Wide range of social protection forms including various pension schemes hold particular importance in execution of state social policy and offer various age to retire. This article highlights the structure, makes comparions where relevant.

Key words: savings, pension, pension benefit, retirement and disability pensions, accumulative pension scheme, mandatory pension

Большое разнообразие форм социальной защиты, включая различные пенсионные схемы, имеют особое значение при проведении государственной социальной политики в разных странах и предполагают различный возраст для получения пенсионного обеспечения. В данной статье освещается структура, проводится сравнение аспектов этой области.

Ключевые слова: сбережения, пенсия, пенсионные пособия, пенсии по возрасту и нетрудоспособности, накопительная пенсионная система, обязательная пенсия

As the world changes very fast the retirement age is becoming various in the world. Also, each state has its own rules for offering well-deserved rest.

Do not forget that the money paid to a person is accumulated on different principles. Each country has its own rules on this matter. What distinguishes the pension systems in the world from nations’ accrual of money in old age? What features should we pay attention to? At what age do you descend to a well-deserved rest in one or another locality? It's rather difficult to answer, because every year in the world various changes take place with respect to pensioners. Here it’s arranged to give further information about this current topic.

Three systems.

At the moment, there are only a few systems in the world that allow you to determine the size of your retirement benefits without special problems. In total, such items are three. Each system has its own peculiarities and nuances. They will have to be taken into account without fail.

The age of retirement in different countries and its size is everywhere different. But in general, cash can be accrued by the following methods:

− for an individual-funded plan;

− distribution system based on taxes (pension);

− distribution on the basis of general tax revenues.

But the age at which you are allowed to go on a well-deserved rest, as a rule, varies. Much depends on the situation in this or that country, as well as on the average life expectancy of people.

Men and women.

However, the retirement age varies from country to country in men and women. As practice shows, countries, where both the «weak» half of the population, and the «strong» reach the possibility of reaching a well-deserved rest at the same time are very few.

All this is connected with the fact that women are a prior considered weaker and less enduring. And this despite the fact that the beautiful half of society lives on average longer than men. Plus, in the length of service, many include the period of care for newborns.

Men almost always get the right to deserved rest later. They are considered the main earners of money, they are stronger and more enduring. But at the same time, as statistics shows, it is often the male half of the society that has a shorter life expectancy.

Table 1

Average life expectancy in different countries, in years

|

A country |

Retirement age, years |

Average life expectancy, years | |

|

Men |

Women | ||

|

Japan |

70 |

70 |

82,1 |

|

Denmark |

67 |

67 |

78,3 |

|

Norway |

67 |

67 |

79,9 |

|

USA |

65 |

65 |

78,1 |

|

Germany |

67 |

67 |

79,3 |

|

Canada |

65 |

65 |

81,2 |

|

Spain |

65 |

65 |

80,1 |

|

Sweden |

65 |

65 |

80,9 |

|

Switzerland |

65 |

64 |

80,9 |

|

Armenia |

65 |

63 |

72,7 |

|

Belgium |

65 |

62 |

79,2 |

|

United Kingdom |

68 |

60 |

79 |

|

Italy |

67 |

65 |

80,2 |

|

Poland |

67 |

60 |

75,6 |

|

Georgia |

65 |

62 |

76,7 |

|

France |

67 |

60 |

81 |

|

Kazakhstan |

63 |

58 |

67,9 |

|

Lithuania |

62,5 |

58,5 |

74,9 |

|

Hungary |

62 |

62 |

73,4 |

|

Czech Republic |

62 |

62 |

76,7 |

|

Azerbaijan |

62 |

57 |

66,7 |

|

Moldova |

62 |

57 |

70,8 |

|

Russia |

60 |

55 |

66 |

|

Ukraine |

60 |

55 |

68,6 |

|

Belarus |

60 |

55 |

70,6 |

|

Uzbekistan |

60 |

55 |

72 |

Modern tendencies.

Each state tries to leave the pension system in a stable state. But in today's conditions it is very difficult to do this. In 2015–2016, retirement age in different countries of the world began to increase. Or in the states began to actively discuss these changes. The global crisis makes itself felt — to work, if you exclude pensioners, there is practically nobody. The available funds in the treasury of each country are not enough for all expenses. Therefore, for the sake of replenishment, it is necessary to force the population to work longer.

Hence, the retirement in different countries of the world (the table will be presented) is a variable one. It is recommended to learn about these features constantly. Maybe in this or that state there have been pension reforms!

Also in some countries, they say not only about the increase in the retirement age, but also about the equalization of this indicator among men and women. In any case, now there will be no drastic changes — such a step will lead to a general riot. The population is not ready to sharply delay their legal rest. Therefore, almost all countries have begun to slowly, but confidently raise the retirement age.

Peculiarities of pension systems.

At the same time, do not forget about the formation of pension savings. It has already been said that countries use different principles of calculating money «for old age». The most popular method is combining several types. What features and principles of pension formation conceals in itself each of three existing pension systems?

Individual-funded — this is when a citizen works, part of his earnings are transferred to the Pension Fund. Either it does for the subordinate employer. Further from these savings will be formed a pension in old age.

Distributive with a basis on pension taxes — current employees do not save their money. They transfer part of the earnings to pay the pension to current pensioners. Accordingly, their «savings for old age» such employees will receive at the expense of working citizens after retirement.

Distributive on the basis of general taxes — cash is paid out of funds that are received by the tax fund.

The longest work.

What kind of retirement is possible in different countries of the world? Who works the most? Or rather, the longest of all the others? The thing is that if you do not take into account the plans of the countries to raise the retirement age, then at the moment after all the well-deserved rest awaits the inhabitants of Albania.

Here, men retire at 69.5 years, and women — at 64.5. Also work longer than all the others should citizens in Denmark. Here, for everyone, there is a restriction on getting out to a well-deserved rest. Both men and women living in Denmark go out to «rest» at the age of 67.

This list should include Germany. The age of retirement in different countries of the world is usually different for the male and female half of society. But the rules apply to the Germans, as well as in Denmark — all are equal in the issue of getting to a well-deserved rest. In addition, it is allowed to do this only after 67.

And who in the world works less than all? It has already been said that the pension system constantly suffers changes in each state. But at the same time somewhere the age of getting on a deserved rest is the lowest.

Among such countries at the moment is Belarus. In it, men receive a pension with 60, and women — with 55 years. Here are Russia and Ukraine. In Turkey, men go on a well-deserved vacation just like in the previously listed countries, but women must work up to 56 years. In France, all receive a pension with 60.

These countries are unbeatable leaders in entering a well-deserved rest. Only this does not mean that the standard of living of pensioners among those who may not work earlier is better or worse. It all depends on the rules that apply to the formation of pension savings.

Leaders on pensions.

Now the age of retirement in different countries is understandable. But does it somehow affect the money received? In fact, not really. Basically, everything depends on the welfare of the country. Everywhere the level of pensions is different. Many in general try to save money for old age, so as not to depend on the state.

Now quite high pension payments in France are received by citizens. If you transfer a pension to a pension, then in this state, a person is entitled to 42–43 thousand rubles. Then you can include in the list of the most «rich» pensioners Germany — 32–33 thousand. In Japan, pensioners on average earn 27,500, in the United States a little less — 24–25 thousand.

The lowest pensions.

The retirement age in different countries (the table is presented), as already can be seen, does not have a significant effect on payments. Which countries least support people who have gone on a well-deserved rest?

Below there is comparison of countries by their deduction of money to support pensioners.

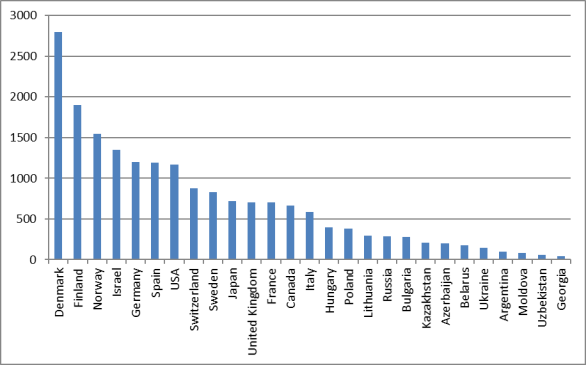

Fig. 1. The size of the average pension abroad (dollar per month)

As can be seen from the table the largest number of deducting money is in Denmark and vice versa in Georgia. From the position of state budget the government allocate money as they could afford.

Taking everything into consideration it can be said, different countries have their own approach and authority to manage their pension system. It is always been taken into account in order to support their social strategy and increase enthusiasm of labours.

References:

- Alier M. And Vittas D. (2001): «Personal Pension Plans and Stock-Market Votality», Holzmann-Stiglitz, eds. 391–423.

- Islamov Bakhtiyor, Shadiyev Rustam (Uzbekistan). «New demographic trends, employment and labour market in Uzbekistan». 2015.

- The statistics from web sites.