This paper examines the conduct of Indonesian monetary policy through various stages of economic development. In particular, this research focuses on the study of changes in the monetary policy management mechanism of Indonesia since the Asian financial and monetary crisis so far. In addition, the paper analyzes the achievements and constraints in managing the monetary policy of Indonesia since the application of flexible monetary policy targeting inflation. From there, the authors provide some lessons learned in managing monetary policy for Vietnam in the coming time.

Keywords: monetary policy, monetary policy management, target inflation

Monetary policy management is always one of the macroeconomic issues that countries are particularly interested in intervening in the economy to achieve economic growth, price control, employment and other goals in each stage of development of each country.

In recent years, the Vietnamese economy has shown a lot of instability. It is expressed most clearly through the inflation rate of Vietnam increased, decreased erraticallyVietnam's inflation is more stable in 2016 (3.24 %) and 2017 (3.55 %), but the growth rate is not high. In addition, the world economic situation has many changes, monetary policies of major countries are regularly adjusted which affects the economy of Vietnam.The issue for Vietnam is to choose a right, flexible, consistent and transparent monetary policy that will enable the economy to grow rapidly and sustainably.

The effect of monetary policy is that many economists point out that it is highly dependent on the ability of policymakers to choose the appropriate monetary policy framework to influence the economic activity and price control. Therefore, in order to select effective mechanisms for managing monetary policy, Vietnam should study and learn experiences in managing monetary policies of countries with many socio-economic similarities with Vietnam. In countries around the world and in the region, Indonesia is one of the countries with many similarities. Indonesia was one of the four most severely affected by the Asian financial crisis 1997.However, Indonesia has overcome the consequences of the crisis and has certain achievements in economic development after the crisis. One of the reasons leading to this success is that Indonesia choose an appropriate policy framework and the monetary policy operating effectively.

In this article, the authors focus on research the experience of managing monetary policy of Indonesia from which to draw lessons learned for Vietnam.

Literature review

In domestic and foreign studies on monetary policy in Indonesia, there are several studies:

Hoang Thi Lan Huong (2013) introduced a new view on a complete exchange rate policy, applying the method of dividing the exchange rate regime into phases and using the main macroeconomic indicators for analysis. In this study, the author compares the exchange rate policy of Vietnam with China, Thailand, Indonesia, Malaysia, and Singapore. In addition, the author not only study the experience of managing monetary policy of Indonesia but also compare the exchange rate policies of Vietnam with the policy of Indonesia.

Nguyen Van Ha (2015) studied, analyzed and assessed the current situation and main contents of the reform of the financial and monetary system in Indonesia.This study focused on the experience of restructure the banking system and financial system of Indonesia and highlights the successes, lessons learned and experiences for Vietnam.

The study by Andrew Filardo and Hans Genberg (2012) pointed out that the choice of monetary policy frameworks and the different approaches by central banks in the Asia-Pacific region to achieve their inflation target. The study also confirmed that this region is typical of the use of monetary inflation targeting. It can be seen as a pattern for central banks in countries that are pursuing counter inflationary monetary policy and offering better solutions to monetary policy management. Indonesia is one of the countries mentioned in this study.

Therefore, the above research only mentioned one or some of the contents of monetary policy of Indonesia. The content of the Indonesian monetary policy in these studies has not been mentioned as the main objective of the study. Thus, the study of the authors in this paper is not duplicated and filled the research gap

Methodology

To achieve the purpose of this study, the author uses qualitative methods with typical methods:

– Analytical and synthesis method: Based on the analysis of experience in monetary policy management in Indonesia, the article reviews and synthesizes lessons for Vietnam in implementing monetary policy.

– Comparative approach: Through the collection of information, the authors general data on the experience of monetary policy management of Indonesia. At the same time, the authors compares and contrasts with the monetary policy management mechanisms of Vietnam; from there, they found similarities and differences in managing monetary policy of Indonesia and Vietnam

Experience in managing monetary policy of Indonesia

Indonesia's economy is considered one of the emerging market economies in the world. Indonesia is also a country with impressive economic growth after overcoming the Asian financial crisis of the late 1990s (World Bank, 2017). Indonesia is classified as a new industrialized country. In addition, Indonesia is the 16th largest economy in the world by nominal GDP and the seventh largest in terms of GDP (purchasing power parity). The Indonesia's macroeconomic indicators are shown in Table 1.1:

Table 1

Some macro indicators of Indonesia from 2011 to 2018

|

Macro indicators |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

Growth rate (%) |

6.2 |

6.0 |

5.6 |

5.0 |

4.7 |

5.0 |

5.1 |

5.3 |

|

Inflation rate (%) |

5.4 |

4.3 |

8.4 |

8.4 |

3.4 |

3.0 |

3.5 |

3.5 |

|

Public debt (% of GDP) |

23.1 |

23.0 |

24.9 |

24.7 |

27.4 |

28.3 | ||

|

Current Balance / GDP (%) |

0.2 |

-2.8 |

-3.3 |

-3.1 |

-2.1 |

-1.8 |

-1.6 |

-1.8 |

|

Population (Million people) |

245 |

248 |

251 |

254 |

258 |

261 |

264 |

267 |

|

% Poor population |

12.5 |

11.7 |

11.5 |

11.0 |

11.1 |

10.9 |

na |

Na |

|

Unemployment rate (%) |

6.6 |

6.1 |

6.3 |

5.9 |

6.2 |

5.6 |

na |

na |

[Source:https://www.indonesia-investments.com/finance/macroeconomic-indicators/item16]

Until now, monetary policy frameworks applied in Indonesia are heavily influenced by the developmental stages of the financial sector (Solikin M. Juhro and Miranda S, 2016). We can see more clearly when studying the Indonesian monetary policy through stages.

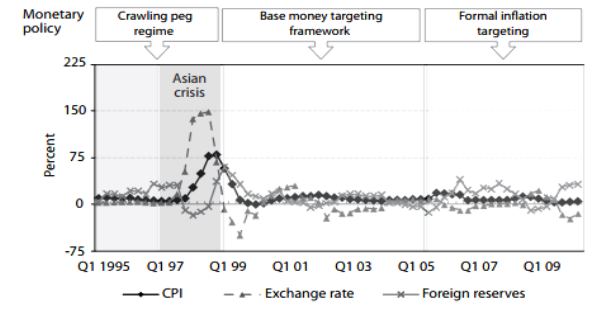

– Prior to 1999: Indonesia implemented a policy of monetary policy anchored at a crawling peg rate (Crawling Peg Regime);

– 1999–2005: The Monetary Policy Framework of Indonesia takes the basic money as the target(Base Money);

– From 2005 to 2017: Indonesia adopted the framework of the formal inflation targeting policy.In this period, Indonesia adjusted the traditional inflation targeting framework to flexible monetary policy in late 2008 and officially applied and maintained the flexible inflation targeting policy from 2009 until now.

Fig. 1. Monetary Policy of Indonesia from 1995 to 2009 [Source: Asian Development Bank (2010)]

Prior to the deregulation of finance in 1983, Indonesia's financial system was underdeveloped and characterized by financial control. Essential policy components are interest rate ceiling and interest rate management. Bank lending is directly allocated through selective credit control. Accordingly, the Government of Indonesia defined lending priorities for all economic sectors, activities and beneficiaries. In June 1983, the Indonesian government announced the abolition of the ceiling interest rate for all banks and removed most of the interest rate controls previously applied to state-owned commercial banks. These policies are primarily intended to offset the decline in oil revenues, which forces the government to act to promote domestic savings. In addition, the elimination of financial constraints will improve the efficiency of the financial sector and attract overseas deposits. Moreover, abolishing the credit allocation mechanism will improve the efficiency of capital use.

In October 1988, the government continued to introduce strong measures aimed at loosening its finances, notably the reduction of compulsory reserve ratios. Despite, there was significant changes in monetary activity, the objectives of the monetary policy remain unchanged: price stability (low inflation), sustainable economic growth and balance of payments.

The economic and financial crisis that began in mid-1997 has had a more serious, prolonged and difficult impact on Indonesia than in other countries in the region. Pressure on exchange rates and foreign currency reserves during the crisis forced the Indonesian central bank to abandon its crawling peg regime and allow floating Rupiahs in August 1997.The sharp devaluation of the Rupiah is the starting point for the crisis which has led to the worst economic situation in Indonesia in more than 30 years. Real GDP fell by 13.2 % in 1998, in addition to the large-scale collapse of the banking system, corporate bankruptcy and job loss in industries, particularly construction (Halim Alamsyah et al., 2001).

Immediately following the floating of the currency, the Indonesian government passed a tightening monetary policy, raising interest rates aggressively and forcing SOEs to withdraw capital from the banking system and buy value certificates from the central bank. In addition, in order to avoid the bankruptcy and collapse of the entire banking system, the Indonesian central bank has played the ultimate lender role to provide large liquidity to troubled banks. This caused a temporary loss of monetary control at the end of 1997 and early 1998. Therefore, the main objective of the Indonesian central bank was to restore confidence in the currency; inflation must be stopped and inflation must be lowered.

After the crisis, there was a change in the implementation of the monetary policy, which was accompanied by a new banking law by the Indonesian central bank. It regulated total independence for the central bank in the formulation and implementation of monetary policy. It stipulates that the Indonesian central bank as an independent state non-government body, and set the monetary policy objective of maintaining the stability of the Rupiah. To achieve this, the law allowed the central bank to implement the monetary policy by setting up a monetary targeting system, taking into account the inflation target and managing the money. Another important change introduced by the new law is forbidding the central bank to subsidize government spending and buy government bonds in the primary market. However, central bank was allowed to buy bonds on the secondary market to achieve the objective of monetary policy.

After the transition period of the CSTT framework from the basic monetary framework as a target to the inflation targeting policy from 2000 to 2005, the Indonesian central bank officially adopted the inflation targeting framework in July 2005. The central bank implemented a more transparent communication strategy aimed at strengthening monetary signals through the use of interest rates and exchange rates by Indonesian central banks such as policy interest rates and short-term money market rates. Under the framework of this new monetary policy, the central bank of Indonesia to strengthen the policy mechanisms and implemented through a forward-looking strategy to pursue inflation targeting.

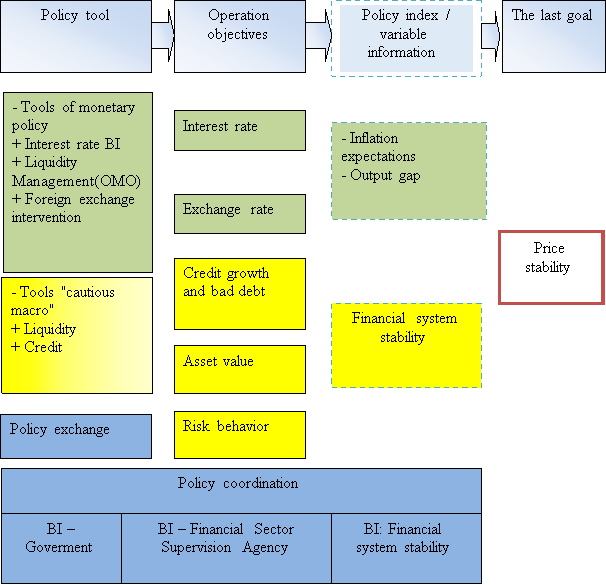

Shortly before the 2008 financial crisis, the central bank of Indonesia adjusted operating monetary policy in the direction of flexible inflation targeting monetary policy instead of the traditional framework (Reza Siregar and Siwei Goo, 2008; Josef T. Yap, 2008).Following the global financial crisis and economic recession, the Indonesian central bank continued to build and pursue a flexible inflation targeting mechanism in the direction of putting financial security indicators into its response function. Flexible inflation targeting monetary policy is applied in Indonesia until now.

Fig. 2: New version for flexible inflation targeting monetary policy mechanism [Source: Inflation Report 2010 of Indonesia Central Bank]

The main monetary policy instruments used by Indonesia since the introduction of inflation targeting are policy rates to influence monetary policy objectives rather than the use of open market operations and reserve instruments which is the key tool in the previous phase. The central bank of Indonesia has set itself a key policy interest rate, with a clear, carefully selected notification effect on the basis of thorough research on the transmission mechanism of monetary policy.

Assessment and lessons learned for Vietnam

- Assessment

Indonesia has made changes to the monetary policy framework before adopting the inflation targeting policy. However, before adopting the official monetary policy inflation target, other monetary policy frameworks face many economic problems leading to monetary policy not achieving its policy objectives. One of the most obvious manifestations of Indonesia's monetary policy is the failure to control inflation.This is demonstrated by the table below:

Table 2

Inflation rate of Indonesia during 1995–2005

|

Year |

Target inflation |

Real inflation |

Year |

Real inflation |

Real inflation |

|

1995 |

- |

9,43 % |

2000 |

3–5 % |

3,72 % |

|

1996 |

- |

7,96 % |

2001 |

3–5 % |

11,5 % |

|

1997 |

- |

6,22 % |

2002 |

9 % — 10 % |

11,87 % |

|

1998 |

- |

58,38 % |

2003 |

9 ± 1 % |

6,58 % |

|

1999 |

- |

20,48 % |

2004 |

5.5 ± 1 % |

6,24 % |

|

2005 |

6 ± 1 % |

10,45 % |

[Source: World Bank (2018)]

The results of the monetary policy management show that the manipulation of monetary policy and monetary policy in Indonesia was not effective.

The formulation of monetary policy with multiple objectives is also one of the causes of the failed in conducting monetary policy in Indonesia. Because monetary policy objectives may be contradictory, leading to Indonesia's central bank can not achieve simultaneous goals. This also led to a decline in confidence in monetary policy.In addition, volume-driven operations that influence the flow of money have shown delays in achieving goals.And the central bank also showed a lack of control over the total means of payment for M2 when it grows fast. During this period, tools were used primarily as compulsory open market operations andreserve instruments. These tools are primarily intended to curb inflation, which has led to Indonesia's post-crisis economic recovery very slowly. Practices indicate that the use of these tools is inappropriate.

The adoption of the official inflation targeting policy framework in July 2005 has helped Indonesia achieve positive results in terms of achieving inflation, economic growth and stabilizing interest rates and reduce the volatility of inflation.

Beside the efficiency for the economy, in the operating management of inflation targeting policy framework has achieved remarkable achievements as follows:

– Firstly, in order to effectively manage the inflation targeting policy, Indonesia created a legal corridor before Indonesia adopting the new monetary policy framework by issuing a central bank law in 1999 and 2004 to regulate the operations of the central bank. The provisions in the law have clearly defined the responsibilities of the Indonesian central bank for the development and administration of monetary policy and also indicate the coordination between the central bank and the Government in implementing the objectives of monetary policy.This has enabled the implementation of the monetary policy objective to be consistent with other macroeconomic policies in order to create higher operating efficiency.

– Secondly, the central bank of Indonesia has a consistency in monetary policy. Accordingly, the objectives, inflation indexes and monetary policy instruments are clearly defined, specific and consistent throughout policy implementation.

– Thirdly, the determination of inflation and the target inflation are adjusted by the central bank in each period. The central bank of Indoensia identified moderate inflation targeting at an early stage and as the economy stabilized, Indonesia gradually lowered its target inflation.

– Fourthly, the application of inflation targeting framework in Indonesia has a clear roadmap. The first period was from 1999 to 2005, Indonesia was in transition and Indonesia used unofficial inflation targeting policy. In the second period from 2005 to 2008, Indonesia announced the official introduction of inflation targeting policy.And by the end of 2007, in early 2008, Indonesia's monetary policy was governed by a flexible inflation targeting framework.This mechanism is applied to the present.

- Lessons learned for Vietnam

From the experience of operating the inflation targeting policy of Indonesia, we can draw some lessons for Vietnam as follows:

– Firstly, in setting monetary policy, Vietnam needs to identify clearly who is responsible for setting monetary policy objectives, especially for inflation targeting.

– Secondly, when defining the objectives of monetary policy, Vietnam should set a clear and consistent objective, which should aim at stabilizing the value of the currency as a top priority.

– Third, the experience of monetary policy management in Indonesia indicates that in developing and applying the new monetary policy framework, it is necessary to choose the right time to apply and to set a clear roadmap for the implementation.

– Fourthly, in the process of operating monetary policy, Vietnam should take the initiative in flexibly managing and coordinating the tools and selecting effective transmission channels so as to effectively carry out the impacts of tool to target policy.

– Fifth, Vietnam should closely monitor the macroeconomic situation, monetary market at home and abroad, strengthen the analysis and statistics to timely have appropriate responses.

References:

- Akihiro Kubo, 2009, “Monetary targeting and inflation evidence from Indonesia’s post-crisis experience”.

- AndrewFilardoandHansGenberg, 2014, “TargetinginflationInAsiaandthePacific: lessonsfromtherecentpast”.

- Alan S. Blinder (2000), Central banking in theory and practice, the MIT Press, London.

- Andrea Schaechter (2001), Implementation of Monetary Policy and the Central Bank’s Balance Sheet, IMF Working paper, Washington DC.

- Andrea Schaechter (2000), Adopting Inflation Targeting: Practical Issues for Emerging Market Countries, IMF Occasional Paper No 202, International Monetary Fund, Washington DC.

- Asian Development Bank. (2010). Monetary Policy Discipline and Macroeconomic Performance: The Case of Indonesia. ADB Economics Working Paper Series No. 238

- Bank Indonesia. (1999). [Measurement of an Inflation Target in a Forward Looking Monetary Policy Framework. Division of Real Sector Studies, Directorate of Economic Research and Monetary Policy, Jakarta.

- Budiono. (1994). Revisiting Our Monetary Targets: M0, M1, or M2? Mimeo. Jakarta: Bank Indonesia.

- Carare, Alina, Andrea Schaechter, Mark Stone, and Mark Zelmer, 2002, “Establishing Initial Conditions in Support of Inflation Targeting,” IMF Working Paper 02/102 (Washington: International Monetary Fund).

- Fredence Smishhin (2007). The Economics of Money, Banking and Financial Marhets 8th. Ed. Pearson Education, Indonexia

- Fahrana et.al. (2013). Inflation Targeting Framework: Indonesia inComparison. Final Monetary Economics Paper

- Goeltom, Miranda S. (2008). Essays in Macroeconomic Policy: The Indonesian Experience. Jakarta: Gramedia.

- Harmanta, M. Barik Bathluddin và Jati Waluyo, 2011, “Inflation targeting under imperfect credibility: lessons from Indonesian experience”.

- Halim Alamsyah, Charles Joseph, Juda Agung and Doddy Zulverdy. (2011). TOWARDS IMPLEMENTATION OF INFLATION TARGETING IN INDONESIA. Bulletin of Indonesian Economic Studies, Vol. 37, No. 3, 2001: 309–24

- Inflation report of BOT, BI and BSP.

- Jonas, J. and Mishkin, F. S. (2003), Inflation Targeting in Transition Countries: Experience and Prospects, Working Paper 9667, NBER Working Paper Series.

- Le, V. H., & Pfau, W. D. (2009). VAR Analysis of the Monetary Transmission Mechanism in Vietnam. Applied Econometrics and International Development, 9(1), 165–179.

- Mishkin, F. S. (2004), Can Inflation Targeting Work in Emerging Market Countries?Working Paper 10646, NBER Working Paper Series.

- Mishkin, F. S, The economics of money, banking and financial markets, 9th. Addison-Wesley edition, 2010.

- Mishkin, F.S., and K. Schmidt-Hebbel. (2001).One Decade of Inflation Targeting in theWorld: What Do We Know and What Do We Need to Know. NBER Working PaperNo. 8397, Cambridge MA.

- Neumann, M. J. M., and J. von Hagen (2002), “Does inflation targeting matter?”, FederalReserve Bank of St. Louis Review, 85, 127–148.

- Nguyễn Ngọc Bảo, Điều hành chính sách tiền tệ trong tiến trình tự do hóa giao dịch vốn tại Việt Nam, Đề tài NCKH, 2008.

- Nguyễn Thị Kim Thanh, Những vấn đề đặt ra và giải pháp hoàn thiện mục tiêu, cơ chế truyền tải của chính sách tiền tệ trong điều kiện hội nhập kinh tế quốc tế, Đề tài NCKH, 2005.

- Reza Siregar và Siwei Goo, 2008, “Inflation targeting policy: the experiences of Indonesia and Thailand”, CAMA Working paper series.

- Takeshi Inoue, Yuki Toyoshime và Shigeyuki Hamori, 2012, “Inflation targeting in Korea, Indonesia, Thailand and the Philippines: the impact on business cycle synchronization between each country and the world.

- Thórarinn G. Pétursson. (2005). Inflation targeting and its effects on macroeconomic performance. SUERF — The European Money and Finance ForumVienna 2005.

- Tô Kim Ngọc, Lê Thị Tuấn Nghĩa (2012), Phối hợp chính sách tiền tệ và chínhsách tài khóa ở Việt Nam,Hội thảo cấp Ngành Phối hợp chính sách tiền tệ và chính sách tài khóa trong điều tiết kinh tế vĩ mô.

- Tô Thị Ánh Dương và các cộng sự (2012), Lạm phát mục tiêu và hàm ý đối với khuôn khổ chính sách tiền tệ của Việt Nam, Nhà Xuất bản Tri Thức.

- Tô Thị Ánh Dương (2015), Áp dụng chính sách lạm phát mục tiêu: Lý luận và Thực tiễn, Nhà Xuất bản Khoa học Xã hội.

- Tô Thị Ánh Dương (2016), “Những điều chỉnh chính sách tiền tệ củaViệt Nam giai đoạn 2011–2015”

- Tô Kim Ngọc và Nguyễn Khương Duy (2014), “Chính sách mục tiêu lạm phát — kinh nghiệm của một số nước châu Á và bài học cho Việt Nam”

- https://www.indonesia-investments.com/finance/macroeconomic-indicators/ item16

- https://www.adb.org/countries/indonesia/economy

- https://en.wikipedia.org/wiki/Economy_of_Indonesia.