This paper presents a vector autoregressive model of the interest rate pass-through in Kazakhstan based on the cost of funds approach. Estimation results suggest that the interest rate pass-through in Kazakhstan is incomplete and weak. The interest rate pass-through to retail deposit rates is higher in the long run. Furthermore, it is also higher for the short-term deposits of non-banking legal entities. The pass-through from deposit rates to lending rates is incomplete for short-term lending rates for non-banking legal entities. On the contrary, the pass-through from deposit rates to long-term lending rates for non-banking legal entities and short-term lending rates for individuals is overshooting. Information asymmetry and the absence of credit rationing are the most probable explanations of this phenomenon.

Keywords: interest rate channel, pass-through, VAR, Kazakhstan

Introduction

The main purpose of the National Bank of Kazakhstan (NBK) is to maintain the price stability. The NBK implements its policy in the inflation targeting framework since the 20th of August, 2015. Before that period, the national currency — tenge — was pegged within a band and the exchange rate channel was the main channel of monetary transmission. On the contrary, traditionally, the main transmission channel within the inflation targeting framework is the interest rate channel. The interest rate pass-through is a widely used measure of the effectiveness of the interest rate transmission. The speed and completeness of the interest rate pass-through define to what extent monetary policy changes would affect investment decisions of firms and households, and, ultimately, aggregate demand, output, and inflation. Therefore, understanding how this channel works in Kazakhstan (and to what extent) could help the monetary authorities improve the effectiveness of monetary policy transmission.

The analysis is conducted using VAR framework based on the cost of funds approach. The main contribution of this study is that for the first time both bank deposit rates and lending rates in Kazakhstan are analyzed in the context of inflation targeting based on the cost of funds approach using VAR framework.

The main empirical findings are as follows. The pass-through of market interest rates to retail deposit rates within one month barely exceeds 30 % and is higher for non-banking legal entities than for individuals. The most probable reason for that is that Kazakhstan Deposit Insurance Fund quarterly sets maximum recommended rates for deposits of individuals. In the long term, the interest rate pass-through tends to be higher and for legal entities’ short-term deposits is even close to one. The pass-through from deposit rates to lending rates is also higher in the long run and is overshooting for long-term lending rates for legal entities and for short-term lending rates for individuals. This can be explained by information asymmetry in the absence of credit rationing.

Brief literature overview

There exists a large amount of literature on interest rate channel transmission in developed and emerging countries. Nevertheless, there is not enough research on the interest rate pass-through in Kazakhstan. Among those few authors who contributed to the study of interest rate transmission process in Kazakhstan, stand out working papers of the NBK staff. Chernyavskiy investigated how base rate changes affect exchange rate, output, economic growth and inflation using correlation analysis. He found evidence that the monetary transmission in Kazakhstan is functioning at its every stage [1, p.27]. Orazalin [2, p.16] assessed effectiveness of the monetary transmission in Kazakhstan during 2008–2017 in the VAR framework and found that in that period the main channel of transmission was the exchange rate channel. Other authors also contributed to the study. Ishuova [3, p. 113] developed a DSGE model for Kazakhstan and found that the monetary policy is the most effective within strict inflation targeting framework. Demidenko et al. [4, p. 73] researched effectiveness of monetary policies of Eurasian Economic Union countries using SVAR models and found that money supply and exchange rate dynamics have significant impact on price level in Kazakhstan. However, the authors do not come to clear conclusions about the interest rate channel effectiveness in the country. Applying the SVAR framework to the data from 1994 to 2016 Ybrayev [5, p. 45] finds that a positive shock of interest rate has uncertain effect on inflation in Kazakhstan in the long run. Jamilov and Egert [6, p. 11] studied interest rate pass-through and monetary policy asymmetry in the Caucasus and Central Asia and came to conclusion that the interest rate pass-through in Kazakhstan is weak and asymmetric although it is stronger than in other countries of the region.

Methodology

Base rate is the main monetary policy instrument of the NBK. However, the base rate does not change often and is not suitable for our study. The current state of development of interbank, money, and capital markets in Kazakhstan does not allow matching maturities of interbank and retail rates. For the purpose of this research, indicator TONIA (Tenge OverNight Index Average) approximates the base rate. TONIA is a REPO rate that also serves as an operational goal of the NBK. According to Grynkiv [7, p. 14], cost of funds approach is the best suitable method for assessing interest rate pass-through from an interbank rate to bank retail rates.

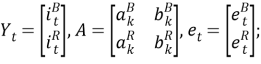

Scatterplot analysis if the first stage of this study. It provides an insight on the relationship between each pair of rates. The next stage is VAR analysis. Researches have different views on stationarity of interest rates. In this paper, the VAR framework closely follows de Bondt [8, p. 14] in specifying VAR and choosing an optimal number of lags. The following specification of VAR in levels is used:

![]() (1).

(1).

where

![]() is a retail deposit (lending) rate

is a retail deposit (lending) rate

and ![]() is an interbank (retail deposit) rate.

is an interbank (retail deposit) rate.

Quantitatively the interest rate-pass through is calculated as the ratio of cumulative response of retail deposit (lending) rate to a shock of interbank (retail deposit) rate [9, p. 31].

Data

The data used in this study is available on the NBK’s and Kazakhstan Stock Exchange’s official websites and. The data range starting from February 2016 allows capturing the period when the exchange rate of the national currency was not just de jure but also de facto floating. Furthermore, it helps to exclude previous shocks of interbank market that followed the devaluation of the national currency in 2014 and resulted in high devaluation expectations of all economic agents and the deficit of tenge on the interbank market. During the period under the study, there has been an ongoing structural change in the retail deposit market. The dollarization of deposits decreased from 78 % to 46 %. However, current level of financial dollarization still significantly limits the effectiveness of interest rate channel in the retail deposit market. Retail interest rates under the study are weighted average of deposit and lending rates for non-banking legal entities and individuals with matching short-term and long-term maturities. In the period under the study (i.e. February 2016 — January 2019) on average 83 % of new deposits were opened in the national currency. 91 % of those deposits belonged to non-banking legal entities; the majority of those deposits were short-term deposits. In the same period on average 85 % of new credits were issued in tenge: 65 % of them to non-banking legal entities. 81 % of new credits of the non-banking legal entities in tenge were short-term credits.

Empirical results

Scatterplot analysis showed that the deposit rates of individuals are mostly inelastic to changes in interbank rate. The main reason for this is that all banks in Kazakhstan (except for two Islamic banks) are members of the deposit insurance system and Kazakhstan Deposit Insurance Fund quarterly sets maximum recommended rates for deposits of individuals. Scatter plots of deposit rates for non-banking legal entities suggest that there is relationship between the interbank rate and short-term deposit rates (from 0 to 1 month and from 1 to 3 months).

VAR analysis showed that changes in the interbank rate affect legal entities’ deposit rates with maturities from 1 to 3 months, from 3 months to 1 year and deposit rates of individuals with maturities from 1 to 3 months, form 3 months to 1 year, and over 5 years. As can be seen from the table 1, the immediate interest rate pass-through from interbank to retail deposit rates is weak. It is higher in the long run and even close to one for the deposit rates for legal entities with maturities from 1 to 3 months.

Table 1

Pass-through of TONIA to new retail deposits

|

Deposits of non-banking legal entities |

Deposits of individuals | ||||

|

From 1 to 3 months |

From 3 months to 1 year |

From 1 to 5 years |

From 1 to 3 months |

From 3 months to 1 year | |

|

After 1 month |

0.32 |

0.17 |

0.14 |

0.22 |

0.05 |

|

After 1 year |

0.90 |

0.57 |

0.48 |

0.53 |

0.31 |

Scatterplots of retail deposit and lending rates suggest that there exists a relationship between short-term deposit and lending rates of legal entities with corresponding maturities. VAR analysis confirmed that finding and revealed that long-term lending rates for legal entities and short-term lending rates for individuals also depend on corresponding deposit rates (Table 2). The overshooting of interest rates can be explained by information asymmetry and the absence of credit rationing.

Table 2

Pass-through retail deposit rates to retail lending rates with matching maturities

|

Deposits of non-banking legal entities |

Deposits of individuals | |||

|

From 1 to 3 months |

From 3 months to 1 year |

From 1 to 5 years |

From 1 to 3 months | |

|

After 1 month |

0.22 |

0.17 |

0.66 |

1.31 |

|

After 1 year |

0.49 |

0.63 |

1.07 |

2.52* |

*Here the interest rate pass-through after eight months is shown because the cumulative impulse response is significant for eight months only.

Credits to individuals with maturities from 1 to 3 months constitute around 5 % of total credits in tenge. Long-term credits to legal entities make up around 12 % of total credits in the national currency. Short-term credits to legal entities, on the other hand, make up 53 % of total credits in tenge. Thus, by changing base rate National Bank of Kazakhstan can mainly affect deposit rates for non-banking legal entities and through them influence retail credit rates for non-banking legal entities. Given the proportional distribution of retail deposits and credits, one can conclude that the main instruments of this transmission are short-term deposit and lending rates for non-banking legal entities.

Conclusions

This paper studies interest rate pass-through using scatterplot and VAR analysis. Furthermore, the paper explicitly focuses on how changes in the interbank rate are transmitted through retail deposit rates and, consequently, to lending rates.

The first conclusion is that interest rate pass-through is incomplete and weak. The proportion of TONIA change that is passed through within one month is found, at its highest, to be around 32 %. The pass-through is higher in the longer term and is even close to one for deposits of legal entities redeemable within 3 months. In total, the effect of policy changes is greater for short-term instruments. This fact is explained by the structure of the economy and, consequently, the credit market. It also reflects the historical savings behavior of the economic agents of the country. For some of the lending rates the interest rate pass-through is greater than one. This fact can be explained by information asymmetry and the absence of credit rationing

Secondly, the transmission process mainly goes through short-term deposits and credits of non-banking legal entities. The main reason for this is that Kazakhstan Deposit Insurance Fund quarterly sets maximum recommended rates for deposits of individuals.

Of course, the data is still scarce which limits the accuracy of the VAR analysis. The next step would be to analyze the asymmetry of the interest rate pass-through as soon as more data becomes available.

References:

- Чернявский Д. Трансмиссия монетарной политики Национального Банка Казахстана. — Национальный Банк Республики Казахстан. Департамент исследований и статистики. Аналитическая записка № 2018–2, 2018. 27 с.

- Оразалин Р. Трансмиссионный механизм денежно-кредитной политики в Республике Казахстан. — Национальный Банк Республики Казахстан. Департамент исследований и статистики. Экономическое исследование № 2018–3, 2018. 20 с.

- Ишуова Ж. Ш. Прогнозирование влияния денежно-кредитной политики на экономику Республики Казахстан на базе модели динамического стохастического общего равновесия // Вестник КазНУ. Серия экономическая. 2013. № 3 (97). С 105–114.

- Демиденко М. В., Коршунов Д. А., Карачун О. Р., Миксюк А. Ю., Пелипась И. В., Точицкая И. Э., Шиманович Г. И. Денежно-кредитная политика государств — членов ЕАЭС: текущее состояние и перспективы координации. — М.: ЕЭК, СПб.: ЦИИ ЕАБР, 2017. 148 с.

- Ybrayev Zh. The prospect of inflation targeting in Kazakhstan // Eurasian Journal of Economics and Finance. 2017. 5(1). P. 33–48 [на англ. яз.].

- Jamilov R., Égert B., Interest Rate Pass-Through and Monetary Policy Asymmetry: A Journey into the Caucasian Black Box. — William Davidson Institute Working Paper Number 1041, 2013. 23 p. [на англ. яз.].

- Grynkiv I. Interest rate pass through in Ukraine. A thesis submitted in partial fulfillment of the requirements for the degree of Master of Arts in Economics. — National University “Kyiv-Mohyla Academy” Economics Education and Research Consortium Master’s Program in Economics, 2007. 71 p. [на англ. яз.].

- De Bondt G. Retail bank interest rate pass-through: new evidence at the euro area level // European Central bank working paper series. 2002. № 136. 142 p. [на англ. яз.].

- Мирончик Н., Профатилов С. О влиянии обменного курса на инфляцию. // Банкаускi Веснiк. 2015. С. 25–34.