Introduction

The process of formation of the investment portfolio is related to the selection of a particular set of objects for investment activities. Modern portfolio theory is based on the fact that investors can invest not only in one, but in several objects, thus forming a kind of collection of investment objects.

The problem of constructing the investment portfolio in terms of the optimal combination of risky securities and securities, which are not at risk in the investment portfolio and its management strategy, is relevant for a developing economy.

Types of risks and value of aportfolio

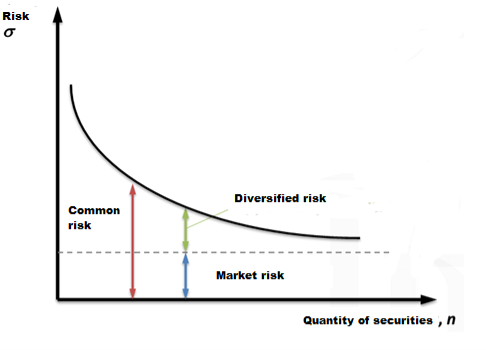

Investment risk includes two types of risk: systematic (market) and unsystematic (diversifiable). Systematic risks affect the entire market as whole, unsystematic affects just individual securities. An example of an unsystematic risk is a technological disaster at the plant, failure of launch of a new product or wrong management. Therefore, unsystematic risk applies to individual companies or economic sectors.

Picture 1. Diversified risk

If there is one asset (for example, one share) in your portfolio, the volatility of portfolio will be equal to the volatility of this asset. If there will be several assets in portfolio which are independent and do not change equally, the portfolio volatility decreases. The larger the number of independent assets, the less diversifiable risk.

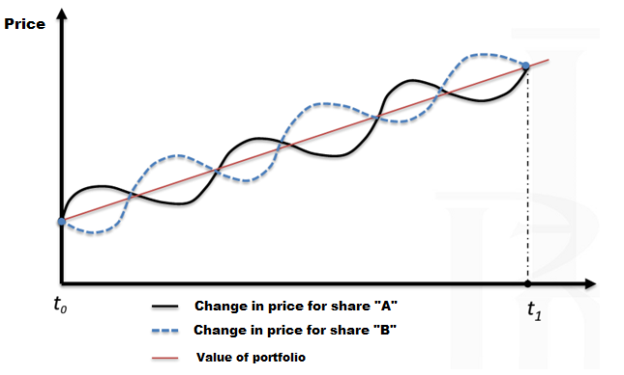

For example, let us take two assets. Price of both asset fluctuates in the opposite — one increases, the other decreases. Both asset are volatile, but overall value of the portfolio increases smoothly. So, we see two risky assets turned into a risk-free portfolio.

Picture 2. The value of a portfolio

Unfortunately, in reality it is almost impossible to find two assets that behave like in the picture. Market’s assets do not behave synchronously, some are growing, others are falling, someone stronger, and someone weaker. Through this multi-directional portfolio, risk is reduced. As the various assets in the portfolio increase, risk will be reduced.

For example, if your portfolio consists of one share and its price falls by 50 %, then your portfolio will drop for the same price. If the portfolio consists of 10 stocks, your portfolio will fall by only 5 %.

On the other hand, too broad portfolio diversification can reduce your profitability and bring it closer to the index of profitability. Diversification does not mean you have to buy as much, shares, bonds and other assets.

How to diversify an investment portfolio?

Diversifying your portfolio by buying a mix of investments can help to protect it from the ups and downs of the market. To reduce the risk of the investment portfolio, assets should not be connected with each other and shouldn’t behave the same way in different economic conditions. Therefore, the investment portfolio should include different asset classes. Each asset class, in turn, should also be diversified.

The economy may grow, stagnate or fall. Therefore, the stock market also can grow, stand or fall. Therefore, the portfolio should include assets that work well in all three cases. The behavior of economic sectors may also be different: some will grow, others fall.

There is a simple example of multi-directional behavior of industries. In 2014 because of devaluation of the ruble, stocks of exporting companies increased, due to the fact that they receive the proceeds in foreign currency, but the costs are in rubles and also stocks of telecommunication companies decreased, because they vice versa receive revenue in rubles, but buy imported equipment for currency.

Levels of diversification.

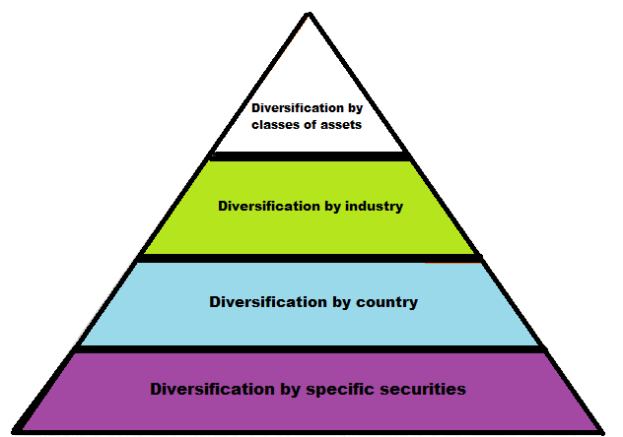

Portfolio can be diversified on several levels:

Picture 3. Levels of diversification

First Level on the classes of asset: stocks, bonds or deposits, real estate, commodity assets (gold, silver).

Second Level is by countries. In the world, financial markets can be divided into developed, emerging and frontier. Developed markets are the US, Canada, France, Germany, Great Britain, Japan, Australia. Emerging markets are Russia, India, China, South Africa, Brazil, Argentina, Mexico and others. Frontier markets are Ukraine, Georgia, the Philippines, Indonesia. Another division is geographical: North America, Latin America, Europe, Asia, Africa, the Middle East and so on.

The markets of some countries may grow when markets of others fall. Such situation was in 2013–2014, the developed markets were growing, while emerging were falling. Economic conditions can also vary widely. Some countries will rage with inflation (as it was in Russia in the 90's), in the other — deflation (as in Japan).

Third Level is by industry. As the example above, one sector can grow, others fall. The Russian stock market can be divided into several sectors:

‒ Oil and Gas — Gazprom, Novatek, Rosneft, Lukoil, Gazprom Neft, Surgutneftegaz, Bashneft.

‒ Consumer sector — Magnit, Dixy, M. Video

‒ Telecommunications — MTS, Megafon, Rostelecom

‒ Transport — Aeroflot, Transaero, UTair, FESCO

‒ Finance — Sberbank, VTB, Vozrozhdenie, Bank of Saint Petersburg, the Moscow Stock Exchange.

‒ Chemistry and petrochemistry — Acron, Uralkali, Fosagro, Dorogobuzh, Nizhnekamskneftekhim

‒ electric power industry — Rossetti, FSK, RusHydro, Inter RAO UES, E.ON Russia, Moscow United Electric Grid

‒ Metallurgy — NLMK, Mechel, MMK, Rusal, Severstal

‒ Mining and quarrying — Norilsk Nickel, Raspadskaya, Mechel, Polymetal

‒ Builders and developers — PIC, OPIN, LSR, Mostotrest

‒ Pharmaceuticals — Pharmstandard, Protek, Veropharm

‒ The automakers — AvtoVAZ, Sollers, GAZ, Kamaz

Each sector has its own characteristics. For example, the increase in oil prices is good for oil exporting companies, but bad for the airlines, the increase in nickel prices is good for Norilsk Nickel, increase in aluminum — for Rusal. Companies that sell their products abroad and receiving the proceeds in foreign currency benefit from the devaluation of the ruble. Companies buying imported goods and sell it on the Russian market, suffer from ruble’s devaluation. Moreover, economic policy of the state can affect sectors of the economy, for example, raising taxes on oil companies, or the regulation of tariffs for companies from the electricity sector.

Another way to divide the shares into categories is by capitalization — the largest companies (blue chips), medium-sized companies and small capitalization companies.

In the Russian bond market can be divided into three sectors:

‒ Government bonds — issued by the Ministry of Finance — federal loan bonds (OFZ).

‒ Municipalities and subnational — bonds issued by the regions — the Republic of Komi, Samara region, Sverdlovsk region, and others.

‒ Corporate — bonds issued by commercial companies — Rosneft, VTB, Novatek, MTS and so on. Commercial bonds as divided into sectors: banks, machinery, chemicals, oil and gas, etc.

The fourth level is the choice of specific securities. Each sector should include multiple securities. For example, for the oil and gas sector, Gazprom, Rosneft, Lukoil, for financial — Sberbank, VTB, St. Petersburg, and so on.

Thus, investor portfolio can include 20 or more securities.

How many securities include in your portfolio?

Not every investor can keep track of dozens of companies in his portfolio. If you are planning to invest abroad, the number of shares increases to several thousands. Such amount of securities can not be analyzed properly. In such case it would be wiser to focus on any one market well-known to you and to other countries to invest using index funds. If you live in Russia, the Russian market you will know better than the American. Therefore it is possible to analyze and select stocks and bonds on the Russian market independently, but in other countries the United States or Europe to invest through mutual funds or (Exchange Traded Fund). Investment funds are well diversified and includes several securities from different sectors

An example of adiversified portfolio

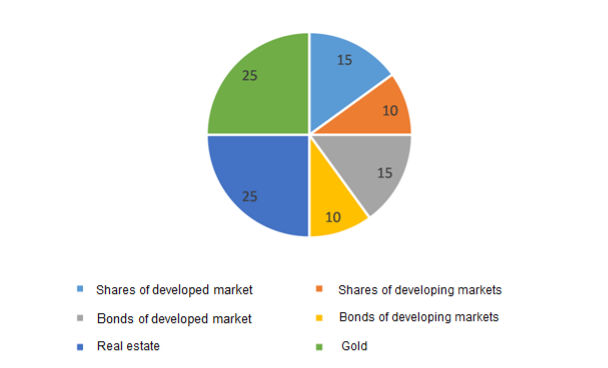

Imagine a portfolio consisting of four asset classes: stocks, bonds, real estate and gold.

For each class will choose the ETF. Each ETF has diversified by country and sector, and contains many of the securities.

Securities of each country in turn are diversified across multiple sectors: finance, energy, technology, insurance and so on. Real estate is divided into commercial (offices, shops, hotels) and residential (houses and apartments).

As you can see, each class of assets diversified across multiple countries, and is represented by hundreds of securities. Even bankruptcy of several dozens of companies will be barely noticeable to the entire portfolio.

Picture 4. Diversified portfolio

In today's environment such diversified portfolio might look something like this:

‒ 20 % — real estate investments;

‒ 15 % — ruble bank deposit; Here it is worth considering the stable trend of lowering interest rates on ruble deposits;

‒ 15 % — currency; rates of the dollar and the euro is too unpredictable;

‒ 15 % — related to the precious metal tools (specialized mutual funds, metal accounts, gold futures);

‒ 20 % — shares of reliable domestic companies, export-oriented and thus receiving the proceeds in foreign currency;

‒ 15 % — a risky venture projects that can bring income that is significantly higher than all other instruments if it will be successful. for example, investing in one of the most promising Russian startups.

Conclusion.

The development of market economy and the consolidation of private property in its various forms has led to the fact that, along with funds widely used as a means of payment and investment securities received.

Their diversity is often complicates the question in what securities to invest exactly to get the greatest benefit.

It should be borne in mind that investments in securities always involve a certain risk. Moreover, the more profitable securities are the more risky it is to invest in it. For this reason, in the economy developed a concept according to which in order to obtain optimum results, money must be invested in various securities.

While working in the securities market, the investor must adhere to the principle of diversification of deposits: to strive for diversity of acquired financial assets in order to reduce the risk of loss of deposits. When compiling a portfolio investor should consider the following factors: the risk — yield, term investments, the type of security.

Knowing or predicting the magnitude of income for certain types of securities the investor can determine its own fiscal policy, plan or expected profits to develop its strategy of action in the stock market.

References:

- Котировки решают все. // Коммерсантъ Деньги. — № 34. — 2006.

- Diversification//www.barclaysstockbrokers.co.uk/.URL:https://www.barclaysstockbrokers.co.uk/get-started/understanding-investing/Pages/diversification.aspx (дата обращения: 18.12.2016).

- Robert L. Hagin. Investment Management: Portfolio Diversification, Risk, and Timing--Fact and Fiction. — 1st Edition. — New Jersey: WileyFinance, 2004. — 299 с.

- 5 Tips For Diversifying Your Portfolio // http://www.investopedia.com/. URL: http://www.investopedia.com/articles/03/072303.asp (дата обращения: 18.12.2016).

- Инвестиции. / Под ред. Ковалева В. В., Иванова В. В., Лялина В. А. — М.: ТК Велби, Изд-во Проспект, 2005. — 440 с

- Markowitz H. Portfolio Selection // Journal of Finance, vol.VII, № 1, March 1952.

- Перепелица Д. Г. Изучение возможностей практического использования модели оптимизации инвестиционного портфеля с применением нечётких множеств на российском финансовом рынке // интернет-журнал науковедение. — 2016. — № 5 (36). — С. 51.

- Шарп У., Александер Г, Бейли Дж. Инвестиции. — М.: Инфра-М, 1997. 3. Chopra V. K., Ziemba W. T. The Effects of Errors in Means, Variances, and Covariances on Optimal Portfolio Choice. — In: Worldwide Asset And Liability Modeling. — Cambridge University Press, 1998.