; adequacy of level of social protection to the amount of insurance payments; creations of conditions for the achievement of financial stability of the system of social insurance.

So, investigating the problem of an institutionalization of the economic relations of social insurance, we have come to the following conclusions. The Bases of social insurance were founded at a boundary of the XIX-XX centuries. The Formation of the elements and forms of social insurance in Russia proceeded under the influence of a difficult complex of social, economic and political factors, that predetermined essential transformations of its institutional nature, a difficult trajectory of development and inconsistency of development of mechanisms of insurance. The Research has showen that since capitalism and up to haw is being evolved and institualized insignificant, by while modern society is much richer today and is more developed, than a century ago, and made huge jump in the development.

Social insurance is a factor of a sustainable development of the human capital from the position of its influence on the possibility of continuous reproduction of the human resources in case of approach of social risks. At the same time, being a factor of a steady reproduction of labor, social insurance promotes stabilization of economic development.

The institutionalization of the economic relations of social insurance is expedient for carrying out on the levels of institutional development allocated by the author. Special attention when developing actions for an institutionalization of social insurance it is necessary to pay attention to a formation of culture of social insurance of the population.

Literature:

- Aleksandrova N. A. Status rent: conditions of emergence and negative consequences. - Kostroma: KGU of N.A. Nekrasov, 2005.

- Antropov V. V. The System of social protection the population in Italy//the Labour law.-2006. - No. 4. - Help system ConsultantPlus.

- Kazakov A.A. A tax policy of the developed countries in the sphere of the collection of socially focused taxes//Taxes. – 2007, No. 1. Help system ConsultantPlus.

- Krakow And. H. Investments into the human capital of higher education institution: features of an assessment of efficiency//Economic analysis: theory and practice. - 2009. - No. 35.

- Nort. Institutes, institutional changes and economy functioning. - M: Beginning, 1997.

- Roik V.D. Pension not a state gift. - Ledger.-2007. - No. 15. Help system ConsultantPlus.

- Shestakova E.E. Employment of the persons of the senior age groups: European experience of the use of active strategy//Labour law. - 2006, - No. 11. Help system ConsultantPlus.

- About formation of an institutional conditions of the further development of social insurance: The concept of improvement of the system of social insurance in the Russian Federation//A Person and work. - No. 1,2,3,4. - 2006.