In the modern world where the economy of technologies and knowledge is put in the first place, questions of legal protection and assessment of intellectual property become more and more urgent. Nowadays, the intellectual property (IP) is one of the most important components of assets of the entity. It is possible to face with such cases, when the cost of intellectual property of the company exceeds the cost of all its tangible assets and IP is the main resource of the company in company’s marketing strategy. All the listed facts show the relevance of the article.

The aim of this article is to examine types of evaluation of intellectual property concerning patent issues.

To achieve the posted aim it is necessary to complete the following goals:

– Analyze the nature of the intellectual property

– Consider methods of evaluating of IP

– Examine peculiarities of patent issues

Assessment of an intellectual property item represents cost determination, caused by potential efficiency for the owner of the right of the asset order. Assessment of intellectual property is always understood as assessment of exclusive rights, which follow from the fact of ownership of an asset. The economic concept of cost of an intangible asset expresses a market view of benefit, which the owner of this object, at the time of assessment of its cost has. The variety of objects of IP does not allow applying standard methods and approaches to their assessment. Anyway evaluation represents a cash measure of how much the legal entity or physical person is ready to pay for ownership of the rights to specific results of intellectual work. Therefore, one of the main factors of a value assessment of intellectual property is determination of its influence on resulting effects of economic activity of the entity.

Assessment of intangible assets includes:

– Value assessment of trademarks

– Value assessment of patents

– Assessment of author's rights

– Damage assessment in case of violation of exclusive rights on intellectual property items

Different types (market, investment, etc.) and different approaches are applied to evaluation of Intellectual Property: comparative, costly, but the most frequent — an income approach to evaluation. In the latter case the cost of intellectual property is determined as its capability to bring to the buyer or the investor the income in the future. It is equated to current value of a net income which can be received from use of this intellectual property for economically reasonable period of its useful use.

In case of non-paid receipt of an intangible asset by the entity assessment of its market value is necessary for its statement on balance. Besides, assessment of market value of intangible assets will allow increasing an indicator of net assets and, as a result, value of the entity.

The value assessment of an intangible asset is always determined for specific date. The main factors influencing the cost of an intangible asset are a possibility of free circulation in the market, validity period, a newness factor, reliability of legal protection of an asset. The major factor influencing the cost of an intangible asset is the size of the expected income from its use.

Fig. 1.

In this article we would like to focus mainly on patents as an example of IP that majority of companies on different markets poses. A patent is a government license that gives the holder exclusive right for a designated period of time to an invention, which is a product, process or a design that, in general, provides a new way of doing something, or offers a new technical solution to a problem. Patent grants its holder a monopoly to make, use, and sell its invention, and to exclude others from doing so. To receive a patent, a patent application must disclose all details of the invention so that others can use it to further advance the technology with new inventions.

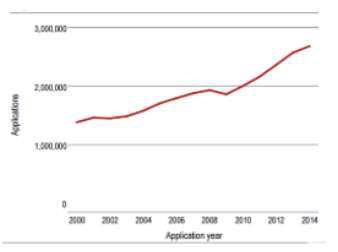

There are several evidences of growing economic significance of patents. However there are other means of protecting company’s returns from inventions (trademarks and trading secrets) during the past 20 years there has been a surge in the number of patents issued. For example in 2012, the number of fillings grew by more than 9 % (it is the fastest annual increase in 18 years). Consequently the number of patents granted worldwide also grew by 13.7 % in 2012.

Fig. 1. Patent applications worldwide

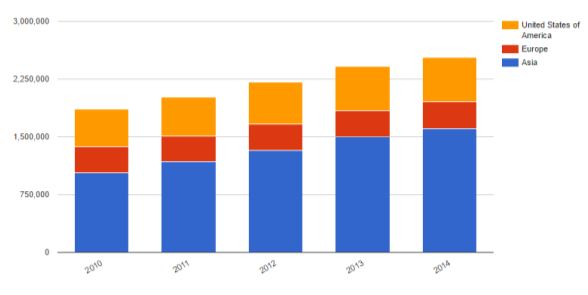

Fig. 2. Total patent applications

Research indicates that about 70 % to 80 % of a company’s market capitalization comes in the form of intangible assets, which include patents. And patents are moving from a legal role to a strategic management one. The value share of knowledge-based components to industrial products is constantly rising. Thus it is not a surprise that companies now are ready to pay more for other companies’ patent portfolios. All these can be attributed to the parallel in innovative activity as well as to the necessity to up large patent portfolios for the purpose of negotiating with other patent holders

Inventions are considered to be a fuel for innovation and thus for the economic growth. And patents are important for maintaining the innovation-driven economies. On the one hand they guarantee inventors the legal tool to fight against imitators; on the other hand patents oblige inventors to explain how a new technology works and to forfeit exclusive rights to the invention after a specified period of time. This mechanism stimulates the progress. Contrary, low patent quality can generate uncertainty, decrease incentives to innovate.

As any valuable asset patents are needed to be evaluated. Companies face the necessity for accurate patent evaluation in different market situations:

1. There are companies that are called Patent assertion entities (PAEs). PAEs do not manufacture or sell goods as well as do not invest in research. Those are businesses that acquire patents from third parties and use them to generate licensing revenues through negotiation and litigation (ex. they are asserting them against alleged infringers). In acquiring and then asserting patents, PAEs target individuals and businesses that already developed or marketed the product on the base of patented technology. So it is critical for those companies to work out the mechanism of evaluation of patents because the quality of patent is deterring how much they are going to pay for a particular patent as well as how effective they are going to act during negotiations.

2. However companies that are providing goods and services are more often creating technologies or products that are patented afterwards, they also may need to evaluate patents. One company may seek to acquire another company. In such situations the acquired company may be an outperforming company that has lost its market share, but still possess valuable IP (including patents) that can be wisely used by an acquirer to enhance its positions on the market. For example, Google acquired Motorola and its extensive collection of patents for more than USD 12.5 billion (though, in the end, Google kept only Motorola’s patent portfolio, selling off other parts of the business, and it estimates that the portfolio cost between 2.5 to 3.5 billion. On the other hand it may be a young start-up that that doesn’t have anything (ex. brand name, consumer loyalty) yet but innovative product or technology that an acquirer wants to obtain before its rivals. So both parties in such deals need to evaluate core patents in order to set a fair price.

3. Also accurate patent evaluation is important for maintaining overall quality level of patents granted worldwide. It is important because low patent quality can be a reason for market failures. Patents are helping to obtain venture capital and securing liquidity (сноска). For example venture capitalists would not finance firms with a potential to be engaged in patent infringement cases raised by another company or by a non-practicing entity.

The biggest challenges that companies face while trying to put a dollar figure on patents is that they are presented in a form of very dense legal documents filled with technical language and jargon, that is hard to evaluate. Moreover companies need to distinguish between individual patent and a patent portfolio.

Firstly, company should determine the quality of the underlying invention outlined in the patent. Secondly, it should check how the patent is constructed. Thirdly, it needs to figure out how to extract value from the patent.

However patents vary greatly in different industries there are general indexes that can be used to evaluate patent quality (patent quality assumes technological and economic value) and hence patent value. They evaluate patent’s underlying invention and the structure of patent documents.

Patent scope

This indicator is evaluating technological breadth of patents in a firm’s portfolio significantly that affects the value of the firm. Broad patents are more valuable when many substitutes in the same product class are available. For each patent document P, the patent scope index is defined as:

![]()

where np denotes the number of distinct 4 digit International Patent Classification (IPC) subclasses the invention is allocated to. The larger the number of distinct 4-digit IPC classes, the broader the scope index, and the higher the potential technological and market value of a patent.

Claims

Claims determine the boundaries of the exclusive rights of a patent owner, given that only the technology or aspects covered in the claims can be legally protected and enforced. The number and content of the claims thus determine the breadth of the rights conferred by a patent. Moreover, a large number of claims contained in the document might also imply higher patent fees. Hence, the number of claims in a patent document may not only reflect the technological breadth of a patent, but also its expected market value.

Backward citations and originality index

In order to evaluate the novelty of the innovation seeking patent protection, patent applicants are asked to disclose backward citations: patents, scientific papers, conference proceedings, databases and other sources of knowledge were used as the basis of the invention. The number of citations made to prior patents and prior non-patent literature (NPL) in a patent can help assess the degree of novelty of an invention. Backward citation includes self-citations (citations made to inventions belonging to the same company). It allows assessing the extent to which new inventions rely on the company’s prior innovative activities. Also there is an opinion that patents that cite scientific NPL may contain more complex and fundamental knowledge, and this in turn increases its value. Backward citations either to the patent or to NPL are contributing to patent value because they show that a patent belongs to a relatively well-developed technology area, and that property rights are less uncertain.

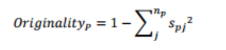

Patent originality is linked to the amount of backward citation. It refers to the breadth of the technology fields on which a patent relies. Inventions relying on a large number of diverse knowledge sources are supposed to lead to original results. And hence patents connected with them belong to a wide array of technology fields. Originality indicator can be defined as:

where spj is the percentage of citations made by patent p to patent class j out of the np IPC 4-digit (or 7- digit) patent codes contained in the patents cited by patent p.

Forward citations and generality index

Forward citations — citations a given patent receives from patents on subsequent technologies reflects the technological importance of the patent. Forward citations are counted over a period of five or seven years after the publication date. Self-citations are also taken into consideration. The number of forward citations can be written as:

![]()

where CITi,T is the number of forward citations received by patent application i published in year Pi within T years from its publication (in the present case, within five years). Cj,i is a dummy variable that gets value 1 if the patent document j is citing patent document i, and 0 otherwise. J(t) is the set of all patents applications published in year t.

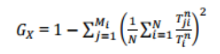

Forward patent citations can be used to assess the range of later generations of inventions that have benefitted from a patent, by means of measuring the range of technology fields — and consequently industries — that cite the patent. This influence is measured by generality index. The patent generality index relies on information concerning the number and distribution of forward citations citation and the technology classes (IPC) of the patents these citations come from. Forward citations cover all categories of citations, and are restricted to a 5-year citation window. Generality index can be written as:

Where X is the focal patent with Yi patents citing the focal patent X, with i = 1, ….., N; 𝑇𝑖𝑛 is the total number of IPC n-digit classes in yi; 𝑇𝑗𝑗𝑛 is the total number of of IPC n-digit classes in the jth IPC4 digit class in yi and j=1… Mi is the cardinal of all IPC4-digit classes in yi.

Breakthrough inventions

Large numbers of backward citations may signal the innovation to be more incremental in nature meaning that it is more about better modification of already existing technology or product. Contrary, breakthrough inventions are high-impact innovations which serve as a basis for technologies that are going to change the industry and create new products or services. Quality and diversity of the technological resources of a firm are positively correlated with breakthrough innovations. There is evidence that of significantly higher patenting growth in cities and technologies where breakthrough inventions have occurred.

Patent renewal

The renewal indicator can represent years during which a granted patent has been kept alive. Years are counted starting from the year in which a patent has been applied till the latest year in which it has been renewed. The renewal of a patent signals that the invention described in the patent document is still useful and thus has some value. Assuming that no rational agent would be willing to pay money for a right that is worthless, more valuable patents are renewed for longer periods.

Grant lag

Grant lag period is the time elapsed between the filing date of the application and the date of the grant. Yime required to reach a granting decision depends on the effort made by the filing party. Recent evidence suggests the existence of an inverse relationship between the value of a patent and the length of grant lag. Well documented applications and close cooperation with the patent office the signals that applicant is interested in accelerating the grant procedure for the most valuable patents. Because the more controversial claims lead to slower grants and well-documented applications are approved faster. The grant lag index relies on patents that are stratified by year and technology field and for each patent p, the grant lag index GrantPi is:

![]()

where Δt is the number of days elapsing between application and granting date; and Max(Δti) is the maximum number of days it has taken any patent belonging to the same class i to be granted.

Patent family size

Patent family is a set of patents filed in several countries which are related to each other by one or several common priority filings. The value of patents is held to be associated with the number of jurisdictions in which patent is protected and large international patent families are particularly valuable. Applicants might be willing to accept additional costs and delays of extending protection to other countries only if they deem it worthwhile.

Patent value: composite index

The patent value index is a composite indicator that tries to capture both the technological and the economic value of innovations and should be based on indictors described above as they are considered meaningful measures of research productivity and are found to be correlated with the social and private value of the patented inventions. There is no generally accepted formula for the calculation of that index. So the researcher can decide how many dimensions of patents’ underlying value (forward citations; patent family size; number of claims; generality index; backward citations or grant lag) to include in the index depending on the aim of the research.

The patent value also depends on the characteristics of the firm that owns it like its market capitalization, the assessments made by financing institutions and prospective acquirers. In a situation when patents are among company’s core assets there additional factors that will influence the value of such company that should be considered after the examination of its individual patents.

– If company provides products or services that are created on the base of patents, it is necessary to perform a parked research and assess how well those products or services are positioned.

– If company possesses a considerable amount of patents it is preferable to built a strategic portfolio out of them. An individual patents on particular piece of a technology or a design or a collection of unconnected patents from different spheres worth less than well-constructed portfolio which protects the originality of sophisticated products. Number of backward and forward self-citations can show quality of patent portfolio.

References:

- GIGAOM Jeff Roberts January 30, 2014 Google paid $4B for patents: why the Motorola deal worked out just fine URL: https://gigaom.com/2014/01/30/google-paid-4b-for-patents-why-the-motorola-deal-worked-out-just-fine/

- World Intellectual Property Organization Statistics 2015 Total count by filling office URL: http://ipstats.wipo.int/ipstatv2/ipsStakeBarchart

- Federal Trade Commission Patent: Assertion Entities Study URL: https://www.ftc.gov/policy/studies/patent-assertion-entities-pae-study

- Business Dictionary URL: http://www.businessdictionary.com/definition/patent.html

- World Intellectual Property Organization: World Intellectual Property Indicators 2015, Patent Chapter p.23 2015 URL: http://www.wipo.int/edocs/pubdocs/en/wipo_pub_941_2015-part1.pdf

- Methods of analysis and assessment of efficiency of investment projects through real options, Moscow/ D. G. Perepelitsa, 2009 URL: http://economy-lib.com/metody-analiza-i-otsenki-effektivnosti-investitsionnyh-proektov-na-osnove-realnyh-optsionov

- Forbes URL: http://www.forbes.com/sites/forbesleadershipforum/2013/06/25/how-to-tell-what-patents-are-worth/#6a31cbfa6ac7

- International Chamber of Commerce: IP: a positive force for society URL: http://www.iccwbo.org/advocacy-codes-and-rules/areas-of-work/intellectual-property/ip-a-positive-force-for-society/

- IOPscience: Modern evaluation of patents URL: file:///C:/Users/Idea/Downloads/MSE_147_1_012069.pdf

- See-the-Forest ™ Patent Analytics URL: http://www.see-the-forest.com/

- The Organisation for Economic Co-operation and Development (OECD): Enquiries Into Intellectual Property’s Economic Impact URL: http://www.oecd.org/sti/ieconomy/KBC2-IP.Final.pdf

- Boston Business Journal: The Importance of Patents: It Pays to Know Patent Rules URL: http://web.mit.edu/e-club/hadzima/the-importance-of-patents.html