Research into the influence of factors on the decision to select bank for depositing customer’s savings in Hanoi, Viet Nam

Авторы: Нгуен Тхи Нгует Данг, Буй Тхи Ханх

Рубрика: Финансы, деньги и кредит

Опубликовано в Вопросы экономики и управления №5 (16) ноябрь 2018 г.

Дата публикации: 11.10.2018

Статья просмотрена: 42 раза

Библиографическое описание:

Нгуен, Тхи Нгует Данг. Research into the influence of factors on the decision to select bank for depositing customer’s savings in Hanoi, Viet Nam / Тхи Нгует Данг Нгуен, Тхи Ханх Буй. — Текст : непосредственный // Вопросы экономики и управления. — 2018. — № 5 (16). — С. 21-30. — URL: https://moluch.ru/th/5/archive/105/3622/ (дата обращения: 25.04.2024).

This research was conducted through a survey of 267 individual clients who have saving accounts at commercial banks. With the support of SPSS 20.0 software, the authors point out that “Bank’s Staff” is the most influential factor in individual customer decision-making when choosing a commercial bank. The following factors are in descending order of influences: «Convenience», «Financial Gain», «Banks’ Reputation», «Banks’ Image», «Influence of Peers» and «MarketingActivities». Because of above reasons, the authors propose recommendations that help commercial banks find out the methods to differentiate from competitors in order to retain existing clients and attract potential clients in boosting sale of deposits and savings.

Keywords: decision-making in bank selection for savings

- The topic

The increasing number of banks nowadays have presented an inevitable trend which bring more and more options to clients in banking services, especially in deposits and savings. The growth in technologies and number of competitors day by day have created a heated competition to attract new clients in banking industry. Thus, there is a growing interest among banks to raise their competitiveness and establish their distinction in the market to attract new and retain old clients.

In many countries in the world, studies related to choices of banks for individual clients have been conducted since decades ago. These studies provide the theoretical foundation for bank selection, however, the results are hardly applicable in Vietnam due to fundamental differences in geography, society, economic environment and laws. Among the great turbulent scene of society and economy in Vietnam, complicated fluctuations in interest and inflation rate have had quite an psychological impact on deposit clients. As a result, the influential factors and the level of influence they have upon the choices of banks made by deposit clients have changed.

Therefore, it is an essential and new approach to identify the factors that individual clients take into consideration when making their choices of banks to deposit their savings and to help banks build appropriate strategy in retaining old clients and attracting new potential clients more effectively.

These practical issues have led the authors to select the topic: Research into the influence of factors on the decision to select bank for depositing customer’s savings in HàNội, Viet Nam.

- Introduction

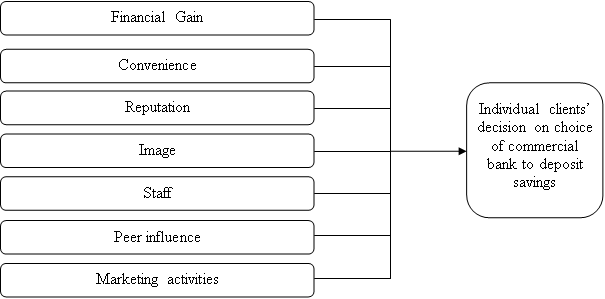

The choice of bank is a specific step in clients’ behavioral journey in regard to their awareness, information collection, consideration and decision making. Usually, clients choose banks based on their awareness and reasonableness. After collecting sufficient information, clients then establish their own criteria to consider and evaluate for their decision making. Therefore, the factors affecting clients’ choices of banks to deposit their savings consist of:

– Financial Gain

This is one of the core competing instruments for banks and consists of interest rate and service fees. Tan & Chua (1986) discovered that high interest rate was one of the factors influencing the choices of banks for savings and deposits. After that, Khazech (1993) and Mylonakis (1998) have added the element of Service fees. In 2008, Mokhlis grouped these elements into Financial Gain, which reflects the benefits that clients receive financially when using services at one bank. Later studies by Mokhlis (2009), Ukena (2012), Nguyen Thi Ngoc Huong et al (2012) continued to further establish the discoveries from these authors.

According to Nguyen Van Tien (2011), interest rate is the percentage of money gained compared against the original deposit, or in other words, interest rate is the ratio of interest money clients received outside of their original deposit amount after a certain deposit period at one bank.

Service fees for saving deposits are all types of fee charged to the clients when they use the deposit service at banks.

Usually, banks will waive the fees for saving deposit, account management, cash withdrawal while charging fees depending on the type and purpose of clients’ deposit such as: additional collection fee, transfer of ownership fee, loss of saving books fee, balance confirmation fee... If the saving deposit services of banks do not have major differences in features and benefits, clientstend to favor banks with low service fees to maximize their financial gain. This could also be considered one of the factors influencing clients’ choices of banks to deposit their savings.

– Convenience

Convenience might include convenience in time and service location, or convenience in parking lot... This is one factor confirmed by many researchers to have influence upon the choices of banks for individual clients. The factor was mentioned by Tan & Chua (1986), Mylonakis (1998), Holstius K. &Kaynak K. (1995), Awang (1999), Ta & Har (2000), Rashid (2009), Hedayatinia (2011), Rashid (2012), and Ukena (2012).

– The reputation of banks

According to studies by Khazech (1993); Mylonakis (1998); Awang (1999); Almossawi (2001); Mylonakis (2007); Abduh (2010); Agrebey (2011); and Rashid 2012, one of the deciding factors in choosing to use a bank is its reputation.

– The image of banks

The image of banks consists of elements such as: banking atmosphere or design and decoration of its infrastructure. The study by Awang (1999) has confirmed the image of banks as one factor affecting individual clients’ decision. This decision then echoed by studies of Mylonakis (1998), Almossawi (2001), Mylonakis (2007), Abduh (2010), Agrebey (2011) and Rashid (2012).

– The staff

The friendliness of staff is one factor presented by the study of Tan & Chua (1986). Later studies by Khazech (1993) and Haron (1994) have pointed out another element being the competency of staff. Thus, competency and attitude of staff are factors which highly influence individual clients’ decision in choosing a bank. Further studies that echoed the conclusion include:Almossawi (2001); Mylonakis (2007); Abduh (2010); Hedayatnia (2011); and Rashid (2012).

– Influence from peers

Tan & Chua (1986) analyzed the factors affecting decisions of choosing banks in Eastern culture. The results indicated that the society in Eastern culture had stronger impact compared to other factors. Other studies by Awang (1999), Lee (2003), Chigamba (2011), Rashid (2012), and Ukena (2012) have showed that not only Eastern culture but Western culture is also subjected to influence from peers. Advice from families and peer groups is an important factor in individual clients’ decisions.

– Marketing activities

The role of marketing activities in banking business is quite similar to other business, being the communication of information from the banks to the clients and vice versa. According to the conclusion from the study by Ta &Har (2000), banks’ marketing activities have impact upon individual clients’ decisions in choosing one bank to use for their saving deposits. This conclusion was later confirmed by other studies including Mylonakhis (2007), Mokhlis (2009), Chigamba (2011), Ukena (2012).

- Research methodology and research model

The authors used quantitative and qualitative research to achieve the study objectives.

– Qualitative research

The study is conducted through 2 steps in order to build the research model

Step 1: Based on theoretical research to build a theoretical research model

Fig. 1. Research Model

Step 2: Expert interviews conducted on consulting specialists at several banks. The objective of this method is to add and modify observations used to measure variables in the research model.

– Quantitative Research

After the research model and variables are built, the quantitative research is conducted as followed:

Step 1: Design questionnaire for trial survey

Table 1

List of variables in the model

|

Code |

Variables |

Sources |

|

Financial Gain (FG), including 4 variables |

||

|

FG1 |

High interest rate |

Tan & Chua (1986); Khazech (1993); Mylonakis (1998); Mokhlis (2009); Hedayatnia (2011); Ukena (2012); |

|

FG2 |

Low service fees |

|

|

FG3 |

Add-on features for saving deposit |

|

|

FG4 |

Promotion and clients’ loyalty programs |

|

|

Convenience (C), including 3 variables |

||

|

C1 |

Convenience of locations for transaction offices |

Anderson(1972); Riggall (1980), Laroche (1986); Tan & Chua (1986); Mylonakis (1998); Holsitutus (1995); Awang (1999); |

|

C2 |

Convenience of operation time of banks |

|

|

C3 |

Availability of parking lot |

|

|

Reputation (R),including 5 variables |

||

|

R1 |

Large-scale banks |

Anderson (1976); Abduh(2010); Agrebey (2011); Rashid 2012 |

|

R2 |

Long-established banks |

|

|

R3 |

Highly trusted banks |

|

|

R4 |

State-owned banks |

|

|

R5 |

Financially strong banks |

|

|

Image (I),including 3 variables |

||

|

I1 |

Well-established infrastructure and modern machines and equipment |

Awang (1999); Okan (2007); Rashid (2012); Nguyen, Thi Ngoc Huong et al (2012) |

|

I2 |

Well-organized and convenient document shelves, notice boards and transaction counters |

|

|

I3 |

Well-equipped and comfortable space for transaction |

|

|

Staff (S), including 4 variables |

||

|

S1 |

Staff with elegant and neat outfits |

Anderson (1972); Laroche (1986); Riggall (1980); Tan & Chua (1986); Khazech (1993); Haron (1994); Abduh (2010); Hedayatnia (2011); Rashid (2012) |

|

S2 |

Staff showing friendliness and manners toward clients |

|

|

S3 |

Staff with sufficient knowledge and professional competency to support clients |

|

|

S4 |

Highly supportive and helpful security guards |

|

|

Peer influence (PI),including 3 variables |

||

|

PI1 |

Influence of advice from family members |

Tan & Chua (1986); Awang (1999); Lee (2003); Ukena (2012); NguyenThi Ngoc Huonget al (2012) |

|

PI2 |

Influence of advice from friends |

|

|

PI3 |

Requirements from clients’ work places |

|

|

Marketing activities (MA),including 3 variables |

||

|

MA1 |

Impressed by advertisements from banks |

Ta &Har (2000); Mylonakhis (2007); Mokhlis (2009); Chigamba (2011);Nguyen, Thi Ngoc Huonget al (2012) |

|

MA2 |

Banks with lots of presents for clients |

|

|

MA3 |

Marketing campaigns from banks to attract clients |

|

|

Decision on bank choice for saving deposit (DC),including 3 variables |

||

|

DC1 |

Clients continuing to use saving deposit service at their current transaction bank |

Ta &Har (2000); Mylonakhis (2007); Mokhlis (2009); Chigamba (2011); Nguyen, Thi Ngoc Huonget al (2012) |

|

DC2 |

Clients planning to open saving deposit accounts in the future |

|

|

DC3 |

Clients planning to introduce friends / family to open saving deposit accounts |

|

Step 2: Design official questionnaire for survey

Step 3: Conduct official survey. Participants are those currently use or have used saving deposit services at commercial banks in Hanoi city, Vietnam. The numbers of issued questionnaires are 300. The numbers of valid responses are 267.

Step 4: Collect and process data, including: (i) Statistical record of collected data; (ii) Processing and analysis of data via SPSS 20.0 software.

- Study results and discussion

1)Test of scale reliability

Table 2

Test of scale reliability

|

Scale Mean if Item Deleted |

Scale Variance if Item Deleted |

Corrected Item - Total Correlation |

Cronbach's Alpha if Item Deleted |

|

|

Alpha (FG) = 0.914 |

||||

|

FG1 |

10.66 |

13.455 |

.761 |

.903 |

|

FG2 |

10.65 |

12.894 |

.835 |

.878 |

|

FG3 |

10.79 |

12.701 |

.808 |

.887 |

|

FG4 |

10.72 |

12.906 |

.811 |

.886 |

|

Alpha(C) = 0.923 |

||||

|

C1 |

10.83 |

12.285 |

.865 |

.902 |

|

C2 |

10.84 |

13.583 |

.796 |

.924 |

|

C3 |

10.76 |

13.264 |

.854 |

.906 |

|

Alpha(R) = 0.923 |

||||

|

R1 |

17.60 |

31.428 |

.769 |

.910 |

|

R2 |

17.66 |

30.767 |

.830 |

.902 |

|

R3 |

17.41 |

30.363 |

.823 |

.903 |

|

R4 |

17.64 |

31.547 |

.794 |

.907 |

|

R5 |

17.84 |

31.678 |

.711 |

.918 |

|

Alpha(I) = 0.901 |

||||

|

I1 |

10.85 |

11.248 |

.756 |

.881 |

|

I2 |

10.80 |

11.522 |

.754 |

.881 |

|

I3 |

10.75 |

11.094 |

.801 |

.864 |

|

Alpha(S) = 0.729 |

||||

|

S1 |

10.94 |

6.026 |

.525 |

.665 |

|

S2 |

10.63 |

7.362 |

.467 |

.701 |

|

S3 |

11.32 |

5.798 |

580 |

.631 |

|

S4 |

11.14 |

6.082 |

.520 |

.669 |

|

Alpha (PI) = 0.813 |

||||

|

PI1 |

5.50 |

4.959 |

.720 |

.684 |

|

PI2 |

5.34 |

5.209 |

.668 |

.740 |

|

PI3 |

5.68 |

5.900 |

.609 |

.798 |

|

Alpha(MA) = 0.724 |

||||

|

MA1 |

5.78 |

4.589 |

.488 |

.703 |

|

MA2 |

6.37 |

4.199 |

.579 |

.595 |

|

MA3 |

6.06 |

4.162 |

.571 |

.605 |

|

Alpha(DC) = 0.797 |

||||

|

DC1 |

7.35 |

3.491 |

.617 |

.752 |

|

DC2 |

7.18 |

3.521 |

.639 |

.724 |

|

DC3 |

6.96 |

3.891 |

.675 |

.696 |

Results from Cronbach Alpha coefficient analysis showed all examined variables to be > 0.6, indicating a close relationship among them. Coefficient values are > 0.3, indicating all variables are accepted. These variables will then be used for exploratory factor analysis (EFA).

2)Test of scale validity

– For independent variables

Table 3

KMO and Bartlett test for independent variables

|

Kaiser-Meyer-Olkin Measure of Sampling Adequacy. |

.784 |

|

|

Bartlett's Test of Sphericity |

Approx. Chi-Square |

6323.240 |

|

df |

153 |

|

|

Sig. |

.000 |

|

Table 4

Exploratory factor analysis for independent variables

|

Measured Variables |

Component |

||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

|

FG1 |

0.771 |

||||||

|

FG2 |

0.703 |

||||||

|

FG3 |

0.681 |

||||||

|

FG4 |

0.612 |

||||||

|

C1 |

0.609 |

||||||

|

C2 |

0.607 |

||||||

|

C3 |

0.564 |

||||||

|

R1 |

0.945 |

||||||

|

R2 |

0.651 |

||||||

|

R3 |

0.912 |

||||||

|

R4 |

0.658 |

||||||

|

R5 |

0.656 |

||||||

|

I1 |

0.809 |

||||||

|

I2 |

0.807 |

||||||

|

I3 |

0.632 |

||||||

|

S1 |

0.809 |

||||||

|

S2 |

0.807 |

||||||

|

S3 |

0.632 |

||||||

|

S4 |

0.602 |

||||||

|

PI1 |

0.843 |

||||||

|

PI2 |

0.720 |

||||||

|

PI3 |

0.656 |

||||||

|

MA1 |

0.795 |

||||||

|

MA2 |

0.672 |

||||||

|

MA3 |

0.565 |

||||||

|

Eigen-value |

7.809 |

2.529 |

2.171 |

2.033 |

1.701 |

1.431 |

1.279 |

|

Variance Explained (%) |

25.795 |

5.637 |

5.173 |

6.550 |

6.506 |

4.726 |

3.506 |

– For dependent variables

Table 5

KMO and Bartlett test for dependent variables

|

Kaiser-Meyer-Olkin Measure of Sampling Adequacy. |

.726 |

|

|

Approx. Chi-Square df |

527.811 |

332.199 |

|

3 |

3 |

|

|

.000 |

.000 |

|

Table 6

Rotatel Component Matrixa

|

Component |

|

|

1 |

|

|

DC1 |

.893 |

|

DC2 |

.853 |

|

DC3 |

.917 |

The KMO coefficients are 0.784 for independent variables and 0.726 for dependent variables, both > 0.5 and thus, the exploratory factor is valid for the study. Barlett tests resulted in 6323.240and 332.199respectivelywith the significance value of sig = 0.000 < 0.05, meaning the data used for factor analysis is suitable.

Results from EFA analysis showed that all groups of variables having factor loading> 0.5 and ranked in group order. This means that all examined variables have closed relationship with each other’s and could well-explain the dependent variables.

3)Test the significance of the factors

– The model’s goodness-of-fit

Table7

Result for goodness-of-fit test

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

Durbin-Watson |

|

1 |

.594a |

.352 |

.342 |

.21139 |

1.837 |

Regression results show adjusted R square value at 0.342, meaning variables input in the model could explain 34.2 % total impact of the variables toward dependent variables. The Durbin-Watsion statistic is at 1.837, indicating that the model does not violate when using multiple regressions and there is no autocorrelation within the model.

Table 8

Analysis of Variance ANOVA

|

Model |

Sum of Squares |

df |

Mean Square |

F |

Sig. |

|

|

1 |

Regression |

28.939 |

6 |

4.823 |

107.935 |

.000b |

|

Residual |

7.284 |

173 |

.045 |

|||

|

Total |

36.222 |

179 |

||||

The value sig (P- value) in ANOVA table is used to assess the fitness of the model. We see that sig value in the table is 0.000 < 0.005, thus the model exists. In other words, F = 107.935 indicates that the model is significant.

– Test the tolerance of factors

Table 9

Coefficients

|

Model |

Unstandardized Coefficients |

StandardizedCoefficients |

t |

Sig. |

Collinearity Statistics |

|||

|

B |

Std. Error |

Beta |

Tolerance |

VIF |

||||

|

1 |

(Constant) |

.650 |

.090 |

7.239 |

.000 |

|||

|

FG |

.189 |

.017 |

.288 |

11.384 |

.000 |

.882 |

1.134 |

|

|

C |

.185 |

.017 |

.334 |

10.722 |

.000 |

.933 |

1.072 |

|

|

R |

.227 |

.018 |

.263 |

12.865 |

.000 |

.773 |

1.294 |

|

|

I |

.292 |

.019 |

.236 |

15.702 |

.000 |

.810 |

1.234 |

|

|

S |

.256 |

.054 |

.347 |

4.773 |

.000 |

.067 |

1.054 |

|

|

PI |

.011 |

.037 |

.019 |

1.897 |

.000 |

.766 |

1.027 |

|

|

MA |

.345 |

.052 |

.014 |

6.677 |

.000 |

.812 |

1.025 |

|

The tolerance value and VIF are both < 10. It can be concluded that there is no multicollinearity.

All factors have sig. smaller than 0.05, indicating that the regression has significant, or, the variables have correlation with individual clients’ decisions on choices of commercial banks for their saving deposits.

Regression model is re-written as followed:

![]()

At the significant value of 1 %, with the assumption of ceteris paribus, the factor Staff have strongest impact on individual clients’ decision on choice of commercial banks for saving deposit in Hanoi city. The next factors in rank of impact level are Convenience; Financial Gain; The Reputation; The Image of Banks;and Influence of Peers in respective order. The factor with least impact is Marketing Activities.

- Proposals

Based on the results of this study, the authors have worked out several proposals to help banks attract more saving deposits from individual clients with details as followed:

– To improve service quality of the staff at the banks with focus on recruiting, training and allocating of staff. Banks should establish a recruitment process with accuracy and reasonableness in order to attract staff with suitable professionalism and knowledge for the jobs. Periodically, there should be professional training courses organized for staff to meet required standards for each position. On the other hand, staff should also have training and coaching to be client-oriented and be conscious in satisfying clients’ needs. At the same time, there should be plan to send highly competent staff at key business segments and new services to attend in-depth trainings and build up a core team of excellent professionals for the workforce in the future.

The staff benefit policy should also take into consideration the professionalism, competency, and work achievements of staff to propose reasonable package and encourage those with high contributions in banks. There should also be disciplinary benchmark with variety of levels from warnings, education, and disciplines for those violating the regulations in order to maintain the standards and improve the service quality provided to clients.

– To ensure the convenience and ease of access for clients to approach banks via a number of methods such as: reviewing and increasing the number of branches and transactionoffices with convenient locations, planning to re-allocate old transaction points and allocate new transaction points. The number of branches and transaction offices must be balanced and maintaining the competition with rival banks; parking lots should be conveniently located.

– To raise the financial gain for clients by maintaining the competitiveness with rival banks to attract clients and waiving fees for services such as validation of account balances, transfer of account ownership... while still conforming with regulations set forth by the State Bank of Vietnam. Furthermore, the banks could make some calculation and review the service fees to raise their competitiveness and not losing their profits.

– Improve the reputation of banks through raising their financial ability and credibility. To be more trustworthy in clients’ eyes, banks should handle their operations in a meticulous, accurate, fast and convenient manner. Additionally, client care should be another focus. To raise financial ability, banks should implement actions aimed at reducing bad debts and raising responsibility of underwriting officers in reviewing pledged assets, working with authorities to process pledged assets in the most effective way. For banks with financial difficulties, recapitalization could be done via various methods such as acquisitions, merges, integrations... to create a bank with strong financial ability.

– To improve banks’ infrastructure and establish an impressive brand image in clients’ minds. When the offered products are the same, clients are still reacting differently towards different bank images. Creating the brand distinction requires banks to focus on re-design and selection of images strongly speaking of their distinction. Thus, banks need to build large headquarters, use modern machines and equipments, regularly upgrade equipments and apply technologies, organize furnitures and materials in convenient and smart ways.

– To optimize social relationships to attract clients. Clients are the most effective promoters for one business, thus, banks should provide quality services from the start in every phases of operation in order to turn existing clients into the most active promoters.

– To build selective marketing strategy to attract the right clients. Banks should consider appropriate advertising methods suitable for each client segment and have clients’ mail box to timely handle complaints and issues from clients. The collected information is a great source of reference for banks to learn of clients’ reaction toward their services and carrying out suitable changes to match clients’ needs; running promotion and sending presents to clients; organizing events as rewards to regular clients, trusted clients, friendly clients... Through these events, banks could promote their brands or introduce new products, sending presents to clients to show gratitude, maintain long-lasting relationship and attract new clients.

- Conclusions

It is essential to identify the factors influencing individual clients’ decisions on their choices of commercial banks for saving deposits because this is the foundation for the banks to build their strategy in raising capital from the economy. The study results conducted on individual clients in Hanoi city have showed the impact level of examined factors toward clients’ decisions in respective order as followed: Staff of Banks, Convenience, Financial gain, Reputation of Banks, Image of Banks, Influence of peers, and Marketing activities. However, the limitation of the paper is that aforementioned factors can only explain 34.2 % of the changes in dependent variables. Thus, the next step for the authors is to research new influencing factors to explain more of the change in the dependent variables and raising the significance of the study results.

References:

- Abduh M. & Omar A. M. (2010), Islamic–bank selection criteria in Malaysia: an AHPapproach,Business Intelligence Journal,July, Vol.5 No.2, pp. 271–281.

- Agrebeyen O. (2011), The Determinants of Bank Selection Choices by Clients: Recent and Extensive Evidence fromNigeria, International Journal of Business and Social Science, Vol. 2 No. 22; December 2011, pp. 276–288.

- Awang M. S. (1997), Bank Selection Decision: Factors Influencing the Selection of Banks Banking Services, unpublished MSc. Dissertation, University of Utara Malaysia, http://etd.aau.edu.et/bitstream/123456789/5524/1/Dawit %20Tekletsadik %20Thesis.PDF, [28/08/2017]

- Almossawi M (2001). Bank selection criteria employed by college students in Bahrain: An empirical analysis., International Journalof Bank Marketing. 19(3), pp. 115–125.

- Chigamba C. &Fatoki O. (2011), Factors Influencing the Choice of Commercial Banks by University Students in SouthAfrica, International Journal of Business and Management, 6(6), pp.66–76.

- Haron, S., Ahmad, N., &Planisek S. L. (1994), Bank Patronage Factors of Muslim and non-MuslimCustomer, International Journal of Bank Marketing,12(1), pp.32–40.

- Hedayatnia A. &Eshghi K. (2011), Bank Selection Criteria in the Iranian Retail Banking Industry.

- Holstius, K. &Kaynak, E. (1995). Retail banking in Nordic countries: The case of Finland,International Journal of Bank Marketing, 13(8), pp.10–20.4.

- Khazeh, K. & Decker, W. H. (1992–93). How customers choose banks,Journal of Retail Banking, 14(4), pp.41–44.

- Lee J. & Marlowe J. (2003), How Consumers Choose a Financial Institution: Decision Making Criteria andHeuristics, International Journal of Bank Marketing,21(2), pp.53–71.

- Mokhlis S (2009). Determinants of choice criteria in Malaysia’s Retail Banking: An analysis of genderbased choice decisions.European Journal of Economics, Finance And Administrative Sciences.16, pp.18–30.

- John Mylonakis (2007), A Research Study of Customer Preferences in the Home Loans Market: The Mortgage Experience of Greek Bank Customers, International Research Journal of Finance and Economics ISSN 1450–2887 Issue 10, pp. 153–166

- NguyenThi Ngoc Huonget al (2012), A study of Influential factors on bank selection decisions of students at Hue College of Economics,Scientific research projects, Hue College of Economics.

- Rashid M. (2012), Bank selection criteria in developing country: Evidence from Bangladesh, Asian Jouenal of Scientific Research, 5(2), pp.58–69.

- Nguyen Van Tien (2011), Finance — Monetary — Banking Textbook (second edition), Statistical Publishing House, Viet Nam.

- Ta HP, Har KY (2000). A study of bank selection decisions in Singapore using the analytical hierarchical process., International Journalof Bank Marketing, 18(4), pp. 170–180.

- Tan C. H. & Chua C. (1986), Intention, Attitude and SocialInfluence in Bank Selection: A Study in an OrientalCulture,International Journal of Bank Marketing, 4, pp.43–53.

- Ukena S. &Monanu G. O., (2012), Analysis of the Influence of Gender on the Choice of Bank in SoutheastNigeria, International Journal of Business and Management, 7(3), pp. 230–241.

Ключевые слова

decision-making in bank selection for savingsПохожие статьи

Factors affecting accounting of transportation service businesses in Da...

The study aimed to determine what factors affect the accounting of transportation service businesses in Da Nang.

Next, Exploratory Factor Analysis (EFA) was conducted to evaluate the appropriateness, unidirection and convergence of factors with KMO ≥ 0.5, total explanatory variance of ≥ 50 % and...

Использование языка R для эконометрического моделирования...

От других продуктов для статистической обработки данных, таких как Stata, SAS, SPSS Statistics или STATISTICA R выгодно отличается лицензией GNU GPL, подразумевающей свободное распространение, кроссплатформенностью и гибкостью — помимо осуществления стандартных...

Comparison of statistical functions for programs (SAS, SPSS, and...)

Application of the three software packages on binary response data gave some similar and some other different results for the three link functions, logit, normit, and complementary logo-log functions. Table-2 demonstrate a summary of the main differences and similarities between SAS, SPSS, and MINITAB.

Building systems of quality analysis adaptive test control of knowledge

This article describes a formalized scheme of representation sets of tests and test results suitable for subsequent analysis of reliability and discriminative tests. A distinctive feature of this scheme is the methodology for the submission of correct answers {Ak,j}...

Статьи по ключевому слову "SPSS" — Молодой учёный

Статьи по ключевому слову. "SPSS": Техника. Технологии.

Анализ способности к эмпатии у семейных пар с разным...

Для обработки результатов диагностики использовалась программа IBM SPSS Statistics 20. Для количественно-качественного анализа

Для выявления различия дисперсий сравниваемых групп по общему баллу эмпатии проведён однофакторный дисперсионный анализ (ANOVA).

Dimensions of Class-related Anxiety among the Students in the...

Furthermore, I conducted a one-way analysis of variance (ANOVA) to examine whether boredom scale’s scores were related to the grade of the students.

Optimization of a protective medium for freeze-dried strains of... Data were expressed as mean ± standard error using one-way ANOVA by...

Похожие статьи

Factors affecting accounting of transportation service businesses in Da...

The study aimed to determine what factors affect the accounting of transportation service businesses in Da Nang.

Next, Exploratory Factor Analysis (EFA) was conducted to evaluate the appropriateness, unidirection and convergence of factors with KMO ≥ 0.5, total explanatory variance of ≥ 50 % and...

Использование языка R для эконометрического моделирования...

От других продуктов для статистической обработки данных, таких как Stata, SAS, SPSS Statistics или STATISTICA R выгодно отличается лицензией GNU GPL, подразумевающей свободное распространение, кроссплатформенностью и гибкостью — помимо осуществления стандартных...

Comparison of statistical functions for programs (SAS, SPSS, and...)

Application of the three software packages on binary response data gave some similar and some other different results for the three link functions, logit, normit, and complementary logo-log functions. Table-2 demonstrate a summary of the main differences and similarities between SAS, SPSS, and MINITAB.

Building systems of quality analysis adaptive test control of knowledge

This article describes a formalized scheme of representation sets of tests and test results suitable for subsequent analysis of reliability and discriminative tests. A distinctive feature of this scheme is the methodology for the submission of correct answers {Ak,j}...

Статьи по ключевому слову "SPSS" — Молодой учёный

Статьи по ключевому слову. "SPSS": Техника. Технологии.

Анализ способности к эмпатии у семейных пар с разным...

Для обработки результатов диагностики использовалась программа IBM SPSS Statistics 20. Для количественно-качественного анализа

Для выявления различия дисперсий сравниваемых групп по общему баллу эмпатии проведён однофакторный дисперсионный анализ (ANOVA).

Dimensions of Class-related Anxiety among the Students in the...

Furthermore, I conducted a one-way analysis of variance (ANOVA) to examine whether boredom scale’s scores were related to the grade of the students.

Optimization of a protective medium for freeze-dried strains of... Data were expressed as mean ± standard error using one-way ANOVA by...