The RMB cross-border settlement business originates from international inter-trade settlement. Due to the growth of China’s economic power and the increasingly active international trade activities, RMB has gradually become the main currency for trade settlement and has been recognized by more and more countries. With the accelerating process of “de-dollarization” and the internalization of RMB, it has provided an important development opportunity for the RMB settlement between China and Russia. This paper focuses on the research on the cross-border settlement in RMB, using empirical analysis combined with qualitative and quantitative methods, and using Stata 16.0 to construct a model analyzing factors influencing the cross-border settlement of China-Russia trade in RMB. In view of the problems existing in the current cross-border settlement of RMB in China-Russian trade, relevant suggestions are put forward. On the one hand, it is necessary to strengthen the cooperation between Russian and Chinese governments, and improve the policy system to prevent exchange rate risks, on the other hand, it is necessary to improve the recognition of RMB in Russia, and promote the upgrade of the import and export product structure of the two countries. The development of cross-border settlement of RMB can increase the trade between the two countries, and with the joint efforts of Russia and China, cross-border settlement of RMB will be developed smoothly.

Keywords: China-Russia trade,CNY internationalization,cross-border settlement.

1. Introduction

China-Russia economic and trade co-operation is at a new historical starting point, while China is experiencing the impact of slower economic growth and the depreciation of the US dollar in the aftermath of the Xinguan epidemic. The rising exchange rate of the RMB, the fact that the value of its currency is still able to maintain strong stability, and the growing confidence in the RMB among the world's countries and their key investors, provide important development opportunities for China to continue to push forward the process of internationalisation of the RMB. From the perspective of market infrastructure construction of the two countries, the current demand of trade enterprises of the two countries, currency settlement and foreign exchange management policies of China and Russia, the current moderate expansion of the scale of China-Russia trade settlement in RMB has become the best time for development. In the new era, the use of RMB settlement can more effectively promote the internationalisation of RMB and the development of the «Belt and Road» strategy. China's renminbi will be increasingly recognised as an international payment currency, a measure that will ensure its gradual entry into the world monetary system, which is crucial for the realisation of the renminbi's true convertibility. Properly resolving the settlement of cross-border trade between the two countries will not only optimise trade cooperation between the two countries, but also play an important role in promoting financial cooperation between the two countries. The financial cooperation between China and Russia provides a strong practical platform for the internationalisation of the RMB.

2. Study on the Development of RMB Cross-border Settlement for China-Russia Trade

2.1 Current Development of RMB Cross-border Trade Settlement in China

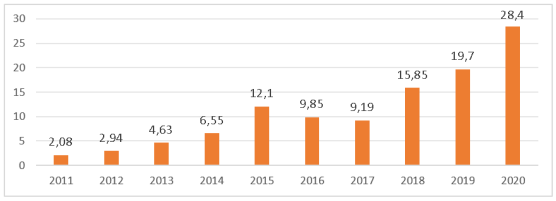

As a result of the financial crisis in 2007, Chinese enterprises and trading partner countries want to use RMB for pricing and settlement, and promote the internationalisation of RMB to avoid risks. Since 2009, five cities in China have been used as pilot cities for RMB cross-border settlement. Subsequently, in 2011, RMB cross-border settlement was introduced nationwide. With the establishment of the pilot RMB cross-border trade settlement, the internationalisation of RMB will be gradually promoted. As of June 2021, the RMB ranks fifth among international payment currencies and occupies an important position among international official foreign exchange reserve currencies. RMB cross-border settlement has started to increase gradually in recent years, as shown in Figure 1. According to the RMB Internationalisation Report released by the People's Bank of China2021 in the first six months, the amount of RMB cross-border receipts and payments was 17.57 trillion yuan, accounting for 48.2 % of the total cross-border receipts and payments of local and foreign currencies in the same period, an increase of 2.4 percentage points compared with the same period of last year. China has gradually formed a new development cooperation relationship with countries along the Belt and Road, benefiting from the fact that the countries are able to engage in regular economic and trade exchanges with each other. At the same time, this new co-operative relationship has also brought new possibilities for RMB cross-border settlement.

Fig. 1: Total RMB cross-border payments, 2011–2020 (in trillions of yuan)

Source: People's Republic of China

2.2 Current situation of RMB cross-border settlement of China-Russia trade

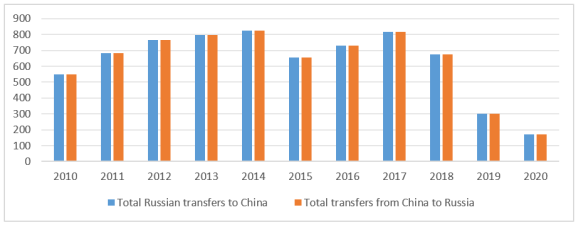

In recent years, the rapid growth of global trade has benefited from the rapid development of the Internet. As a result most financial institutions and common payment systems have developed cross-border transfers to facilitate the settlement of transactions. Cross-border transfer is a common type of transaction. The trend of cross-border trade is contributing to the continued growth in demand for cross-border payments. The use of cross-border payment systems is usually less costly. At the same time cross-border payments ensure exchange rate stability and prevent sharp currency fluctuations, so the movement of funds becomes easier and covers a wider range of areas.The total amount of cross-border transfers through the payment system for Russian-Chinese trade in 2020 reached US$1.85 billion, of which cross-border payments were made to Russia for US$12.9 million and cross-border payments were made to China for US$1.72 billion, as shown in Figure 2.

Fig. 2. Total cross-border payment transfers for Russian-Chinese trade, 2010–2020 (in USD million)

Source: Central Bank of Russia

- Favourable conditions for RMB cross-border settlement between Russia and China

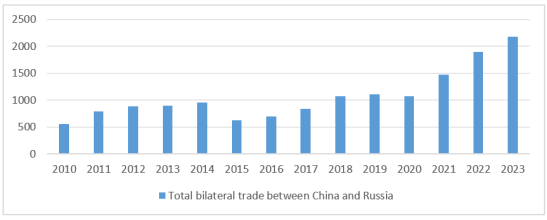

3.1 Rapid development of bilateral trade between China and Russia fuelling RMB settlement

Despite all the difficulties in international trade exchanges caused by the new crown epidemic, the relationship between China and Russia in the economic sphere is actively developing in a positive direction. With the gradual recovery of the global market and the improvement of the Sino-Russian economic environment, trade cooperation between the two countries continues to develop steadily. China-Russia relations have reached an all-time high in recent years, and the comprehensive partnership and strategic interaction between the two countries have entered a new era. In the context of this era the economic and trade co-operation exchanges between China and Russia have been increasing, and the economic and trade complementarities between the two countries have been gradually enhanced. China has always been Russia's largest trading partner. As the largest neighbouring countries, China and Russia have very similar views at the strategic level, and can achieve complementary advantages, the two countries are the most important market in the field of trade and manufacturing, with huge market space. The deployment of mutually beneficial cooperation between the two countries is in the interest of each party and in the most favourable conditions. In recent years the economic and trade relations between the two countries have achieved long-term development due to the improvement of the business environment in Russia and the continuous optimisation of the investment attraction policies of the federal and local governments, which have created favourable conditions for more and more Chinese enterprises to be sent to Russia for investment and economic activities. As shown in Figure 3. According to the data of relevant departments, from January to November 2023, the total trade volume between China and Russia reached US$218.176 billion, exceeding US$200 billion for the first time in history. According to statistics, from January to November 2023, the trade volume between China and Russia was 218.176 billion U. S. dollars, a year-on-year increase of 26.7 per cent.

Fig. 3. China-Russia bilateral trade, 2010–2023 (in USD billion)

Source: China Foreign Trade Statistics Yearbook

3.2. Deepening cooperation between Russian and Chinese banks

In recent years the two countries have been actively promoting continuous co-operation in the financial sphere, innovating and developing forms of interstate financial co-operation. The two countries have held discussions on the development of local currency settlement between China and Russia, local currency transactions on the mutual foreign exchange market, new opportunities for cooperation in the financial sphere between China and Russia, the broader scope and field of settlement of local currencies by banks in the border areas and in the border areas through local currency settlement, and other issues, with a view to realising win-win results for all parties. In recent years the total scale of trade between the two countries has been expanding, the flow of foreign trade commodities, resources and capital between the two countries has been increasing year by year, and the financial cooperation between China and Russia has been deepening, and its results have been increasing. The number of mutual bank accounts between Chinese and Russian banks has steadily increased, the amount of local currency settlements between China and Russia has continued to increase, the acceptance of Russian UnionPay cards has further expanded, and the channels for cross-border investment and cash remittances from enterprises to Russia have continued to expand. The construction of a cross-border e-commerce settlement platform on the China-Russia border has achieved stage-by-stage results. The number of mutual accounts opened by Chinese and Russian banks is steadily increasing, providing more convenient and efficient settlement services for customers on both sides. As the structure of the financial market continues to change, inter-bank relations between the two countries are also being innovated.

3.2.3 RMB exchange rate has stability

Whether the currency exchange rate is stable or not is the main factor that is referred to when choosing which currency to use as the settlement currency. The exchange rate of RMB against US dollar and Euro is relatively stable without big fluctuation. Ruble exchange rate is unstable its fluctuation is larger, so the RMB exchange rate against the ruble will also be constantly adjusted. Chinese and Russian business enterprises and financial institutions are reluctant to use its exchange rate fluctuations of the ruble for trade settlement, in the local currency settlement of both countries prefer to use the RMB as the settlement currency. The exchange rate of RMB against the world's major currencies is close to the equilibrium exchange rate, so the exchange rate trend of RMB is not expected to change significantly in the future. The stability of China's economy is an important guarantee for the RMB exchange rate to continue at a reasonable equilibrium level. The strong Chinese economy has helped the RMB improve its external situation and strengthened investor confidence. In addition to GDP growth, sufficient foreign exchange reserves, sound fiscal policy and a stable financial system have also helped the RMB exchange rate remain stable. A favourable monetary environment has been created as China has implemented a prudent monetary policy, used a full range of policy tools, maintained basic stability in monetary liquidity and kept interest rates at appropriate levels. China has been successful in promoting the RMB as an international currency and opening up the capital account, which has helped attract foreign capital flows and enhance the resilience of the RMB. At the same time, the use of RMB for settlement can significantly reduce the risks associated with trading and exchange rates, reduce the costs incurred by exchanges, and simplify their trading and settlement processes.

4. Empirical Study on the Influencing Factors of RMB Cross-border Settlement of China-Russia Trade

4.1 Selection of Indicators

4.1.1 Explained Variables

This paper selects the total amount of RMB settlement of cross-border trade as the explanatory variable, the total amount of RMB settlement of cross-border trade is the total amount of settlement formed by using RMB to calculate the price to carry out foreign trade activities.

4.1.2 Explanatory Variables

In this paper, the explanatory variables, i.e. influencing factors, are mainly analysed from five aspects: gross domestic product, consumer price index, real effective exchange rate of RMB, total bilateral trade between China and Russia, and offshore RMB index, and the detailed data are shown in Table 1.

Table 1

Indicator statistics, 2011–2020

|

Year/variable |

Total RMB settlement of cross-border trade ( Y ) |

GDP ( X1 ) |

CPI ( X2 ) |

Real effective exchange rate of the renminbi ( X3 ) |

Total bilateral trade between China and Russia ( X4 ) |

Offshore RMB Index ( X5 ) |

|

2011 |

2.08 |

7.66 |

105.4 |

100.1839231 |

792.4 |

0.32 |

|

2012 |

2.94 |

8.46 |

102.6 |

105.8833333 |

881.6 |

0.50 |

|

2013 |

4.63 |

9.3 |

102.6 |

111.8176628 |

892.1 |

0.91 |

|

2014 |

6.55 |

10.1 |

102.0 |

114.5222605 |

952.8 |

1.2 |

|

2015 |

12.1 |

10.81 |

101.4 |

124.8005747 |

630.6 |

1.3 |

|

2016 |

9.85 |

11.7 |

102.0 |

119.2963218 |

695.3 |

1.15 |

|

2017 |

9.19 |

13.05 |

101.6 |

116.3177692 |

840.7 |

1.25 |

|

2018 |

15.85 |

14.42 |

102.1 |

117.927318 |

1070.6 |

1.36 |

|

2019 |

19.7 |

15.49 |

102.9 |

116.0359387 |

1107.6 |

1.35 |

|

2020 |

28.4 |

15.94 |

102.5 |

116.9887023 |

1077.6 |

1.54 |

Source: People's Bank of China, Bank of China, National Bureau of Statistics, China Foreign Trade Statistical Yearbook

4.1.3 Descriptive statistical analysis of the data, see Table 2.

Table 2

Specific statistical analysis values for data

|

Variant |

Observations |

Average |

Standard deviation (std.) |

Min |

Max |

|

Y |

10 |

11.129 |

8.249741 |

2.08 |

28.4 |

|

X1 |

10 |

11.693 |

2.934345 |

7.66 |

15.94 |

|

X2 |

10 |

102.51 |

1.118978 |

101.4 |

105.4 |

|

X3 |

10 |

114.3774 |

6.983729 |

100.1839 |

124.8005747 |

|

X4 |

10 |

894.13 |

161.9879 |

630.6 |

1077.6 |

|

X5 |

10 |

1.088 |

0.3946531 |

0.32 |

1.54 |

Source: Authors' calculations using Stata based on relevant data.

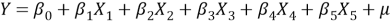

4.2 Modelling

According to the selection of data indicators, the total amount of cross-border trade settlement in RMB Y is the dependent variable, and other influencing factors are the explanatory variables to establish a multiple regression model as follows: "

4.2.1 Data processing and regression

After processing by stata16.0 software, the following data can be obtained, as shown in Table 3.

Table 3

Statistics of indicators of multiple regression

|

Source |

SS |

df |

MS |

Number of obs= |

10 | |

|

F (5,4)= |

6.10 | |||||

|

Model |

541.540651 |

5 |

108.30813 |

Prob>F= |

0.0521 | |

|

Residual |

70.9834412 |

4 |

17.7458603 |

R-squared= |

0.8841 | |

|

Adj R-squared= |

0.7393 | |||||

|

Total |

612.524092 |

9 |

68.0582325 |

ROOT MSE= |

4.2126 | |

|

Y |

Coef. |

Std. Err. |

t |

P>l t l |

[95 % Conf. Interval] | |

|

X1 |

1.862735 |

1.322056 |

1.41 |

0.232 |

-1.807882 |

5.533351 |

|

X2 |

2.578157 |

2.568027 |

1.00 |

0.372 |

-4.551828 |

9.708143 |

|

X3 |

0.2722105 |

0.9917184 |

0.27 |

0.797 |

-2.481241 |

3.025662 |

|

X4 |

0.0028572 |

0.0202406 |

0.14 |

0.895 |

-0.0533396 |

0.059054 |

|

X5 |

5.392273 |

18.24942 |

0.30 |

0.782 |

-45.27624 |

56.06078 |

|

_cons |

-314.4951 |

334.8262 |

-0.94 |

0.401 |

-1244.122 |

615.1316 |

Source: Authors' calculations using Stata based on relevant data.

4.3 Empirical findings

4.3.1 Analysis of multiple regression results

(1) The correlation coefficient of GDP is 1.862735 and its significance level is 1.41 greater than 1, which indicates that it plays a relatively significant positive correlation to the total amount of RMB cross-border trade settlement, and a higher level of economic activity creates a greater demand for currency, and the growth of GDP can boost the total amount of RMB cross-border settlement. The dynamic indicator of GDP has a close and direct link with the international status of the national currency, as steady GDP growth provides long-term support for the national currency.

(2) The correlation coefficient of the Consumer Price Index (CPI) of 2.578157 and its significance level of 1.00 show that the CPI and the total amount of RMB cross-border trade settlements are positively correlated, which is mainly shown by the fact that an increase of one unit in the CPI is associated with an increase of 2.6 trillion RMB in the total amount of RMB cross-border settlements. Consumer price index data is often considered a useful indicator of the effectiveness of government economic policies on the state of the country's economy, which is a factor that forex trading can take into account when assessing the likelihood of currency fluctuations.

(3) The significant level of the real effective exchange rate of the renminbi is less than 1 and its relevance is small. The exchange rate has a significant impact on the foreign trade of countries, acting as a communication tool between indicators of value in the domestic and foreign markets, influencing the price ratio of imports and exports and leading to changes in the internal economic situation, as well as changing the behaviour of exports or with imports.The increased volatility of the real effective exchange rate of the renminbi is due to the characteristics of Chinese exports. In addition to the behaviour of exporters, the instability of the exchange rate stems from the lack of a mature market for foreign exchange derivatives.

(4) According to the model to analyse the total amount of bilateral trade between China and Russia, it is found that the total amount of trade between the two countries and the total amount of RMB settlement has a small influence factor, which is obviously inconsistent with the growth of the total amount of cross-border settlement of trade between the two countries. Due to the lack of the right to choose the settlement currency, Chinese business enterprises are at a disadvantage in trade with Russia. In export trade, because Russia is a seller's market, there are a large number of Chinese co-operative companies to choose from, and Chinese trading enterprises occupy less initiative. In import trade, because China imports mainly crude oil, timber, metals and other materials, the degree of import dependence is higher. The influence of the degree of product differentiation on the choice of settlement currency is directly related to the overall development of the country's economy. It is worth noting that the raw materials sector accounts for a large share of the Russian economy.

(5) The correlation coefficient of the offshore RMB index is 5.392273, which is positively correlated with the total amount of cross-border RMB settlement. In recent years, China has begun an aggressive effort to incorporate the RMB into trade settlements and payments with other countries. In order to increase demand for the RMB, the People's Bank of China (PBOC) has entered into certain agreements with the central banks of other countries regarding currency swaps. Under these agreements, the PBOC began to provide them with RMB in exchange for other countries' national currencies. RMB deposits in banks outside China began to form. These offshore renminbi began to be used to pay for foreign trade transactions, investments, loans and in the foreign exchange market. The use of the renminbi in offshore business remains an important part of the internationalisation of China's currency. The increased role of the renminbi in the global monetary system has been quite effective, as it minimises the financial risks associated with current account liberalisation.

5. Suggestions for Promoting the Development of RMB Cross-border Settlement in China-Russia Trade

5.1 Increase the publicity of RMB cross-border settlement and improve the recognition of RMB

First of all, it is necessary to increase the publicity of using RMB settlement in Russian trade enterprises. Through the characteristics of RMB currency stability and RMB exchange rate stability, Russian trading enterprises can truly feel that the use of RMB settlement can not only increase the income but also reduce the risk and loss of the transaction, and improve the recognition of Russian trading enterprises to the RMB. Through its publicity, the number of times RMB settlement is used in the settlement field of the two countries will be expanded, and the development of RMB cross-border settlement of China-Russia trade will be promoted. Financial institutions can widely promote RMB cross-border trade settlement through various channels and publicity platforms, striving to gain a favourable position for RMB in China-Russia trade settlement. China's foreign trade enterprises should continuously increase the frequency of using RMB settlement, and at the same time expand the use of RMB settlement to expand its influence.

5.2 Strengthen the co-operation between Chinese and Russian governments and enrich the policy system continuously

Relevant government departments should further improve the financial system. Firstly, the two countries should be committed to deepening bilateral economic and financial relations, strengthening macroeconomic policy coordination, and enhancing contacts and cooperation on economic and financial issues of common concern. Secondly the two countries are committed to creating the most favourable conditions for promoting the sustained growth of bilateral trade and investment through cooperation in the field of finance and taxation. Secondly, the two countries should continuously support multilateralism and support and maintain the multilateral trading system. As China's «One Belt, One Road» co-operation continues to deepen, China should strengthen financial co-operation with the relevant countries, expand the influence of the RMB, promote the development of trade in the relevant countries, and realise mutual prosperity between the countries. We should strengthen monetary cooperation with trading countries, increase the amount of currency exchange between trading countries, expand the scope of currency exchange, secure the supply of offshore RMB, and promote RMB settlement of cross-border trade. The governments of the two countries will increase their support for financial institutions and commercial enterprises, and give certain preferential policies to the cross-border RMB settlement of China-Russia trade, so as to increase the enthusiasm of all parties to participate in the process.

5.3 Maintaining the stability of the exchange rates of the two currencies and preventing exchange rate risks

The stable operation of China's finance is conducive to maintaining a stable exchange rate and foreign exchange market. The two countries will continue to maintain the stability of the exchange rates of the two currencies and take necessary adjustment measures according to the changes in the situation to strengthen prudent macro-control. China will continue to deepen exchange rate reform and raise the level of international trade liberalisation. It will also accelerate the implementation of currency reform and liberalise the financial market to allow freer trading of the RMB. An increase in the RMB's share of international trade transactions will reduce China's exchange rate risk, and the reduction in foreign exchange risk will save hedging transactions and financial transactions. China continues to reform the exchange rate formation mechanism of the local currency and adopts a continuous adjustment model to hedge risks. The practice of RMB settlement will gradually take shape.

5.4 Promote the optimisation and upgrading of import and export product structure

The two countries should gradually expand the scope and strengthen the degree of cooperation between bilateral trade areas. China's exports to Russia are usually low value-added products, so it is necessary to change the structure of export products and gradually shift to high value-added products. Second, it is necessary to maintain the trend of positive development of China-Russia trade relations, and the areas of trade cooperation between the two countries must be constantly updated. China and Russia should make full use of the potential of bilateral scientific and technological cooperation in areas such as 5G mobile networks, big data and artificial intelligence to speed up the signing and implementation of relevant trade projects. Meanwhile the development of cross-border e-commerce can also provide a new impetus for bilateral trade. Thirdly, trade cooperation between the two countries is one of the most effective ways to boost economic growth in China's economic development pattern. Pay close attention to the prospects of foreign economic and trade cooperation, constantly expand the diversity of imported and exported products, enhance their comprehensive competitiveness, and increase the popularity of related products. At the same time, we should further strengthen the co-operation with countries and regions along the Belt and Road, broaden the depth and breadth of their co-operation, and continue to expand the relevant areas of trade in services.

6. Conclusion

The growth of cross-border RMB payments demonstrates first and foremost the strong position of China's economy, which is growing rapidly, while at the same time it has started to recover from the New Crown Epidemic earlier than other countries and has become one of the few economic powers. The internationalisation of the renminbi is one of the directions of China's long-term strategy, the renminbi's growing share in local currency settlements between China and Russia, the growing demand for the renminbi in Russia, and the expectation that the mechanisms and channels of cooperation between the two countries in local currency settlements will continue to be improved, legal protections will be strengthened, and the scope of its use will continue to expand. The share of ruble and RMB settlements between Russia and China is likely to rise further in the coming years, and it is expected that the launch of digital currencies in both countries will facilitate the successful realisation of this goal. It is believed that the internationalisation of the RMB and the use of the RMB as the main settlement currency in cross-border trade will benefit the world.

References:

- Sun Shaoyan Ma Yuezhu. Analysis of cross-border RMB settlement between China and Russia [J]. Jilin Financial Research.2014,(12):48–55

- Xu Yumei Li Xiaoyan. Research on Enhancing the Trade Facilitation Level of China and Russia [J]. Theoretical Discussion.2021,(04):102–107

- Guo Yulian. Countermeasure Suggestions for Promoting the Development of Cross-Border RMB Settlement in the Russian Far East [J]. Heilongjiang Finance.2015,(01):23–24

- Na Hongsheng Sun Lei. Promoting cross-border RMB settlement between China and Russia [J]. China Finance. 2015,(11):32–33

- Guo Liancheng. The construction and development of new type of economic cooperation relationship between China and Russia under the new situation [J]Research on Financial Issues.2016,(11):113–121

- Xu Po Ling. Correct assessment of Russia's economic strength and the prospects of China-Russia economic and trade relations [J]. China Economic Report.2017,(11)

- Sun Lei. Problems and policy suggestions of cross-border settlement of e-commerce between China and Russia [J]. Heilongjiang Finance.2017,(05):42–43

- Zhang Zhimin. China-Russia Currency Cooperation, Constraints and Path Choice for Improvement — Based on the Perspective of RMB Internationalisation [J]. Russian Journal.2014,4(03):46–54

- Zhou Yanling Chen Zhenguang. Analysis of the impact of local currency settlement on China-Russia economic and trade cooperation [J]. Knowledge Economy.2016,(19):44–46

- Liu Jue. Analysis of financial co-operation between China and Russia [J]. Journal of economic research.2014,(32):164–165

- Sun Shaoyan Shi Hongshuang. Research on Cross-border RMB Settlement between China and Russia--Analysis Based on the Dual Background of RMB Internationalisation and U. S.-European Sanctions against Russia [J]. Northeast Asia Forum.2015,24(01):30–41

- Xu H. Cheng Rong Xu Yan. Local Currency Settlement of China-Russia Trade and the Difference between the Two Countries' Economic Systems [J]. China Business Journal.2018,(18):51–53

- Qi Lili. The current situation and problems of local currency settlement in China-Russia bilateral trade [J]Business Economics.2017,(02):94–95

- Feng Chengyan Shu Boran. Analysis of Influencing Factors of RMB Cross-border Settlement in Countries Along the «Belt and Road» [J]. Foreign Economic and Trade.2017,(03):106–112

- Chang Xiaoming. Cross-border RMB settlement with Russia needs to be improved [J]. China Finance. 2014,(02):94

- Wang Xiaoquan. Analysis on the background of «de-dollarisation» of China-Russia settlement and payment system and the prospect of RMB settlement [J]. Russia East Europe Central Asia Research.2021,(02)

- Wang Yue. Research on RMB cross-border settlement under China-Russia trade [D]. Tianjin University of Finance and Economics, 2015

- Karina. Research on RMB Cross-border Settlement Issues in China-Russia Trade [D]. Harbin Institute of Technology, 2018

- Friedrich von Hayek. The Denationalisation of Money. Nova Press [M], 2007