Today’s the oil industry of Russian in conditions of low oil prices and possible scenario of the development in nearly future

There's Kashchey Besmertniy withers over Zlatom,

There’s Russian spirit... there’s smell of Russia!

A. S. Pushkin «Ruslan and Lyudmila»

There is a widespread myth that Russia is «sitting on an oil needle». Proponents of the myth affirm that Russia's economy supposedly is based almost exclusively on the export of hydrocarbons, and if the volume of export decreases and the oil price falls down significantly, it will lead to a complete economic collapse of Russia’s economy. Everyone knows the well-known times of confrontation between the USSR and the USA that is called «The Cold War», when in 20th century the America and the United Arab Emirates entered into an agreement and started a price war by lowering the price on «Black gold» and the pressure on the Soviet Union’s economy. This factor plays into the Russian state’s opponents hands today, although nobody is not talking about the beginning of a new round of the Cold War. What will happen to Russia’s oil industry in modern conditions? Will be it destroyed or not?

Key words: Petroleum exchange, OPEC, oil production, foreign exchange market, monetary management.

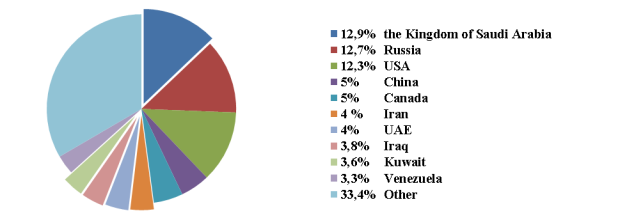

According to the International energy Agency (IEA) a part of oil production in the World was in Saudi Arabia 12.9 %, Russia 12,7 %, in the United States 12,3 %, China 5 %, Iran 4 %, Canada 5 %, in UAE 4 % and Venezuela with 3,3 %, Kuwait 3,6 %, in Iraq 3,8 %. Organization of the Petroleum Exporting Countries 28. %. (Statistical information is represented in the Figure 1.)

Fig. 1 Share of OPEC oil production, %

To date more than 60 % of oil produced in the world is accounted for only ten countries. More than 70 % of the world's export oil is accounted for the same ten countries. The share of other countries account for less than 40 %. It is clear that the World depends only from five Middle Eastern countries — Saudi Arabia, Iran, Iraq, Kuwait and the United Arab Emirates. They account for a quarter of world oil production. Thereby these countries have the opportunity to affect the oil market oil and influence oil quotations.

Table 1

Oil price depending on supply/demand/OPEC production

|

Year |

Oil price (Urals), $ |

Total crude oil supply, mb/d |

World crude oil demand, mb/d |

OPEC crude oil production, 1.000 b/d |

|

|

|

|

| |

|

2011 |

109.19 |

88.1 |

57.8 |

29.766 |

|

2012 |

110.49 |

89 |

58.5 |

31.132 |

|

2013 |

108 |

90 |

60 |

30.214 |

|

2014 |

98.08 |

91.3 |

62.3 |

30.075 |

|

2015 |

51.46 |

92.7 |

63.44 |

31.544 |

Table 1 shows us the trend in changes of oil prices (Factor Y) from 2011 to 2015, and data on international reserves (Factor ![]() ) / demand (Factor

) / demand (Factor ![]() ) /crude oil production in OPEC countries (Factor

) /crude oil production in OPEC countries (Factor ![]() ).

).

Having carry out regression analysis on the basis of these data by using Excel, we get the following equation (Formula 1) and meaning of correlation R:

![]() (1)

(1)

Regressive statistics: Multiple R = 0.89

![]()

This equation shows us correlation between factors and they affect a crude oil price on petroleum exchange. Interrelation between factors is at level 89 % that point at a good relation.

According to the OPEC’s forecast a world oil reserves will increase by 2.26 % from 92.7 mb/d. to 94.8 mb/d., it is accounted for + 2,1 mb/d., a world oil demand will raise by 2.09 % from 63,44 mb/d. to 64,77 mb/d., it is accounted for +1,33 mb/d.. OPEC oil production will be at level 2015 and it is amounted 31,545,000 b/d., provided that the current geopolitical situation in the middle East will be saved as well as sanctions against Iran are.

Since the limitations of Iran oil delivery have been taken a crude oil production went down to 748 b/d. At the moment Iran is able to increase its oil production to 1.025 b/d (OPEC’s information is represented in Table 2.). Using Formula 1 we can calculate a price of Urals oil crude in 2016. If the Iran’s limitations have been cancelled in 2016, a price of Urals crude oil will be 40.84 $ per barrel. If the Iran’s limitations have been prolonged, a price of Urals crude oil will be 49.05 $ per barrel. This calculation have been constructed by using OPEC’s current forecast for 2016.

Table 2

Iran crude oil production per year, 1.000 b/d

|

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

|

3.928 |

3.706 |

3.628 |

2.977 |

2.673 |

2.766 |

3.18 |

|

Change +/- |

-0.222 |

-0.3 |

-0.951 |

-1.255 |

-1.162 |

-0.748 |

The oil needle of Russia

Active U. S. policy in the middle East and North Africa in ХХI century contributes to the fact that the above prices can fall. For example, the cost of producing a barrel of Libyan oil is the lowest in the world and is equal to 1 U.S. dollar. Today Libyan oil production is controlled by the USA.

Other major oil exporters like the Qatar and the United Arab Emirates, the Saudi Arabia carry out the pricing policy of exported oil in the condition of U. S. policy. This means that the prices of a large part of Russian oil exports is not very stable and depend on political decisions of some countries, including the United States. This factor does not contribute to the strengthening of the Russian ruble.

There is a direct correlation to the stability of the ruble exchange rate from the world prices for oil, gas, energy. It is necessary to note that the ruble exchange rate depends on the dynamics of oil prices by 80 % and other factors by 20 %.

To demonstrate the changes of the Russian ruble to the dollar depending on the changes of world oil prices, we will carry out the regression analysis.

Table 3

Ruble according to oil price in 2015

|

Month |

Oil price, $ |

Dollar rate,Rub |

|

September |

46.58 |

66.77 |

|

August |

45.29 |

65.20 |

|

July |

55.6 |

57.7 |

|

June |

60.67 |

54.50 |

|

May |

63.07 |

50.58 |

|

April |

58.6 |

52.93 |

|

March |

54.19 |

60.26 |

|

February |

57.31 |

64.68 |

|

January |

46.14 |

61.88 |

Having finished regression analysis on the basis of these data (Table 3.), we get the following equation (Formula 2) and meaning of correlation R:

Regressive statistics: Multiple R = 0.82

![]()

![]() (2)

(2)

This equation shows us correlation between factors and how crude oil price affect the ruble. Interrelation between factors is at level 82 % that point at a good relation.

Using Formula 2 to calculate the rate of exchange depending on the price of Urals crude oil and using the calculating of oil price that depend on Iran oil production. will get two scenarios:

Scenario 1 «Cancellation of sanctions against Iran».

|

Year |

Dollar rate,Rub |

Oil price (Urals), $ |

Total crude oil supply, mb/d |

World crude oil demand, mb/d |

OPEC crude oil production, 1.000 b/d |

|

2016 |

73.37 |

40,84 |

94,08 |

64,77 |

32,345 |

If world oil price drops to 40 dollar per barrel on condition that Iran will begin to increase its oil production, USA dollar will be more than 73.37 ruble

Scenario 2 «Use of sanctions against Iran».

|

|

Dollar rate, Rub |

Oil price (Urals), $ |

Total crude oil supply, mb/d |

World crude oil demand, mb/d |

OPEC crude oil production, 1.000 b/d |

|

2016 |

63.72 |

49,05 |

94,08 |

64,77 |

31,545 |

If sanctions against Iran are prolonged, a barrel of oil will cost 49 dollar and dollar will be 63,72 rubles respectively.

Oil industry of Russia

Extract from the “Independent newspaper “ in article "50 dollars per barrel kill the oil industry»: «Having faced in the course of the last year with the double slump in oil prices and a sharp profits collapse, oil companies are trying to cut their costs. First of all are reduced investment program. For example, previously we have been received the news about the staff reduction by 6.5 thousand jobs and 20 % drop of investment in one of the largest oil and gas companies — British-Dutch “Royal Dutch Shell”. About the beginning of the reduction in investment also say analysts of “Wood Mackenzie LTD”. According to them, the major energy companies have already pigeonholed more than 200 billion dollars of investment in 46 projects. The respondents «Independent newspaper» experts warn that at risk group are many oil projects, including Russian».

From this statement it can be concluded that Russian oil companies will face the same problems that Western. Only factor that plays into their favor is the fact that the Central Bank conducts monetary management to lower the value of the national currency, that will reduce financial-economic losses of the oil industry. Their ruble income will remain the same but the income of the population in terms of dollar value will decrease and they will have to refuse from many their future plans such as trips abroad and buying expensive imported cars. The oil production cost will be less than in developed countries and the factor allow to stay afloat for some period of time, using their reserves that were set aside for promising programs. Repair cost per unit of the mechanized fund will increase because the industry uses a lot of foreign equipment and the company will have to reduce their budgets for procurement, this condition will lead to increase of deteriorations, failure of equipment and increase of accidents in industry. To avoid costs, will be made optimization at all points, it will also wage fund of workers and staff reductions.

Further lowering the oil prices and the high dependence on imported equipment will push managers to think about creating our own production of oil and gas equipment to avoid large expenditures in the future. This will lead to increased investments in own production and own scientific and technical programs of research.

Conclusion

The current oil production cost in Russia, including the production, the depreciation costs of basic assets and the delivery of products to customers, estimated by experts at 30–35 dollars per barrel. Optimization costs (improved logistics, reduction of bonuses for managerial personnel of oil companies) can reduce this index to 25–30 dollars per barrel. This means that if the price on the world market is 40–50 dollars per barrel, our oil industry will have big problems in 2016, a gradual deterioration and eventually failure of the production facilities. There is certainly not to up to design the deposits in the Arctic.

Reference:

- Organization of Petroleum Exporting Countries «Annual report 2011–2014»: http://www.opec.org

- K. Shalabanov, D. A. Roganov «Practical work of econometrics by means of Excel»: — Kazan: Tisbi,2008

- S. Osetrov, N. A. Osipov «Microsoft Excel 2010 for analysts»: — SPt: SRU ITMO, 2013.

- ConsultantPlus — legal system: http://www.consultant.ru/document/cons_doc_LAW_50642/

- Berberov A.B, Dibirov Kh.M. «Correlation and regression analysis of budgets revenues» (based on corporation tax, individual tax and unified social tax).: — Moscow, Russia.

- Statistical Review of World Energy 2015: http://www.bp.com/en /global/corporate/energy-economics/statistical-review-of-world-energy.html

- International energy Agency: http://www.iea.org/publications

- Independent newspaper: http://www.ng.ru/economics /2015–09–22/ 1_oil.html?id_user=Y/74

- V. Arinichev, I. V. Arinicheva, V. M. Smolencev «Probability theory and mathematical statistics»: -Krasnodar: KubSAU, 2014.

- E. A. Zhuravleva «Matrix modeling of competitiveness»: -Krasnodar: KubSU, 2013.