Applying Basel II is one of the urgent requirements to Vietnam credit institutions in general and Vietnam commercial banks in particular with the aim of operating safely, effectively. In recent years, The State Bank of Vietnam as well as Vietnam commercial banks have made a great deal of effort to execute some standards under Basel II, especially, the capital standard. Nevertheless, along with achievements, the compliance of the capital standard at Vietnam commercial banks based on this accord has revealed a lot of difficulties and inquired some solutions to these problems in the next period.

Keywords: Basel II, The State Bank of Vietnam, Vietnam commercial bank, capital standard

- Commercial banks and Basel II

Commercial banks play important credit intermediates in the national financial system. The operation of commercial banks has a great influence on economic development. However, doing business on currency field makes commercial banks face up to a lot of risks, especially credit risk. Thus, effect, stability and safety in the commercial bank system’s operation is one of crucial requirements to any nations.

In over the world, Basel Committee on Banking Supervision (BCBS) was established in 1974 in Basel city — Switzerland by a group of Central banks and Supervising agencies. BCBS appeared after a number of the international monetary crises and banking markets crises and has made many discussions related to the international cooperation with the purpose of reducing gaps in the banking supervising operation as well as improving its quality. One achievement of BCBS’s activities is building and giving the norms to evaluate the levels of safety, effect of the banking operation which have displayed in The Basel Capital Accord (Basel) in oder to prevent commercial banks from bankruptcy, minimize risks that could threaten to the financial stability not only in each nation but also the whole world. Basel I was issued in 1996 with standards in the globalization trend so as to strengthen the stability of the international bank system, especially, while the credit risk has made negative impacts on banking operations and establish an equally international bank system to reduce unfair competitions among banks. To repair the restrictions of Basel I, on 26/06/2004, Basel II was officially issued. Beside the purposes given in Basel I, Basel II has oriented to speed up the acceptance of the tighter rules in risk management. Basel II has included three pillars. Pillar 1 has a number of capital regulations that combine with operating risk in the formula for Capital Adequacy Ratio (CAR) at 8 %; Pillar 2 involves in supervising excution and Pillar 3 consists of market disciplinary principles. To ensure the banking operation safely, not only require commercial banks maintain an full amount of capital, did BCBS give 25 basic principles that could supervise commercial banks effectively. Since its born and application, Basel I and Basel II have played important roles in the operation of commercial banks. A more detailed look at the practical experiences reaveals that inspite of bad influences of financial cirses on commercial banks’ operation all over the world, to commercial banks having applied Basel, they got a lot of advantages from these accords to prevent risks and guarantee their capital.

- The reality of applying capital regulations based on Basel II at Vietnam commercial banks

In practice, to perform the opening, execute the international commitments in the integrated inclination and maintain its position towards the competition of foreign banks requires Vietnam commercial banks and The State bank of Vietnam (SBV) oblige to implement the policies in accordance with international practice, especially, use and comply fully with Basels’ standards given. Applying Basels in operation is one of the prerequisites to prevent Vietnam commercial banks from credit risk. SBV and commercial banks have gradually applied Basel in risk management but the application has just expressed by choosing some simple targets in recent years. By the end of 2015, there had been only ten commercial banks chosen to apply Basel II experimental, included: BIDV, Vietinbank, Vietcombank, Techcombank, ACB, VPBank, MB, Maritime Bank, Sacombank và VIB. Afer 2018, Basel II will be applied at all Vietnam commercial banks. In the previous years, Vietnam commercial banks have steps by steps complied disciples given by SBV related to the following basic contents:

Table 1

CAR laid down from 2005 to 2017 in Vietnam

|

No. |

Consolidated CAR (%) |

Seperated CAR (%) |

Applied date |

|

1 |

8 |

- |

15/05/2005 |

|

2 |

9 |

9 |

01/10/2010 |

(Sources:Decision No.457/2005/QĐ-NHNN issued on 19/04/2005; Circular No.13/2010/TT-NHNN issued on 25/05/2010; Circular No.36/2014/TT-NHNN on 20/11/2014)

Vietnam commercial banks implemented CAR through Decision No.457/2005/QĐ-NHNN issued on 19/04/2005 stipulated the principles of prudential ratios in the operation of credit institutions. CAR, meanwhile, was at 8 % applying to all Vietnam commercial banks, not mention to the differences among their scales, sizes, risks. In the years from 2006 to 2008, the equity of Vietnam commercial banks increased significantly due to the advantages of business environment as well as the boom of the securities market in Vietnam. However, the tendency of transformation from rural joint stock commercial banks to urban joint stock commercial banks and the establishment of new commercial banks in this period caused CAR unstably. According to Decree No.141/2006/NÐ-CP dated on 22/11/2006, the legal capital of Vietnam credit institutions had reached at 3.000 billions VND at least by the end of 2010. Since increasing the capital quickly through this decree and the impacts of the stimulus demand policies as well as loosing the monetary policy, there was a sharp growth in the credit activity of Vietnam commercial banks. As a result, the risk assets of Vietnam commercial banks continued to rise that leaded to the rapid decline in their CAR.

Facing up to the inadequacies of the previous regulations and the urgency of the credit risk management, SBV issued Circular No.13/2010 / TT-NHNN on 25/5/2010 (Circular No.13) definied the safe ratios in the operation of commercial banks. Circular No. 13 presented obviously that there was an increase in CAR ranging from 8 % to 9 % with the consolidated CAR and the seperated CAR. Moreover, Circular No.36/2014/TT-NHNN on 20/11/2014 (Circular No.36) set up the new standards of banking management to guarantee the operation safely. Circular No.36 has maintained the minimum of CAR at 9 %, however, comparing to Circular No.13 the formula has adjusted closer.

Table 2

Average CAR of the goup of five joint stock commercial banks having the most assets from the year 2010 to the year 2015 (*)

|

Year |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

|

CAR (%) |

9,91 |

12,74 |

11,29 |

11,73 |

11,36 |

11,38 |

(*) Included: BIDV, Vietcombank, Vietinbank, ACB, MB

(Sources: Annual report in 2015 of these commercial banks)

Credit risk management

Currently, Vietnam commercial banks have divided their loan porfolio into five loan groups according to the payment deadline. Whereas, Sub-standard loans, Doubtful loans, Loss loans have classified by the bad debt catergory. In addition, the regulation of provisions has given as a solution to compensate for loss due to credit risk.

Table 3

Loan groups and Provision Ratios

|

No. |

Loan groups |

Provision Ratios (%) |

|

1 |

Group 1 — Current loans |

0 |

|

2 |

Group 2 — Special mentioned loans |

5 |

|

3 |

Group 3 — Sub — standard loans |

20 |

|

4 |

Group 4 — Doubtful loans |

50 |

|

5 |

Group 5 — Loss loans |

100 |

[Source: Decision No.22/VBHN-NHNN issued on 04/06/2014]

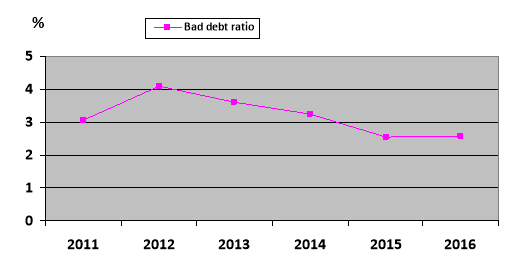

In Vietnam, in 2012, there was a boom of the bad debt caused a high of credit risk as a consequence of stimulating loans for many previous ages since many loans decided based on the clients’s need instead of credit principles when the growth in shares of Vietnam commercial banks was out of controls. Above all, the compliance of the legal disciples has not been serious, many large loans have approved to invest cross under the direction of leaders or shareholders.

Therefore, SBV set up Circular No.02/2013/TT-NHNN on 21/01/2013 replacing Decision No.493/2005/QĐ-NHNN on 22/04/2005 with the strict rules of classifying loan groups. Furthermore, to improve the quality of the assets, Vietnam commercial banks have concentrated on controlling the quality of bad debts and excuting these. They have re-evaluated the quality of their assets, the capacity of taking back bad debts and the value of bad debts. On the other hand, Vietnam commercial banks have also checked, reassessed the quality of enterprise bond and other credit institutions bond investements. Based on that results, they would account, transfer, reduce the investment scales in enterprises in the fields which come to a lot of risky potentiality such as: real estate, fisheries. They have focused on raising the quality of traditional banking services, developing the modern banking services moderately through updating, applying the advantages of the high technology. Noticeably, following Circular No.02/2013/TT-NHNN and Circular No.09/2014/TT-NHNN, from 01/01/2015, Vietnam credit institutions have refered the debt classifying results of Vietnam Credit Information Centre (CIC) to each custumers to re-arrange the clients’ loan groups by the highest loan group if many different credit institutions made loans to them.

Fig. 1. Bad debt ratio on total loan in Vietnam between 2011–2016

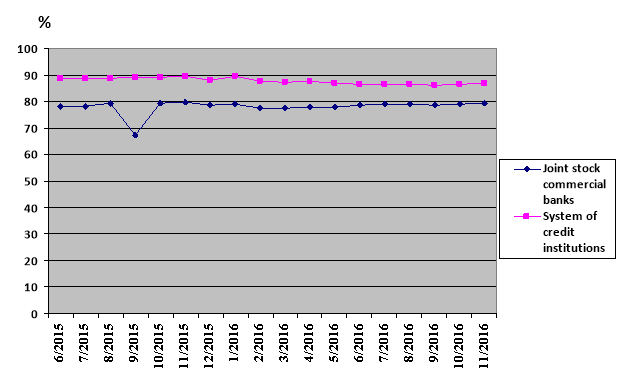

To lending activity, Circular No.13 limited the participation in Vietnam commercial banks’s activities related to sercurities and real estate business. Circular No. 36 has tightened the credit limitation such as: Loans on Deposits Ratio (LDR), Long- term, middle — term loans on short — term deposits…The risk ratio of assets has divided in to 5 levels: 0 %, 20 %, 50 %, 100 % và 150 %. Otherwise, LDR has been around 80 % — 90 % and Long- term, middle — term loans on short — term deposits at maximum 60 %.

Fig. 2. LDR in Vietnam

- Some restrictions of applying capital standards based on Basel at Vietnam commercial banks and orienting some solutions for the next period

Admittedly, applying Basel II has made many positive impacts on the banking activities, however, Vietnam commercial banks have to face up to a lot of difficulties and restrictions to meet the requirements of the accord, namely:

– CAR of all Vietnam commercial banks has reached above 9 %. Nevertheless, this figure has not reflected fully the sufficient quantity of their capital. The CAR formulas in accordance with Circular No.13 and Circular No.36 have released many shortcomings. Its denominator given by SBV specifies only credit risk but without market risk, operation risk and not sufficiently mention to other factors as follows Basel II.

– Financial leveraged ratio has increased in recent years shows that the scale of the equity has declined as opposed to the total assets, specially at State commercial banks. Remarkably, from 2011 to 2015, the risk assets of these banks grew at average over 19,4 % per year, higher than at 15,43 % per year of the equity. Consequently, CAR dropped from 10,8 % to 9,42 % in 2001 and at the present nearly reaches the minimum 9 %.

– LDR and the Long-term, middle-term loans on short-term deposits of Vietnam commercial banks have been quite high in this peridod. Although Circular No.36 has loosen the latter up to 60 %, the high bad debt ratio connected to using a lot of deposits to make a number of loans. Hence, Circular No.06/2016/TT-NHNN on 27/5/2016 was issued by SBV has identified the process of decreasing that ratio at 50 % by 2017 and at 40 % by 2018 with the aim of controlling the system’s credit risk, liquidity risk.

Moreover, the compliance with financial market rules involved in publishing and clarifying information in the system of Vietnam commercial banks has showed a lot of shortcomings: there have been some data not be updated on public, the weak quality of accounting and financial information, etc.

In front of the urgent requirement of applying capital standards under Basel II in the banking operation and overcoming those given obstacles, each of Vietnam commercial banks and SBV could use some solutions overall as the following:

– Vietnam commercial banks could adjust their investment porfolio to reach CAR based on Basel II. Otherwise, to increase the equity, Vietnam commercial banks could continously promote the effective impacts of issueing stocks channel to attract potiential investors. For instance, Common Wealth Bank of Australia (CBA) — the number one retailing bank in Australia with more than 100 year experiences, has been considered as a stragetic shareholder of Vietnam International joint stock commercial bank (VIB). It has played an important role in help VIB become one of 10 choosen Vietnam commercial banks by SBV to apply Basel II firsly in Vietnam.

– Vietnam commercial banks are oblige to make regulations, process together the systems of internal risk management and supervision to meet inquiries of Basel II. The system of risk management should be created and run effectively from head offices to branches and transactions spots.

– To improve the clarity of information, make baking operation healthy, decrease gaps between international accounting rules and Vietnam accounting standards and risks management, hasten the intergated process of Vietnam commercial bank system.

– Human resources have been considered as big difficulties, obstacles to Vietnam commercial banks due to the fact that the quality of human resources have not been equal, managers lack the experience and knowledge of management, specially, there has been a shortage of employers who used to experience the application of Basel II. To increase labour productivity, to attach employees and to manage risks are the basis to get the goals of firm revenue growth along with the supply of surpassing banking services.

- Conclusion

Creating a safely, fairly and equally competitive business environment to the financial market in general and the banking market in particular has been one of the most important targets of SBV to meet the integrated requirement in this period. Therefore, the application of Basel II is the crucial mission to excute this aim. Nevertheless, the system of Vietnam commercial banks has been quite weak and the financial market in Vietnam has been inexperienced as compared to these of other developed countries that cause the application of Basel II to be pressure and challenges to many Vietnam commercial banks. Thus, in oder to ensure the process of Basel II application in the next period that need a great deal of effort and cooperation among Vietnam commercial banks and the mangagement, supervision of SBV.

References:

- Dinh Xuan Cuong, Nguyen Truc Le (2014), Some leverage for Vietnam Commercial Banks to Approach Basel II, Journal of Science, VietNam National University — Ha Noi.

- Nguyen Dang Don (2009), Modern commercial bank management, East publisher, Ha Noi.

- Dinh Xuan Hang, Nguyen Van Loc (2012), Commercial bank credit risk management, Finance publisher.

- Pham Thi Hong Van (2016), The impacts of Basel II on credit operation at Vietnam commercial, The international scientific conference- The stable development of Vietnam financial market in the international integrated trend, Cultural publisher.

- Basel Committee on Banking Supervision (2005), Basel II: International Convergence of Capital Measurement and Capital Standards: A Revised Framework, http://www.bis.org.

- KPMG (2007), Managing credit risk: Beyond Basel II, http://kpmg.com

- The state bank of Vietnam (2005), Decision No.457/2005/QĐ-NHNN issued on 19/04/2005.

- The state bank of Vietnam (2005), Decision No.493/2005/QĐ-NHNN issued on 22/04/2005.

- The state bank of Vietnam (2005), Circular No.13/2010/TT-NHNN issued on 25/05/2010.

- The state bank of Vietnam (2013), Circular No.02/2013/TT-NHNN on 21/01/2013.

- The state bank of Vietnam (2014), Circular No.36/2014/TT-NHNN on 20/11/2014.