Each country has its own strengths and weaknesses. Someone is good at the agriculture, someone — at the commodity production. This article will consider a number of comparisons of doing business in Russia and Germany.

Automotive industry

Germany is a world leader and an outstanding manufacturer in automotive industry. Worldwide, German car is known as reliable, safe, innovative and design vehicle. This strong brand creates global demand and export is three quarters of all domestic production. Situation in Russian automotive industry is totally different. The main point is a loss of people’s trust. Russian automotive industry has bad reputation among the population.

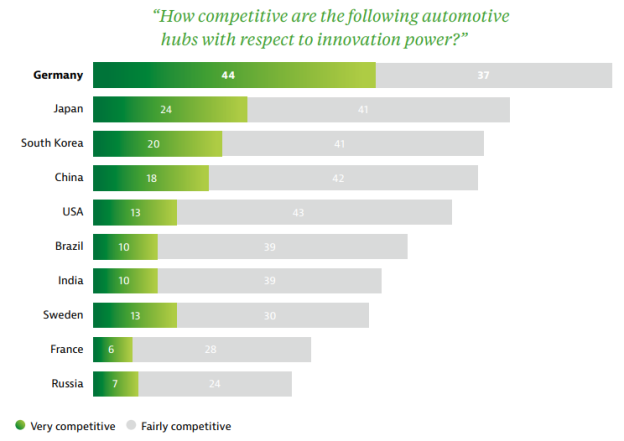

Always to be competitive German companies invest a lot in research and development. Automotive industry spent in R&D one third of the total manufacture industry expenses. Germany willingly follows technological trends and works hard for improving automotive industry in more sustainable way through developing alternative drive technologies (including electric, hybrid and fuel cell cars), adaptation of lightweight materials and electronics and reduction of carbon emission. Germany is planning to become a lead provider of electro mobility solutions by 2020 [4].

Fig. 1. Assessment of Innovation Power Germany 2013 in percent [4]

The last several years Russian economy was under the pressure of economic restrictions and low oil prices. As a consequence, many sectors of the Russian economy were affected by external factors, which caused decline of the industrial production index by 4.5 %. But on the other hand, the new economic reality led to more attraction of potential investors. In the coming years, increasing in foreign direct investment is expected. In 2016 sales of passenger cars amounted to 1,125,000 units and LCVs (light commercial vehicle) — to 106,000 units. The forecast of Russian automotive market is quite optimistic. Sales can reach 2 million vehicles by 2020. Probable forces of this growth will be the ruble exchange rate, stable oil prices, government supporting programs, and low auto loans interest rates. One of the main problems in Russian automotive market is lack of modern infrastructure, which is totally necessary for growing process. As statistics shows, in 2016 passenger car density in Russia was 358 units per 1,000 adults, which is 42 % lower than in Western Europe (615 units). Moreover, indicator of the passenger car age (on average 12 years) is needed to be improved by replacing obsolete and worn out vehicles.

Despite the crisis automotive companies are not going to leave Russian market and some of them are planning to build new plants. Among German manufacturers, for example, Mercedes-Benz is planning to build a new plant with annual capacity of 25,000 vehicles in the Moscow region by 2019 [4].

To summarize, Russia should take a closer look at the German strategy of automotive industry development as an example of well-established and successful model and continue implement innovations in this process.

Start-up scene

To start new business in Russia is much easier than in Germany due to the level of competition and cost factors. There is a lot of space for new ideas. Russia has great opportunities for further growth and business development. While in Germany it is very «crowded» at the market. In Germany, where the quantity and quality of competition is very high, it is rather difficult to develop business.

Nowadays, a number of individual entrepreneurs or other commercial enterprises on the territory of the Russian Federation, although slowly, but is growing. The reason of this, first of all, is good conditions for starting and developing business. It allows you to start your own business even with minimal starting capital. The state supports entrepreneurship with a great amount of funds. Furthermore, labor costs are much lower than in Europe.

Another important point is the size of share capital. In Germany, according to the corporation, minimum required capital is 25,000 euro for a GmbH and 50,000 euro for AG. In comparison, minimum share capital in Russia is 10,000 rubles (about 160 Euro) for limited liability company (LLC). To open Russian joint stock company that can be open or closed requires a minimum share capital of 100,000 rubles (about 1500 Euro) for open one, while the minimum share capital required for a closed joint stock company is 10,000 rubles (about 160 Euro).

Agriculture

Nowadays, Russia has huge reserves of resources and opportunities: it has about 10 % of total cultivated world area suitable for sowing (78 525 thousand hectares). A special place in the Russian agricultural sector is the production and processing of grain crops. The grain sowing part in 2015 was 58.8 % of the whole area.

The most important grain crop is wheat. Its annual consumption in the world is estimated at 700 million tons. The largest share in the structure of wheat consumption is occupied by the countries of the European Union-120 million tons, then China and India with consumption volumes of 100 and 75 million tons respectively. For more than one year Russia has been among the leaders in the production of this herb. On June 10, 2016, the export of Russian wheat is estimated at 24.5 million tons [3].

One of the main reasons for «jump» of the Russian grain market is a record wheat yield in south part of Russia — the Krasnodar, Stavropol and Rostov regions. In addition, exports have become very profitable due to the devaluation of the ruble. As a consequence, it is cheaper for importing countries. Moreover, with the help of economic restrictions agriculture has a high speed of growth, especially wheat and barley.

Germany also has strong agriculture industry. Half of the land in Germany is farmed. However, the basis of this success differs from Russia’s one. Germans strength is animal husbandry: no other country in Europe produces as much milk or pork. Cattle, pigs, poultry are the main directions of husbandry. Feed for animals are grown on around 60 percent of agriculturally used land, for instance maize or wheat. These and other crops also play an important role in the generation of renewable energy. Besides animal products, the main produce for human consumption is bread cereals, potatoes, sugar beet, fruit and vegetables. The main growing and production areas are those that are favorable due to geological, climatic or infrastructural conditions [5].

Fig. 2. Selected production outputs in Germany in 2015 [5]

Germany shows a sense of sustainable responsibility in agriculture sector. Overall, though, Germany is a net importer, import is bigger than export. There is a trend of decreasing of farms number. However, the amount of goods is rising dramatically that shows development in efficiency. The majority of German farms are family businesses.

In conclusion, there is a big gap in the levels of country development. Russia is a developing country, which economic power basically consists of huge amount of natural resources, like gas and oil. Germany is a well-developed country with a powerful technological and production industry. However, Russia has rapid growth and there is a high probability of flourishing future.

References:

- Doing Business in Russia 2016 // Baker & McKenzie. URL: http://www.bakermckenzie.com/-/media/files/insight/publications/2016/06/doing-business-in-russia-2016/bk_russia_doingbusiness_2016.pdf (дата обращения: 17.12.2017)

- Overview of the Russian and CIS automotive industry // Invest in Russia. URL: http://investinrussia.com/data/files/sectors/Overview-of-the-Russian-and-CIS.pdf (дата обращения: 17.12.2017).

- Russian wheat market in 2015/16 MY: price growth as a forced measure and a prerequisite for maintaining production volumes // Informational and analytical agency «APK-Inform». URL: http://www.apk-inform.com/ru/exclusive/topic/1068993#.WMEjrKDvUbf (дата обращения: 17.12.2017).

- The automotive industry in Germany, Industry overview // GTAI Germany Trade and Invest. URL: http://www.gtai.de/GTAI/Content/EN/Invest/_SharedDocs/Downloads/GTAI/Industry-overviews/industry-overview-automotive-industry-en (дата обращения: 17.12.2017).

- Understanding Farming // Federal Ministry of Food and Agriculture. URL: http://www.bmel.de/SharedDocs/Downloads/EN/Publications/UnderstandingFarming.pdf?__blob=publicationFile (дата обращения: 17.12.2017).