The article deals with legal aspects of organization of crowdfunding platforms in Russia, as well as with specifics of development of crowdfunding.

Key words: crowdfunding, law, Federal law.

Nowadays, the organization of crowdfunding sites is of particular relevance and importance in the Russian Federation. Crowdfunding is a way of collective financing based on voluntary contributions.

The term of crowdfunding came into Russian from English, as it was (Serdyukov and Lipcan 2018). The history of this phenomenon itself began quite a long time ago; it related to fundraising and the first attempts to raise money for projects whose projection on social development of society was much more important than the amount of funds collected or election campaigns of politicians.

The history of the emergence of crowdfunding abroad began to form in the UK since the 18th century; this period can be called the forerunner of modern credit crowdfunding. The famous writer Jonathan Swift, who was the author of the story about Gulliver in the land of the midgets, founded the Irish Loan Fund. This organization was established to support poor families in Ireland. Everyone could use it to transfer any funds to help ordinary Irishmen feed children or send them to school. The trend laid down by the writer, became not only a trend, but also formed the basis of the Protestant mentality, involving assistance to the disadvantaged (URL: https://zakon.ru/discussion/2015).

The most striking event for the residents of the Western hemisphere, determining the further success of crowdfunding projects, was the collection of money for the installation of the Statue of Liberty. Six months, 120,000 donors, many of whom were able to transfer only one dollar, and the symbol of American democracy raised its torch over Manhattan. From the point of view of the mentality of the nation, this story has become the basis for the further success of any crowdfunding projects.

The modern crowdfunding came to Russia in early 2011, i.e. almost at the same time as in the rest of Eastern Europe. Several dozens of sites were created, and most of which were quickly closed. The market became quite monopolistic, and the Boomstarter and the planet sites occupied its main positions, as they had significant resources invested in. It was difficult to compete with them (URL: https://zakon.ru/discussion/2015).

These websites could offer only two formats for backers, these are free crowdfunding or pre-sales, they had no opportunities for credit or equity crowdinvesting. This did not relate to the peculiarities of the Russian mentality, it related to the fact that the platforms were not ready to provide legal mechanisms for the implementation of this area of work (URL: https://search.rsl.ru/ru/record/01002891433).

Under the absolute impossibility of developing of crowdfunding in the direction of economic efficiency, the cases related to the books publishing had success in Russia. This direction suddenly trended. As almost all among the second most reading nation have an unwritten novel in their desks, many of them were published thanks to crowdfunding industry. Thus, the development of technology and change of thinking of humanity led to the emergence of crowdfunding. That is, we have our national funding, or as they say, "every little bit helps".

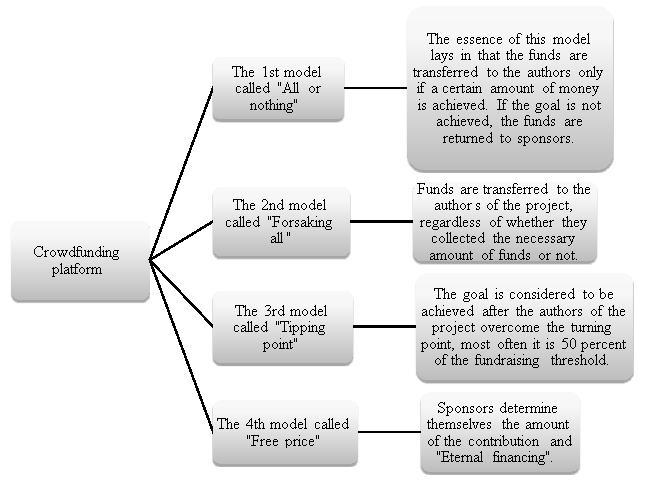

Crowdfunding websites can be divided into certain models as follows (Serdyukov and Lipcan 2018):

Many people confuse crowdfunding with charity. However, there is a significant difference between them: the crowdfunding investors get something in return, whether it is just a gratitude, a mention on the website, or on the packaging of the product. Alternatively, the investor receives part of the company's property, shares of the enterprise.

There are two crowdfunding schemes:

- Joint stock crowdfunding. This type of collective investment involves obtaining part of the property, shares of the enterprise, dividends.

- “Royalty model”, where the investors receive a share of income or profit of the financed project as a reward.

One can also highlight the following distinctive features of crowdfunding:

- Clear idea: the funds should be collected only for specific and clear objectives,

- Limitation: the collection of money should be limited to a certain period,

- Venture capital: investment in a project do not involve a 100 percent guarantee of return on investment,

- Result-orientation: the project organizer should report on the achieved results, as well as on usage of funds.

Thinking globally, crowdfunding has a Pro Bono basis, as the majority of investors sponsor any cinogenicity project, not requiring any counter rewards. However, sometimes the profit motive is still there (for example, music groups distribute tickets to their concert to all of their sponsors), and it is also real, as it is concluded from the date of transfer of investor funds to the account of the organizer.

Regarding civil law, crowdfunding is a civil legal relations that arise between the Creator of the project (organizer) and the Investor (user). Crowdfunding should be attributed to unnamed contracts, as it is not fixed in any legislative act. The term of “unnamed contract” is not provided for by law and can be found in the legal literature only. The civil code, in turn, refers to the unnamed contract as a contract not provided for by law or other regulations. However, this term, of course, needs to be clarified, since it is impossible to correctly apply civil law norms without an exact wording and qualification of the contractual obligation (URL: https://www.globalinnovationindex.org/content/page/data-analysis).

Based on the above, the crowdfunding method of collecting funds is a tool for obtaining money, like any other method; and like any tool, it can be used in both plus and minus.

In order to create a legal basis for implementation of crowdfunding activities, the Central Bank and Duma deputies AG Aksakov, IB Divinsky, OA Nikolaev, and Senator NA Zhuravlev developed and submitted for consideration the draft Federal law No 419090-7 “On alternative ways to attract investment (crowdfunding)” on 20 March 2018, i.e. it was introduced on the same day with the bill “On digital financial assets” (Arkhipov 2015, Servetnik 2004). The bill is aimed at establishing legal regulation of relations to attract investment by legal entities or individual entrepreneurs using information technology, as well as at determining the legal basis for the activities of operators of investment platforms for the organization of retail financing (crowdfunding).

References:

- AE Arkhipov. Legal nature of crowdfunding. Author. 2016;5:39.

- VM Ganeeva, AE Tsvetkova. Crowdfunding as a tool for investment. Economics and management in the 21st century: tendencies and development. Novosibirsk: LLC “Center for the development of scientific cooperation”; 2014. pp. 83-88.

- New English-Russian dictionary: About 200,000 words and phrases. Russian state library (Electronic resource). URL: https://search.rsl.ru/ru/record/01002891433 (date accessed: 04.25.2019).

- The need for changes in legislation and some aspects (Electronic resource). URL: https://zakon.ru/discussion/2015 (date accessed: 04.25.2009).

- IO Serdyukov, ME Lipcan. The legal status and development of crowdfunding platforms in Russia. Novosibirsk: Scientific community students “Interdisciplinary study”; 2018. p. 613.

- AA Servetnik. Qualification of contracts and its impact on the application of civil law. Bulletin of the Saratov state Academy of law. 2004;4:25.

- The Global Innovation Index (Electronic resource). URL: https://www.globalinnovationindex.org/content/page/data-analysis (date accessed: 04.25.2019).

- History of crowdfunding. Website about crowfunding and fundraising in Russia and the world (Electronic resource). URL: https://search.rsl.ru/ru/record/01002891433 (date accessed: 04.25.2019).

- Legal aspects of organization of crowdfunding platforms in Russia. Body of Law. (Electronic resource). URL: https://search.rsl.ru/ru/record/01002891433 (date accessed: 04.25.2019).