Introduction

Mauritania, a West African country rich in natural resources, is rapidly developing its hydrocarbon sector thanks to major offshore projects such as the Grand Tortue Ahmeyim (GTA) project. While pipelines and maritime transport support large-scale exports, tanker trucks play a crucial role in the domestic distribution of petroleum products such as gasoline, diesel, kerosene, and fuel oil. These vehicles supply remote areas, mining operations, power plants, and urban centers in a country where road transport is the primary mode of national transportation. This article examines the context, operators, regulations, challenges, and statistics of this vital logistics segment, and includes tables and graphs.

The context of the hydrocarbon sector in Mauritania

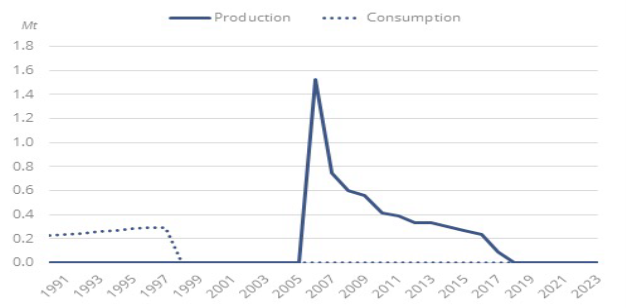

Mauritanian oil production began in 2006 at the Chingouetti field but has since declined, with the focus shifting to natural gas. The GTA project, developed by BP and Kosmos Energy, aims to produce LNG starting in 2023, with the gas being transported by pipeline to the coast. However, refined fuels are primarily imported through ports such as Nouakchott and Nouadhibou and then distributed inland by tanker truck due to limited rail and gas infrastructure. Major road networks connect coastal ports to the interior, supporting mining (such as iron ore at Zouerate) and power generation.

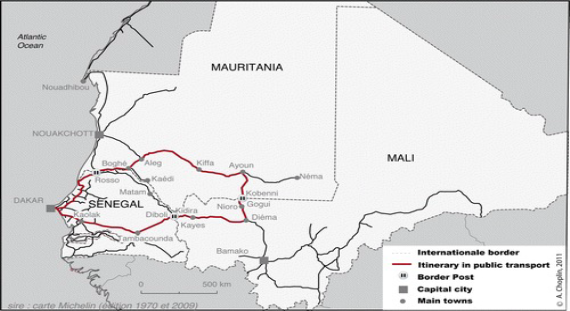

Public transport and border crossings in Senegal, Mauritania and Mali

Map of the main road networks, secondary networks and other road networks across Africa

Main operators and tanker fleet

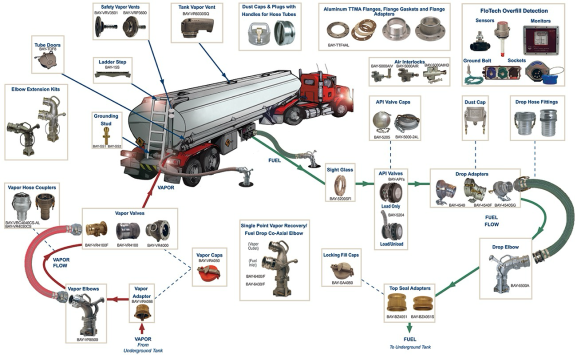

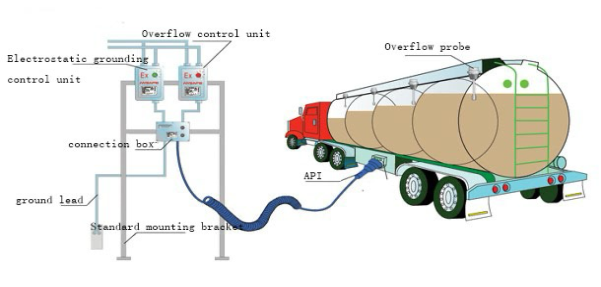

The Mauritanian Hydrocarbons Company (SMH), a state-owned enterprise, is a major player in the sector. In October 2025, it acquired three 50,000-liter tanker trucks for transporting aviation fuel, equipped with 430 hp 6x4 tractors. Other operators include M2P-OIL SA for petroleum product distribution, Africa Global Logistics (AGL) for oil and gas logistics, and private companies such as TLC SARL for road freight transport. CarMax Vehicle and other similar suppliers offer specialized tanker trucks equipped with safety features such as non-return valves.

Table 1

|

Operator |

Role |

Key fleet characteristics (2023–2025) |

|

Mauritanian Hydrocarbons Company (SMH) |

National oil company responsible for aviation fuel and strategic reserves. |

In October 2025, three 50,000-litre tank trucks (430 hp 6x4 tractors) were purchased; three more were purchased in 2023. |

|

SOMELEK |

National Electricity Company |

Call for tenders for 2024 for the supply of 10 tank trucks with a capacity of 50 m³ (8 for fuel oil, 2 for diesel). |

|

SKI Group — MKTL |

private logistics giant |

More than 40 tanker trucks (capacity of 15,000 to 40,000 litres), covering the entire country. |

|

General Services and Logistics (GSL) |

private operator |

8x4 and 6x6 all-terrain tanker trucks for mining and remote sites. |

|

Various small entrepreneurs |

Local and regional transport |

The older units, with a capacity of 20,000 to 35,000 litres, are being progressively modernized. |

Regulations and safety standards

The transport of hydrocarbons is regulated by Law No. 2010–033 (Crude Hydrocarbons Code), which governs exploration, production, pipeline transport, and storage. 20,24 Regulations relating to road transport include the mandatory issuance of a license from the Ministry of Petroleum, Energy, and Mines, vehicle technical inspections, and compliance with international standards such as the ADR for dangerous goods. 21,22 The Master Plan recommends strengthening regulations regarding safety and diversification. 23 Recent agreements, such as the border agreement between Senegal and Mauritania, facilitate cross-border road traffic. 27

Logistical, environmental and safety problems

Challenges include poor road conditions, a harsh desert climate (temperatures exceeding 45°C), and security risks related to banditry or armed groups, as evidenced by regional attacks on fuel convoys. 40,41,42,43,44 Environmental concerns include the risk of pollution in coastal areas such as Lévrier Bay. 8 Mitigation measures include the use of all-terrain vehicles, armed escorts, and spill response protocols.

Table 2

|

Trial |

Description |

current mitigation measures |

|

poor road conditions |

Many roads are unpaved or covered with sand and damaged by flash floods. |

Use of all-terrain tractors with 6x6 and 8x4 wheel configurations. |

|

Extreme climate |

Temperatures regularly exceed 45°C, leading to increased steam pressure and a greater risk of leaks. |

Insulated tanks, safety valves |

|

Long distances and isolation |

Up to 1200 km one way (Nouakchott → Zouéra), with a small number of service stations. |

Column tracking system, satellite communications |

|

Security-related risks |

In some areas of the north and east, there is a risk of banditry and terrorism. |

Armed escort on main roads |

|

Environmental risk |

Risk of groundwater contamination following an oil spill in the Sahara. |

Mandatory installation of double-walled tanks in newly acquired properties. |

Statistics and trends

The extractive sector, including hydrocarbons, contributed 18.91 % to GDP and 76.28 % to exports in 2023. Petroleum products account for 68 % of electricity generation. Although road transport volumes are limited, global trends show an increase in oil transit, with Mauritania's production and imports rising due to the development of the Greater Toronto Area. OPEC data indicates an increase in hydrocarbon production in Africa between 2020 and 2025.

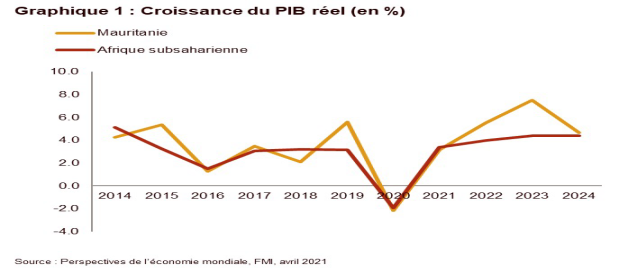

Comparative analysis of real GDP growth: Mauritania versus Sub-Saharan Africa (2014–2024)

Evolution of national hydrocarbon production and consumption over time

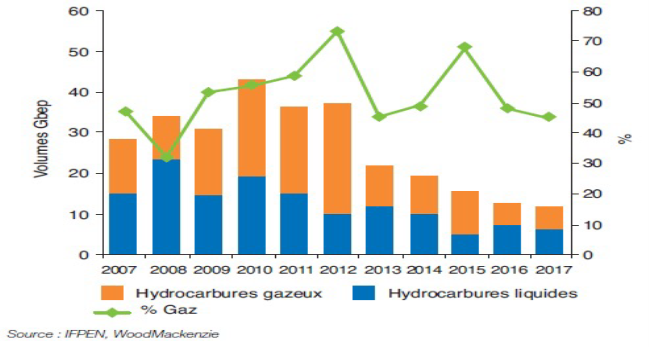

Evolution of gas and liquid hydrocarbon production (2007–2017)

Conclusion

In Mauritania, maritime transport of petroleum products remains essential due to the lack of an extensive pipeline or railway network. Although the future gas boom (GTA, Banda, Bir Allah) relies primarily on maritime transport, domestic demand for diesel, gasoline, and kerosene will continue to grow, driven by mining activities, electricity generation, and urbanization.

Recent investments in modern, efficient, and safer tanker fleets (SMH, SOMELEC, and private operators) demonstrate a clear increase in professionalism and safety. However, sustained progress will require:

— Continued modernization of road infrastructure (particularly the Nouakchott-Zouéra corridor).

— Full implementation of digital tracking and automated loading systems.

— Stricter adherence to environmental and safety regulations.

In the short and medium term, tanker trucks will remain an essential part of Mauritania's energy distribution network, providing the link between deepwater deposits and end users scattered across some of the world's most challenging terrain.

References:

- Société Mauritanienne des Hydrocarbures (SMH) Official Website — https://smh.mr/

- SMH News: Acquisition of 3 New Tanker Trucks for JET Fuel Transport — https://smh.mr/the-smh-acquires-3-new-tanker-trucks-for-jet-fuel-transport/ (Published October 2024, updated context in 2025)

- Ministry of Petroleum, Mines and Energy (via related portals) — https://www.energies.gov.mr/ (English section available)

- Hydrocarbons Code (Petroleum Code) — Law n°2010–033 (amended by Laws n°2011–044 and n°2015–016)

- Fichtner Consulting Report: Master Plan for Transport of Refined Petroleum Products, Mauritania — https://www.fichtner.de/en/projects/detailpage/master-plan-for-transport-of-refined-petroleum-products-mauritania

- EITI Mauritania Profile — https://eiti.org/countries/mauritania

- U. S. Trade.gov Country Commercial Guide: Mauritania — Oil and Gas — https://www.trade.gov/country-commercial-guides/mauritania-oil-and-gas

- African Business: Mauritania’s SMH Takes Critical Role in Growth Story — https://african.business/2024/11/partner-content/mauritanias-smh-takes-critical-role-in-growth-story

- IEA Country Profile: Mauritania — Oil — https://www.iea.org/countries/mauritania/oil

- Energy Capital Power: Exploration and Investment Opportunities in Mauritania’s Petroleum Industry — https://energycapitalpower.com/exploration-and-investment-opportunities-in-mauritanias-petroleum-industry/

- ADR (Agreement concerning the International Carriage of Dangerous Goods by Road) — UNECE overview: https://unece.org/transport/dangerous-goods