As it is known, development of structures and mechanisms of corporate governance is a necessary condition for the development of market economy. At present, this question for Uzbekistan has become much more central as the state economic policy among priorities continues stimulating the attraction of foreign investments and maintaining the economic growth of the country. The system of corporate governance in domestic enterprises does not play last role in the achievement of given tasks.

In the process of market reforms carried out in Uzbekistan almost all large enterprises have been transformed to joint-stock companies (joint-stock company) as well as the household associations have been established which head companies are also joint-stock company. Presently, joint-stock companies (corporations) provide most parts of raw material for reproduction.

Owners of joint-stock company are shareholders. Giving the capitals to the joint-stock company, they do not participate in management of its current activity; do not represent it in mutual relations with an external world. These functions are delegated by hired operators (managers) who are allocated with the right to care of another's property. At the same time, shareholders take up the whole risk connected with an effective utilization of the share capital. In addition, there are a number of issues before shareholders: how to limit the behavior of managers focused on extraction of personal benefits; how to induce managers to operate effectively the company; how to secure itself against unqualified managers.

Today, both businessmen and foreign investor are concerned about the development of corporate governance in Uzbekistan for it is directly connected with the main question for them – the right of the proprietor to freely control his profit.

Therefore, the reason of recent crisis in South East Asia was backwardness of the corporate governance, in relation with the Organization on economic cooperation and development (OECD) has developed and has confirmed principles of the corporate governance which have obtained the international recognition as in the countries with transitive period of economy do not have a single model of an effective corporate governance and there are various approaches to their application.

Therefore, today the basic aim and task of our state experts is to search for effective ways of corporate governance in the Republic of Uzbekistan.

As it shows the numerous researches conducted in the USA, Asian countries, European and Latin America, the overwhelming majority of investors consider that at an estimation of companies as potential object for an investment, and the attention to an estimation of financial indicators of the companies should be given to work of boards of directors. Then, out of two companies with approximately identical financial indicators, investors will prefer the corporate governance which is better organized. The size of awards for the level of corporate governance varies from 18 to 27 % depending on the price of stocks.

Shareholders are considered to be legitimate owners of corporation and suppliers of the capital. At a stage of development of the company of attracting external capital often is the vital necessity. However, investors give the capital only to those who maintains to practice of effective corporate governance.

Questions of the effective organization of corporate governance are a subject of long-term discussions and researches. Even the countries with sufficiently developed market economy ambiguously approach to define the effectiveness of existing mechanisms of management. Distinctions in legal systems, institutional structures and traditions offer various approaches to the solution of problems available in this area where each country has obtained unique experience in the solution of own problems of economic growth.

However, the most widespread and applied approaches to define corporate governance are the followings:

The approach to definition of corporate governance as managements of integration association. For example, according to I. A. Hrabrovoy, the corporate governance is a management of organizational-legal registration of business, optimization of organizational structures, construction mutual company relations according to the accepted purposes [6]. S. Karnauhov defines corporate governance as management of a certain set of synergistic effects.

The earliest and most often used approach is based on following consequences from essence of the corporate form of business — division of institute of proprietors and institute of managing directors — and concludes in protection of interests of a certain circle of participants of corporate relations (investors) against inefficient activity of managers.

Problems of joint-stock property, mechanisms of interacting interests of various participants of the company, formation of national model of a corporate governance are analyzed in scientific researches of Berkinova B, Gulyamova S, Hamidulina М, Yakusheva R, Fattahovoy J, Zaynutdinova Sh, Vohidova M.

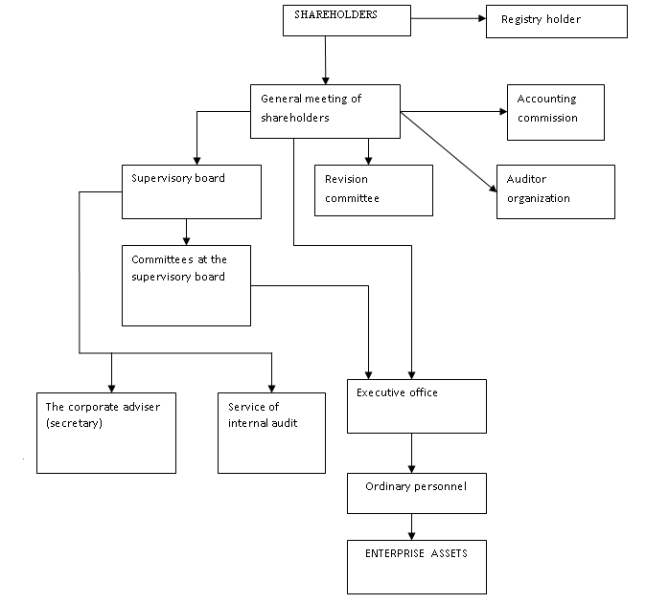

For the last few years there have been historical transformations in economy of Uzbekistan. The structure of national models of corporate governance was formed. With insignificant additions, conformable to the most authoritative opinions and recommendations, it is possible to present schematically (pic) [7].

Figure 1.

Distinctive signs of the given scheme from other analogues are:

− The account of the fact of division from owners of function of a property management at preserving function of possessing it, that is available in the hierarchy scheme: the owner — a buffer control of the property — the property;

− Including additional elements in structure of a corporate governance in addition to traditional inclusion.

However, without improvement of skills of management by the companies focused on receiving profit, without improvement of system of protection of the rights of shareholders investment from external sources remains for the Uzbek companies problematic. Besides, corporate governance improvement of quality is not only stimulation of inflow of the foreign capital, but also modernization of work of the organization as a whole. Transition from closed and at times business not under control to proprietors to the business mutual relations based on principles of a transparency and the external control will essentially increase possibilities for economic growth in Uzbekistan.

In our point of view «bottlenecks» in the system of corporate governance of the Uzbek companies is possible to carry the following:

− Formal participation of members of the supervisory boards in management of the companies that leads to discredit the idea of creation of these bodies as authorized representatives of shareholders;

− Low professionalism and insufficient efficiency of functioning the supervisory boards do not allow to carry out the complete control over activity of the company and to take adequate measures on achievement of the purposes established by shareholders;

− Not opened or incomplete disclosing the information on structure of the property and real owners of the companies that reduces interest of investors and complicates making decisions on investment;

− Non-use of the international standards of the financial reporting (ISFR) that is considered by foreign investors as opacity;

− Untimely or incomplete disclosing of the information to shareholders, infringement of their rights (especially minority shareholders) at participation in general meeting;

− Closeness of the companies regarding development and management strategy, including management of risks that makes activity of the company badly predicted, so unattractive for investors;

− The formal estimation of an overall members’ performance of the supervisory board and managers of the company, weak communication of their compensation with results of activity of the company that negatively affects quality of work;

− A dominating role of the manager (director) as «owner» of the company, testifying to a passive role of the supervisory board and lacking conducting in practice of good corporate governance;

− Nonpayment or scanty payment of dividends that frequently testifies non-well thought strategy of managers on reinvestment the received profit, and oblivion of that fact that owners of these means are shareholders. The level corporate governance depends not only on internal managerial processes in the company (micro level), but also from external factors (macro level).

The decision of these questions will allow: initially, to raise efficiency of corporate governance in joint-stock companies; secondly, to provide conditions and guarantees of attraction of the investment; thirdly, to satisfy with the qualitative goods in internal and foreign market; fourthly, to reduce state interventions in corporation managements. Thus, realization and developments of corporate governance are favorable for both shareholders, investors, managers of corporation and for the government.

References:

- Karimov I. A. Main purpose-wide scope of reforms and continue the way of modernization with persistence. Uzbekistan, 2013. — 64.

- Druker P. Exercises of management in the 21st century: Trans. from English: — М: Publishing house «Williams», 2004. — 272 p.

- Afonichkin A. I. Basics of management. The manual: — М: Knorus, 2011. – P. 272.

- Yoldoshev N. Q., Mirsaidova Sh. A., Goldman E. D. Innovation management. Textbook: Economics, 2011. — 312 p.

- Hatamova G. R. Improvement of the mechanism of innovative strategy in corporate structures (as an example «Tashkent tractor factory» Public corporation).: Candidate of economics diss. autoref. — Т, 2010. — 28 p.

- Hrabrova I. A. Corporate governance: integration questions. – M.: the Science and technics, 2000. – 198 p.

- Hamidulin М, the Concept of construction of national model of a corporate governance // J. Market, money and the credit. – 2007. №5. – P. 28-33.