Social protection and welfare policy plays the central role and reflects essence of tendency of national development and prosperity of population. Wide range of social protection forms including various pension schemes hold particular importance in execution of state social policy. This article highlights the structure, importance and role of pension system in Uzbekistan and makes comparions, where relevant.

Key words: pension, savings, pension benefit, retirement and disability pensions retirement, accumulative pension scheme, mandatory pension

Политика социальной защиты и благосостояния играет центральную роль и отражает сущность тенденции национального развития и процветания населения. Большое разнообразие форм социальной защиты, включая различные пенсионные схемы, имеют особое значение при проведении государственной социальной политики. В данной статье освещается структура, значение и роль пенсионной системы в Узбекистане и проводится сравнение, где это уместно.

Ключевые слова: пенсия, сбережения, пенсионные пособия, пенсии по возрасту и нетрудоспособности, пособие, накопительная пенсионная система, обязательная пенсия

The pension fund has a huge impact on the economy of any state, since its main goal is to ensure the level of material wealth earned by man through redistribution and accumulation of funds. Everyone, wherever he lives, by his work and past social contributions guarantees himself a certain level of living in the future.

As the society ages, the issue of pension provision and the transition of this system to funded principles becomes more and more urgent. But often for an ordinary citizen the formation of a balanced budget seems very far from his daily worries. However, all the activities of such a complex and socially significant financial institution, such as the Pension Fund, directly depends on how economically justifiably and correctly the relevant budget parameters have been determined.

In recent years, throughout the world, much work has been done to reform the pension system within the framework of pension reform, in particular, the introduction of a funded system. Under such a system, contributions accumulated in the pension system due to payments of the employee and his employer are not spent on payments to today's pensioners, but are accumulated, invested and bring in income until the payer retires. All the savings of the payer and all his investment income received on these savings are his personal property, which will ensure the payment of a pension.

In the previous period, to ensure the social protection of the elderly, the world was dominated, mainly, by distribution systems. However, the gradual aging of the population (especially in developed countries), along with a sharp increase in the corresponding costs, is forcing an increasing number of countries to switch to a funded scheme of fixed contributions. Systems adopted in different countries differ from each other, but they are united by the fact that pension payments are determined by the amount of pension contributions recorded on individual accounts of citizens.

The situation is different with persons who are not formally connected with labor relations and are in the category of citizens for whom voluntary participation in the funded pension system is provided by legislation (private entrepreneurs, members of dehkan farms and others). Unfortunately, all of them are not in a hurry to join it, since accumulative pension contributions are considered by this category of people as a kind of additional tax. This is due to a misunderstanding of the fundamentals of the functioning of the accumulative pension system as a whole, and in these circumstances, there is an urgent need for a large-scale public awareness campaign, the benefits of a funded pension system, the mechanism and the specifics of its formation, and the implications of the absence of pension savings.

Carrying out pension reform, the Pension Fund of the Republic of Uzbekistan fulfills the function of one of the active participants in reforming the social sphere of the country and approving new relationships between generations, social groups, employers, workers and the state. The result of the reform should be the creation of a modern, high-tech and efficient system of citizens' pensioning. With this system, the relevant statistical data necessary for the further development of the pension business and compulsory when forecasting the required means for providing people needing social protection should be collected.

A distinctive feature of the accumulative and distributive pension systems is the approach to the financing of pension benefits. In the distribution system, the source of cash payments is employee contributions, which are expensed in the current period and which are directly distributed among pensioners. With a funded system, pensions are paid exclusively at the expense of pension contributions made by a pensioner for the period of their work. When using this system of financing, incoming contributions are not immediately spent on the payment of pensions, but accumulate in the form of a certain reserve capital. After reaching the retirement age, recipients have the right to choose to receive these funds at a time or during a period established by them independently.

The accumulative pension system, in comparison with the distribution system, has a number of advantages. This system provides for the recording of each sum paid for each year and month of the employee's length of service.

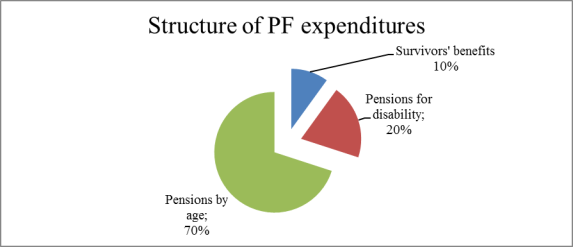

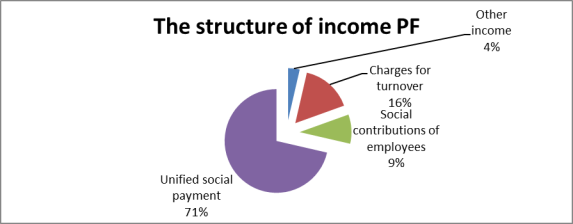

Fig. 1. *Source: Ministry of Finance of the Republic of Uzbekistan

Legislation of the Republic of Uzbekistan fixes the state obligations to each participant of the accumulative pension system, for the safety and payment of funds accumulated on individual savings accounts. After the participant's retirement, these obligations will be fulfilled in full.

In order to protect against inflation, the funds of the funded pension system can be used as credit and investment resources. Mandatory accumulative pension contributions, interest and other income received by citizens from the use of funds on individual accumulative pension accounts are not subject to taxation and other mandatory payments.

Participants in the funded system are usually better protected from political risks closely associated with any distribution system.

Fig. 2. * Source: Ministry of Finance of the Republic of Uzbekistan

With the functioning of the mechanism of the funded pension system, the incentives to conceal income are reduced among the population. Citizens become interested in ensuring that employers fully implement pension contributions and, accordingly, pay salaries that are called «in white». The result is that the economy of the country has funds for long-term investments.

However, accounting for money on individual accounts significantly complicates the technical organization of the funded pension system in comparison with the distributive system. There is considerable confusion, and even a loss of funds, especially when moving from fund to fund. The only way to avoid this is to develop a clear mechanism for obligatorily informing depositors about the state of their savings account and resolving disputes over the state of the account.

In Uzbekistan, there are about 31.5 million people (according to data for 2013.) Almost 70 % of them are able-bodied population and only 4.7 % are people 65 and older. Women in this country retire at 55, men at 60. The average life expectancy of women is 75, men — 70 years.

The average Uzbek gets a salary of $ 340. The minimum wage is 42 dollars.

The pension system of Uzbekistan has a mixed character, here simultaneously operate the distribution pension system and the accumulative pension system.

In the first case, the operator is an Extra-budgetary pension fund under the Ministry of Finance of the Republic of Uzbekistan (RU) — it is a state institution responsible for organizing pension provision for citizens, assigning pensions, social benefits, compensatory and other payments to citizens, ensuring the recalculation of pensions and other payments in accordance with the procedure established by law. In the structure of the fund there are 14 territorial administrations, 196 district (city) departments, covering all regions of Uzbekistan.

In the second, the State-Commercial People's Bank is one of the country's major universal banks. The means of the accumulative pension system are formed in the bank by accumulating funds on individual pension accounts. The bank is an agent of the government in the implementation of social programs and operates as a universal commercial bank. In accordance with the law «On funded pension provision of citizens», the Halk Bank is the only organization that accumulates the accounts of citizens participating in the funded pension system.

Comparing to other countries we can establish some new main aspects of pension system in them and its current functioning.

The experience of the UK shows that even with a highly established system of personalized accounting, no one is insured against technical mistakes. In addition, there may be conflicts about the status of the pension account and the lack of literacy of the insured. In the UK there are fairly strict mandatory and voluntary standards for dealing with citizens' appeals for all financial organizations working with pension funds. In the Kingdom also operates a special pension Ombudsman (Pension Ombudsman) — an organ of extrajudicial settlement of disputes. Timely resolution of disputes related to various aspects of the pension system allows, first, to avoid major mistakes, and secondly, increases the trust of citizens to the system as a whole.

In many countries where only voluntary participation in the funded pension system is provided and there is no distribution pension system, those who receive non-salary income (lawyers, consultants, tutors), as well as housewives, are outside the existing pension system. When they reach retirement age, they are without any pension support (the minimum state pensions are often not provided).

Since the pension system of Uzbekistan is of a mixed nature, there is no chance for our citizens to remain completely without a pension. This is the advantage of the domestic system over others. It is important to note that the funds accumulated on the individual accumulative pension account, in case of death of the recipient, can be inherited in the established order. Accrued funds are paid to the heir at a time in full.

Taking everything into consideration, it can be said the accumulated pension funds can be paid in the case of the departure of a citizen of the Republic of Uzbekistan from the republic to a permanent place of residence. The accumulative pension system is capable of ensuring the transparency of the pension system as a whole. This part of the labor pension guarantees the necessary pension reserve in case of demographic imbalance.

References:

- Alier M. and Vittas D.(2001): «Personal Pension Plans and Stock-Market Votality», Holzmann-Stiglitz, eds. 391–423.

- Qosimova G. (2007). Byudjetdan tashqari fondlar. Tashkent: Iqtisod-Moliya.

- Tuhtarova M. (2015). Pensionnoye obespecheniye grajdan. Tashkent: NORMA.

- Islamov Bakhtiyor, Shadiyev Rustam (Uzbekistan). «New demographic trends, employment and labour market in Uzbekistan».