The realities of mutual fund industry in Vietnam and lessons from Korea, the United Kingdom and Japan

Автор: Нгуен Тхи Хоа

Рубрика: Региональная экономика

Опубликовано в Вопросы экономики и управления №4 (11) ноябрь 2017 г.

Дата публикации: 30.10.2017

Статья просмотрена: 1197 раз

Библиографическое описание:

Нгуен, Тхи Хоа. The realities of mutual fund industry in Vietnam and lessons from Korea, the United Kingdom and Japan / Тхи Хоа Нгуен. — Текст : непосредственный // Вопросы экономики и управления. — 2017. — № 4 (11). — С. 29-35. — URL: https://moluch.ru/th/5/archive/73/2789/ (дата обращения: 25.04.2024).

While the mutual fund industry has experienced a remarkable growth in the recent decade, the questions arise for both the government authorities and this industry to overcome several obstacles which include the instability of the world economy, the entrance of foreign funds as well as the regulation adjustment in the new context of investment environment. This research will not only shed addition light on analyzing the realities but also imply some solutions to Vietnamese mutual fund development based on lessons from Korea, the United Kingdom and Japan.

Keywords: mutual funds development, realities, lessons

Prior to 2017, mutual funds in the world experience a remarkable growth with regards to size and value of trading, reaching 30 trillion USD in September 2017 due to the positive sign of the security market in the world(Brown et al, 2017). This trade volume represents over one third of total word GDP and contributes significantly to economic growth. Indeed, this industry provides liquidity to the financial system as well as profit for the investors, reducing the exposure of investment risk by optimizing the investment portfolio.

According to Feinberg (2013), mutual fund is “An investment program funded by shareholders that trades in diversified holdings and is professionally managed” or in other word,this fund is a form of collective investment, in which the fund will be established by mobilizing capital from private investors to invest in funds following certain criteria”. In Vietnam, the definition of this fund was specified by State Securities of Commission (2012) which considered mutual fund as a non-bank financial institution attract funds from different sources to invest in stocks, bonds, currencies, or other types of financing managed by professional company, supervisory bank and other authorities.

During the next period, the mutual fund in Vietnam will experience several advantages within the positive signs of the economy. One of the pros is that the low interest rate in Vietnam encourages the available money from citizens flows from banking account to the investment channel that offer higher rate such as mutual fund. Moreover, Vietnamese average per capita income increase nearly 10 % during the period from 2015 to 2017, accounting for 2150 USD and 2350 USD respectively (Hung, 2017). The experts predict that this number will reach a peak at 3000 USD per capita in 2020, which will attract more money to investment channel within the assumption of ceteris paribus over the Vietnamese saving and consumption habit. Either the stability of politics or the openness of investment law will contribute significantly to the development of mutual fund in the near future.

However, it is inevitable that uncertainty conditions of global economy will cause several disadvantages for the investment in Vietnam and mutual fund in particular. Firstly, the instability of politics around the world concerned with Brexit in UK, potential of war between US and North Korea, the revenge of Catalonia in Spain, etc. may cause apolitical crisis as well as an economic crisis. Back to 2008, when the economic crisis followed by the bankruptcy of several companies transmitted from US to almost every country in the world, around 2000 mutual funds were forced to claim bankruptcy or in the process of merger or acquisition as good investment opportunities were rarely to findin the continuous down-trend of securities markets(Banegas et al, 2013; Frey et al, 2014; Hornstein & Hounsell, 2016). Secondly, after participating several free trade agreements include Vietnam- EU, ATIGA, AFTA, ASEAN-Japan, etc. Vietnam becomes more attractive market to foreign enterprises into the financial service field. Therefore, a challenge for the Vietnamese mutual fund is to compete with the increasing number of experience and competitive foreign firms. Another aspect is that, the cons of free trade agreement enhance the velocity of crisis from one country to the others. For example, in case of EU crisis, the funding from EU investors which contribute nearly 20 % of total foreign investment will decrease sharply and these investors will withdraw their capital from Vietnam to offset the cost of crisis in their home country as their share price drop sharply, currency depreciation, etc(Banegas et al, 2013). In addition, Vietnamese mutual fund is still at the initial period of operation compared to US, Japan, Korea, etc with at least 50 years of experience, not only their investment operation but also their governance need to be adjusted to operate effectively.

This research aims to shed additional light by analysing the mutual funds as an important investment channel in Vietnam. The essence of Vietnamese market concentration and country governance analysis are the most challenging features when obtaining appropriate evaluation for this industry. The solutions are suggested for mutual fund industry development based on the lessons of several countries such as Korea, the United Kingdom and Japan. In which, Korea and the United Kingdom acquired the noticeable improvement with regards to ranking in investment and mutual fund development while Japan suffered a huge “step-back” in mutual fund growth during the period from 2014 to 2016.

Methodologies

The objectives of this article are to analyse the current situation of mutual fund industry in Vietnam and give recommendations based on the experience of regulating and developing this industry from different countries such as Korea, the UK and Japan. In order to complete these objectives, this research has applied some methods such as simple statistics analysis to compare between different types of fund, the scale of industry, risk assessment based on the realities of mutual fund industry in Vietnam.

The author collects and synthesizes the literature based on the previous research around the world and Vietnam in the field of mutual fund development experience such as the scale, the impact between factors in corporate governance and country governance on mutual fund performance. The method of collecting data mainly based on the secondary data collection with analysing the previous studies on mutual fund management in several countries. Besides, the research also collects the data from the scientific reports, PhD theses and Master theses from 2010.

The lessons for developing mutual funds

- The lessons from Korea

Security investment trust in Korea was established in 1969 under the form of closed- ended fund(Oh & Parwada, 2007). Up to 2017, mutual fund in Korea has achieved significant growth in terms of size and profit due to the support from the Korean government. In details, the country governance or the investment regulation in Korea ranked at A- the highest level of investment condition evaluation, making this country superior for either foreign or domestic investment.

Most Korean mutual funds structured as investment trust which have a general assembly while investment companies must have supervisory boards that require a certain level of independence. Although open-ended funds given a permission to establish in Korea since 1970, closed-ended funds remained popular until 2001.During the prominent time of closed-ended funds, the main distribution channel of the fund certificate is investment trust company’s own branches rather than brokerage arrangements or security companies.

Within the Korean governance for investment, regulation and taxation authorised by Financial supervisory service (FSS) which operates under the Financial Service Commission (FSC). The other authority is Financial Investment Association (KOFIA) which monitors fund advertising and sales practice in this industry(Ko & Ha, 2011; Oh & Parwada, 2007). The Korean regulations are generally up to date in order to reflect changes in the investment condition. Enforcement procedures in Korea are comprehensive with little oversight not only identifying and punishing but also exposing to Korean citizens by publishing in social media such as newspaper, television or Internet.

The huge advantage of mutual fund in Korea is that participants of retirement pension funds are eligible for tax exemption. In other words, if the investors put their money in the fund until retirement age of 55, the taxes on capital gains will be deferred. Any withdrawal before retirement age will be taxed for severance income. Since 2015, in order to encourage the investors in mutual fund, the Korean government has solely required the investors to pay taxes on interest and dividends, but not on capital gains which means that no additional taxes imposed on investment funds in Korea(Cuthbertson et al, 2016).

Nowadays, Korean investment advisors and media practices treat open-ended funds as the preferred investment option, which distributed widely by bank, insurance companiesor brokerage firms. In 2013, online trading for mutual fund has emerged as the legacy channel that has great impacts on fee and commission. Currently online distribution accounts for 80 % of fund certificate transactions in Korea.

- The lessons from the United Kingdom

There are two primary legal type of open-ended fund in UK considered as open-ended investment companies (OEIC) and authorised unit trusts (AUTs). While OEIC required the board of director which can be independent or not, AUTs governed by trust law and must have an independent entity as a trustee. Similar to AUTs, closed-ended funds or Investment trusts in UK obliged to have an independent board of directors(Ferreira et al, 2013).

In 2016, the UK grade in mutual fund growth is above-average with the significant improvement within the area of legislation. In general, the UK is still a member of EU; they therefore must follow some rules in this area within UCITS (Undertaking for collective investment in transferable securities) regulations, which ensure that EU member must satisfy certain standard in regulatory areas such as fees, commission, disclosure, etc(Brown et al, 2017). For example, all investment funds must meet the minimum requirement of discloser for their fund. In UK, mutual fund companies must report to shareholders semi-annually and be examined by an independent auditor within 120 days after the end of fiscal years. In details, more than 80 % of mutual funds in UK send their portfolios monthly with all the details required for interest parties.

Financial Conduct Authority (FCA) was established in 2013 with the role as the main regulator in UK, replacing the Financial Services Authority after the implementation of Financial Services Act in 2012. Most mutual funds regulated and enforced by FCA and one of the most noticeable law they implemented is Investment Distribution Review with the purpose of improving the clarity of how the firms service their customers. This law remains some disputes at this moment since it eliminated considerably the commission payments to the advisors,but the investor outcomes were not skewed by the incentives (Borgers et al, 2015; Ferris & Yan, 2007; Hu et al, 2016; Matallín-Sáez et al, 2016). Directed brokerage arrangements where fund cooperate with the brokerage firms in exchange for promoting their funds are not permitted.

Similar to the pension fund in Korea, individuals who invest their money in pension fund until retirementwill gain tax incentive. However, the pension funds in UK have some restrictions over time and amount of money that can be withdrawn from these accounts. In details, about 65 % of UK citizens put their money in pension funds to achieve the tax offset. Moreover, the information and promotion of mutual funds in UK can be found easily in newspaper on daily basis.

- The lessons from Japan

In Japan, funds can be structured as contractual funds or trusts without any requirements to have an independence board. The first mutual fund in Japan was launched in 1980 in the form of trust fund, with the support from the government rather than themselves (Banegas et al, 2013; Frey et al, 2014; Hu et al, 2016; Matallín-Sáez et al, 2016). Prior to 2017, nearly 3200 Japanese mutual funds operate in the form of open-ended fund with regards to their structure.

In general, the regulatory identity which is responsible for the securities markets and mutual fund operations is the Regulation and Taxation Financial Services Agency (FSA), ensuring stability of the financial system, inspecting the disclosure document or criminal actions in finance. All of the mutual fund operations must follow the Securities Investment Trust Law (also known as the Investment Trust and Investment Company Act). The country governance over the Japanese mutual funds is allocated based on the ownership of these funds whether it is foreign domiciled fund supervised by Japan Securities Dealer Association (JSDA) or local fund authorised by Investment Trust Association (ITA). Japanese regulations are generally up-to-date in order to reflect changes in the investment industry but some cases exposure in Japan is little oversight(Feinberg, 2013).

In Japan, government imposes specific tax incentives to encourage investor to save for retirement which is similar to the case of taking advantage pension funds in Korea and the UK. Investors in Japan can defer all the income, capital gains or dividends tax until the fund shares liquidation or they are only responsible for paying tax when receiving distribution. Japan allows advisors to receive excess compensation when selling specific fund, which would cause the conflict of interest between customer gains or their benefits with fund selling. The fees and expenses in Japan considered as the highest compared to other countries with 75 % of funds domiciled in Japan report a front load fee due to fact that funds have been given a permission to charge performance fees for good performances.

Disclosure in Japan obliged to public a semi-annual prospectus called “KoufuMokuroshimo”, serving for single funds and explaining the risk exposure for the investors, typically between 5 or 15 pages in length. However, most funds publish the investment risks in general rather than specific risk, but they provide detail information in terms of price of administration and major expenses as requirements from FSA(Kaniel & Parham, 2017).

The current situation of mutual fund domiciled in Vietnam

- The scale of mutual fund industry in Vietnam

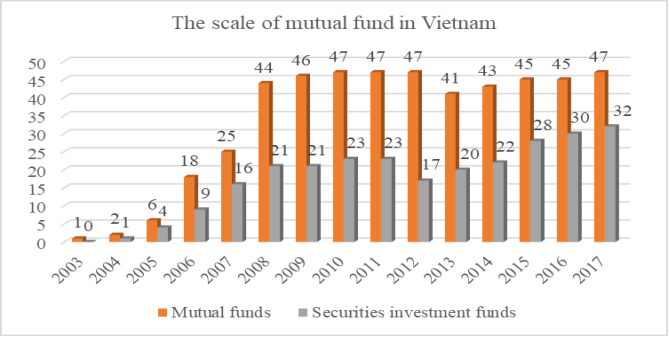

With experience of more than 15 years,Vietnamese mutual fund has achieved significant growth concerned with size and trading value, specifically there are roughly87 investment funds including 40 offshore funds and 47 onshore funds (25 onshore funds active) are operating in the market with net asset value of more than 121.500 billion VND as at 30th June 2017 (equivalent 5.3 billion USD)(DOBF, 2017). The number of Vietnamesemutual funds and securities investment funds is illustrated by the following graph:

Fig. 1. The scale of mutual fund in Vietnam Source: State Security Commission of Vietnam (2017)

Prior to 2002, the mutual fund industry in Vietnam was quite fragile with the operation of offshore mutual funds. The first onshorefund management company waslaunched in 2003 named VietFund Management Company, followed by the establishment of VFMVF1- the first onshore fund in Vietnam. Initially, VFMVF1 structured as the closed-ended fund with the capital of 300 billion VND and listed in HOSE. After more than a decade of development, development trend of mutual funds in Vietnam gets closer to global development trend of mutual funds:open-ended fund becomes more popular for both individual and corporate investors because of outstanding advantages of portfolio diversification, professional management, and liquidity.

It is obvious that the onshore mutual fund grows steadily from the first fund in 2003, reaching 44 funds in 2008, coinciding with the considerable development of security market around the world. Nevertheless, the number of onshore funds remains at around 45 during the following period, implied that the crisis may lead to the restriction in investment opportunities of mutual fund in Vietnam (Frey et al, 2014; Hornstein & Hounsell, 2016). Ferreira et al (2013) argues the main reason is that Vietnamese investment environment with regards to the governance, tax, and company structure cannot motivate the investors; rather than the impact of global crisis since Vietnam considered as one of the least influenced countries in 2008.

Although the number of onshore mutual funds changes very few during the period, total asset under management of onshore open-ended funds increases tremendously from nearly 1,800 billion VND at the end of 2014 to nearly 7,600 billion VND at month end of September 2017. The success of onshore open-ended fund market comes from important factors such as change in investment attitude and foreign capital in-flow. Seft-investing is dominant practice in Vietnam for individual investors rather than using investment trusts as mutual funds. After more than a decade of fund operation, many individual investors realize good performance of mutual funds which outperform significantly over their own returns. Moreover, foreign investors also take a chance to invest in onshore funds that makes up a big capital in-flow in onshore open-ended funds.

While the onshore mutual fund proves the considerably growth in size, it still accounts for a tiny parts of Vietnamese mutual fund market compared with offshore mutual fund.

- Corporate governance

Based on the responsibility of the fund, mutual funds can be divided as either the closed-ended fund or open-ended fund. While closed-ended funds do not oblige to buy back fund certificate, open-ended fund required this responsibility. In Vietnam, the number of open-ended funds outweighs the number of close-ended funds. Open-ended funds have pros over the liquidity in fund raising but cons in the stabilization of the fund with regards to the number of investors and the capital.

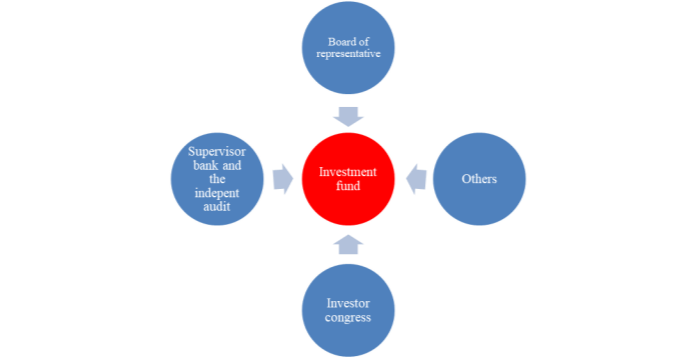

The structure of the mutual fund operation is depicted by the following graph:

Fig. 2. Mutual fund structure in Vietnam Source: State Security Commission of Vietnam (2016)

In which, board of representatives are unqualified members elected by the investors who meet specific requirements in regulated laws. The boards in Vietnamese mutual fund are required at least one independent member majoring in accounting field and one independent member majoring in investment analysis. This can take several advantages since Borgers et al (2015); Matallín-Sáez et al (2016)stated that the greater number of independent members, the better performance of the mutual fund or lower fees compared with smaller number of independent members.

Investor congress includes all the investors in the mutual fund, the highest power entity within the fund. The mutual fund governed by the supervisory bank which protecting the rights of shareholders and the independent audit to evaluate the soundness and stability of the mutual fund.

- Country governance

After 16 years of operation, a bunch of regulations implemented in Vietnamese securities market, which enhanced the stability, unity and soundness of this market especially mutual fund development. In overall, the mutual fund companies authorised by the Law of Enterprise 2014;Law of securities 2006 and amendments; Guidance of law of securities such as Decree No. 58/2012/ND-CP and Decree No. 60/2015/ND-CP; Circular No. 183/2011/TT-BTC dated 16 December 2011 by the Ministry of Finance guiding the Establishment and Management to the Open-ended Fund; Circular No. 229/2012/TT-BTC dated December 27, 2012 of the Ministry of Finance, guiding the establishment and management of exchange-traded fund; Disclosure rule and listing rules of the Ho Chi Minh and Hanoi stock exchanges, regulated strictly by Circular No. 155/2015/TT-BTC guiding for the disclosure of information on the stock market, effective as of 01 January 2016 and the decree 227/2012/TT-BTC instructing the establishment and operation of mutual fund in Vietnam; Decree 87/2017/TT-BTC with the requirement of controlling over financial risk and enforcement to financial company in securities market etc. These rules initially target to create a mutual fund industry of transparency and effectiveness.

Nevertheless, the regulation framework in Vietnam cannot cover all the fields of the market especially the scale of transaction, imbalance between the supply and demand that causes the illiquidity of security market. Occasionally, some operations in Vietnam concerned with issuing securities, interest rate, disclosure are not followed the natural behaviours according to the law of supply and demand in the market. The period from 2015 to 2017 saw the remarkable increase in capitalization of many securities issuers. The booming capital raising through securities market by stock issuing make issuers feel easy to attract more in-flow from free market. Unprofessional investors may be fallen in traps of raising funds of unhealthy companies without acknowledgement. If portfolio managers of mutual funds do not analyse deeply on targeted companies, mutual fund’s investors will suffer a “huge” loss after a short period of time. Furthermore, neither the government nor non-government entities appeared to be reliable and consistent in ranking the mutual fund in Vietnam, which leads to the misbehaviour and misunderstanding of investors due to the lack of trustful information.

Another issue for the Vietnamese investment environment is the tax incentive for the investors as well as the mutual fund corporations. Neither real estate investment trust, ETF nor securities investment fund can take the advantages of tax reduction. In Korea, Japan or UK, the investment fund or investors capital income are exempted from tax while Vietnam charge tax quite heavy with this type of income. Prior to 2013, the business income tax was 25 %, standing at 22 % and 20 % in 2014 and 2016 respectively while individual investors burdens 5 % income tax of interest and cash dividends and 0.1 % tax over total value of transaction even without any capital gains. Moreover, the pension fund — which is common in Korea, Japan, and The UK — regulated by government in 2016 cannot offer the benefit in tax as expected. Too-little-encourage tax scheme for pension fund leads the private pension market harder to overcome obstacles of fragile and junior market.

As can be seen from the analysis, a challenge for the government authority is to adjust the regulations to create professional investment environment that is not only closer to global standards but also better for onshore mutual funds to develop. Without significant adjustment, the country governance will be the most challenging obstacle for the growth of Vietnamese mutual fund.

Some implications for Vietnamese mutual fund industry

- Policy implication

In Korea, Japan and the UK, mutual fund industry is regulated by the highest level of legacy with establishment, operation, disclosure instructions, enforcements and the punishment action with careful investigation will restrict the oversight enforcement. In Vietnam, with the booming and complication of mutual fund industry, the government should have proper adjustment to resolve the interest conflict between the investor and mutual fund. The regulation must be concise to prevent the non-responsible action involved the government authorities, mutual fund or investors, preventing them from further illegal actions. Moreover, supervising strictly by the independent audit in Vietnam exposed to several problems since several cases of connivance between the investor and mutual fund or inside the funds.

In addition, from the experience of Korea and Japan, Vietnamese government should actively involve in information orientationfor whole market. To develop a mutual fund industry, Vietnamese government is encouraged to approach public channel to officially announce one new way of investment besides traditional deposit at banks.Furthermore, the government not only pays attention to the training of management and human resource for the mutual fund but also facilitates the foreign financial experts for advisory of mutual fund development. One of the main factorsfor successfulmutual fundindustry in UK is toown the best foreign experts in financial development generally and mutual fund particularly.

The international practices and lessons from Korean and Japan depict that tax incentive is a crucial factor for mutual fund growth, encouraging the available money from Vietnamese citizens into mutual fund especially domestic fund. According to developed countries experience, the tax exempt to fund certificate transaction with regards to new type of mutual funds such as ETF or REIT can boost the demand of these certificates, therefore attracting new investors in these fields. Another aspect to consider is to taking advantage of pension fund in Vietnam, which required the actively marketing such as details and benefits of pension on newspaper, TV or Internet. The investment of pension fund goes around open-ended funds and direct investment through state bonds and bills, so a good base of open-ended funds is the most important factor to develop private pension fund market.

- Mutual fundimplications

Several researches in Japan, UK and Korea have revealed that the open-ended fundsare flexible to adjust to the changes in the market, taking advantage of fund raising, enhancing the liquidity. While most of mutual funds in Vietnam are in the form of open-ended fund, they have big advantages to increase fund size in trend of in-flow from domestic and foreign sources to securities market generally and to mutual fund specifically. One type of mutual funds constructed for investors concerned with operating fees is ETF which outweighs other type of mutual funds in minimal operation costs. To attract more inflow, mutual funds must prove themselves a good track record of performance and good reputation in operation. To reduce operational risks, mutual funds are suggested to use services provided by outstanding supervisory banks which have many years of experience as service provider. In term of supervising banks, they must prove a strong supervisory role in fund operation processes to ensure funds strictly followed regulated laws.

In Korea and the UK, the investors consider mutual funds as the trustful entities when they follow the marketing disclosure regulation coinciding with the ethics and corporate social responsibility (CSR). In UK, there is a significant difference in fund raising between corporation engaged in CSR and the rest. It suggests the mutual fundsapply the code of ethics and CSR as asset and defensive mechanism against legal issues. Therefore, the mutual fund industry in Vietnam is suggestedto pay attention to not only advertising disclosure but also the CSR.

One of the reason behind the succeed of Korea and the UK or the decrease in Japanese ranking in this industry is the fee of mutual fund. While Korea and the UK charge an extremely low fee, Japan mutual fund can charge the investors based on the performance. However, this only considers during the short period of time from 2014 to 2016, which need to be further investigated, the mutual fund in Vietnam is encouraged to reduce the operation fees and transaction fees- 1 % to 3 % of the certificate value- by optimizing the company structure.

Disclosure regulations in Vietnam obliged to public a prospectus serving for single fund and explaining the risk exposure for the investors, range from 15 to 70 pages in length. However, most funds publish the investment risks in general rather than specific risk, which is quite similar to Japan weakness. Therefore, onshore funds should provide all the information needed for analyzing both systematic and unsystematic risk. Another aspect that Vietnamese mutual fund should improve is to implement more marketing strategy to support investor in information disclosure and attract more fund raising.

References:

- Banegas, A., Gillen, B., Timmermann, A. & Wermers, R. (2013) The cross section of conditional mutual fund performance in European stock markets. Journal of Financial economics, 108(3), 699–726.

- Borgers, A., Derwall, J., Koedijk, K. & ter Horst, J. (2015) Do social factors influence investment behavior and performance? Evidence from mutual fund holdings. Journal of Banking & Finance, 60, 112–126.

- Brown, S. J., Sotes-Paladino, J., Wang, J. & Yao, Y. (2017) Starting on the wrong foot: Seasonality in mutual fund performance. Journal of Banking & Finance, 82, 133–150.

- Cuthbertson, K., Nitzsche, D. & O'Sullivan, N. (2016) A review of behavioural and management effects in mutual fund performance. International Review of Financial Analysis, 44, 162–176.

- Feinberg, P. (2013) 'Desperate' Japanese pension plans now turn to hedge funds. Pensions & Investments, 31(4), 2–2,42.

- Ferreira, M. A., Keswani, A., Miguel, A. F. & Ramos, S. B. (2013) The determinants of mutual fund performance: A cross-country study. Review of Finance, 17(2), 483–525.

- Ferris, S. P. & Yan, X. (2007) Do independent directors and chairmen matter? The role of boards of directors in mutual fund governance. Journal of Corporate Finance, 13(2–3), 392–420.

- Frey, S., Herbst, P. & Walter, A. (2014) Measuring mutual fund herding–a structural approach. Journal of International Financial Markets, Institutions and Money, 32, 219–239.

- Hornstein, A. S. & Hounsell, J. (2016) Managerial investment in mutual funds: Determinants and performance implications. Journal of Economics and Business, 87, 18–34.

- Hu, M., Chao, C.-C. & Lim, J. H. (2016) Another explanation of the mutual fund fee puzzle. International Review of Economics & Finance, 42, 134–152.

- Kaniel, R. & Parham, R. (2017) WSJ Category Kings — The impact of media attention on consumer and mutual fund investment decisions. Journal of Financial Economics, 123(2), 337–356.

- Ko, K. & Ha, Y. (2011) Mutual Fund Tournaments and Structural Changes in an Emerging Fund Market: The Case of Korea*. Seoul Journal of Business, 17(1), 37–64.

- Matallín-Sáez, J. C., Soler-Domínguez, A. & Tortosa-Ausina, E. (2016) On the robustness of persistence in mutual fund performance. The North American Journal of Economics and Finance, 36, 192–231.

- Oh, N. Y. & Parwada, J. T. (2007) Relations between mutual fund flows and stock market returns in Korea. Journal of International Financial Markets, Institutions and Money, 17(2), 140–151.

- State Security Commission of Vietnam (2014),“Báo cáo tình hình hoạt động của các quỹ đầu tư chứng khoán và công ty quản lý quỹ”, Hanoi.

- State Security Commission of Vietnam (2015),“Báo cáo tình hình hoạt động của các quỹ đầu tư chứng khoán và công ty quản lý quỹ”, Hanoi.

- State Security Commission of Vietnam (2016),“Báo cáo tình hình hoạt động của các quỹ đầu tư chứng khoán và công ty quản lý quỹ”, Hanoi.

- DOBF (2017), «Kết quả hoạt động các Quỹ đầu tư 6 tháng đầu năm 2017", Hanoi.

Похожие статьи

Fostering and improving leadership capacity of head of department in...

This trade volume represents over one third of total word GDP and contributes significantly to economic growth. TT-BTC, USD, CSR, VND, ETF, ND-CP, FSA, FCA, DOBF, OEIC.

Похожие статьи

Fostering and improving leadership capacity of head of department in...

This trade volume represents over one third of total word GDP and contributes significantly to economic growth. TT-BTC, USD, CSR, VND, ETF, ND-CP, FSA, FCA, DOBF, OEIC.